Region:Middle East

Author(s):Shubham

Product Code:KRAD0682

Pages:97

Published On:August 2025

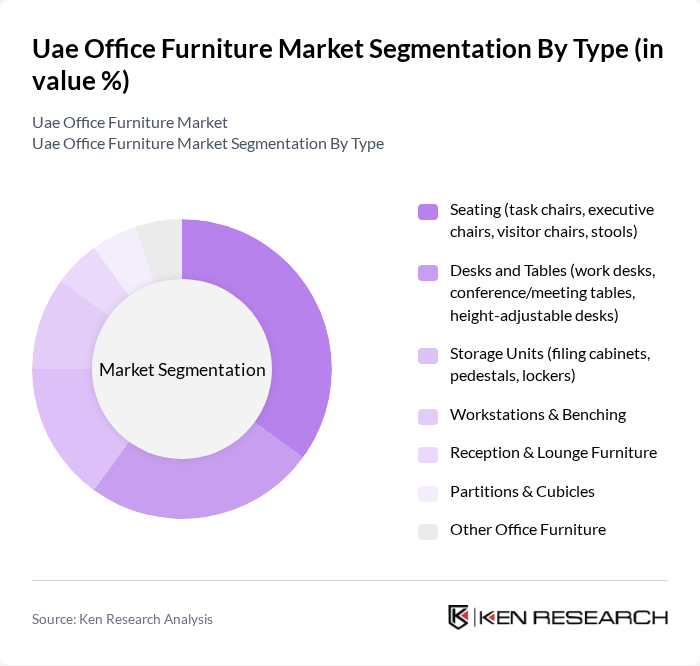

By Type:The office furniture market can be segmented into various types, including seating, desks and tables, storage units, workstations and benching, reception and lounge furniture, partitions and cubicles, and other office furniture. Among these, seating options, particularly ergonomic task chairs, are gaining significant traction due to the increasing awareness of workplace health and comfort.

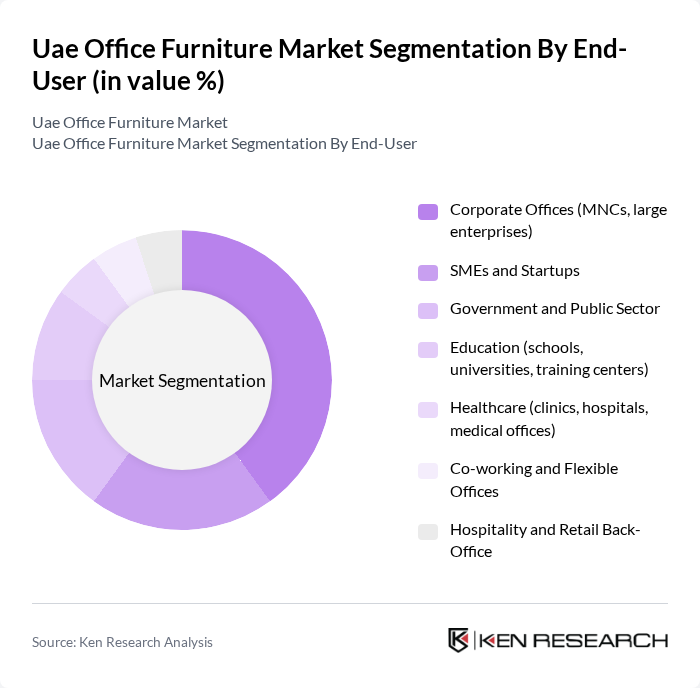

By End-User:The end-user segmentation includes corporate offices, SMEs and startups, government and public sector, education, healthcare, co-working and flexible offices, and hospitality and retail back-office. Corporate offices are the leading segment, driven by the need for modern and functional office spaces that enhance productivity and employee satisfaction.

The UAE office furniture market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA (Inter IKEA Systems B.V.), Steelcase Inc., MillerKnoll, Inc. (Herman Miller and Knoll), Haworth Inc., Teknion Corporation, HNI Corporation (Allsteel, HON), Kinnarps AB, Okamura Corporation, Global Furniture Group, Kimball International, Inc., Bene GmbH, OFS, Boss Design Group, BAFCO Furniture (UAE), Mahmayi Office Furniture (UAE), Highmoon Office Furniture (UAE), Nowy Styl Group, Schiavello Group, Sedus Stoll AG, Humanscale Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE office furniture market appears promising, driven by ongoing trends in workplace design and employee well-being. As companies continue to prioritize flexible workspaces and ergonomic solutions, the demand for innovative furniture designs is expected to rise. Additionally, the integration of technology in furniture, such as smart desks and collaborative spaces, will further enhance the market's growth. The focus on sustainability will also shape product offerings, aligning with global trends towards eco-friendly materials and practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Seating (task chairs, executive chairs, visitor chairs, stools) Desks and Tables (work desks, conference/meeting tables, height-adjustable desks) Storage Units (filing cabinets, pedestals, lockers) Workstations & Benching Reception & Lounge Furniture Partitions & Cubicles Other Office Furniture |

| By End-User | Corporate Offices (MNCs, large enterprises) SMEs and Startups Government and Public Sector Education (schools, universities, training centers) Healthcare (clinics, hospitals, medical offices) Co-working and Flexible Offices Hospitality and Retail Back-Office |

| By Distribution Channel | Specialty Stores & Brand Showrooms Supermarkets and Hypermarkets Online (e-commerce marketplaces and brand websites) Direct/B2B Project Sales (contract furniture) Other Channels |

| By Material | Wood Metal Plastic Glass Fabric/Leather & Upholstery Other Materials |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Design Style | Modern Contemporary Traditional Industrial Minimalist Others |

| By Functionality | Adjustable & Ergonomic Modular Fixed Multi-functional Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Furniture Purchases | 120 | Office Managers, Procurement Specialists |

| Small Business Office Setup | 100 | Small Business Owners, Office Administrators |

| Government Office Furniture Procurement | 80 | Government Procurement Officers, Facility Managers |

| Educational Institution Furniture Needs | 70 | School Administrators, Facility Coordinators |

| Co-working Space Furniture Requirements | 90 | Co-working Space Managers, Interior Designers |

The UAE office furniture market is valued at approximately USD 450 million, reflecting significant growth driven by the expansion of the corporate sector, increased foreign investments, and a focus on ergonomic and aesthetically pleasing work environments.