Region:Middle East

Author(s):Geetanshi

Product Code:KRAA5551

Pages:90

Published On:September 2025

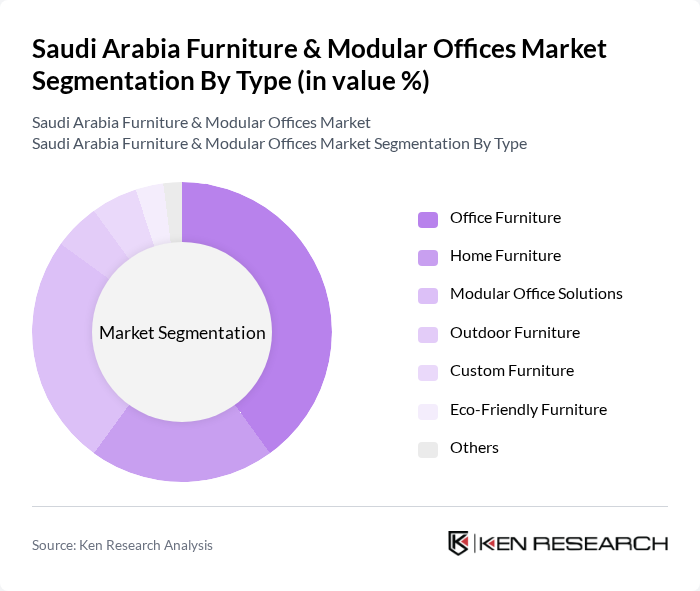

By Type:The market is segmented into various types of furniture, including office furniture, home furniture, modular office solutions, outdoor furniture, custom furniture, eco-friendly furniture, and others. Among these, office furniture is the leading segment, driven by the increasing number of businesses and the demand for ergonomic and functional office setups. Modular office solutions are also gaining traction due to their flexibility and adaptability to changing work environments.

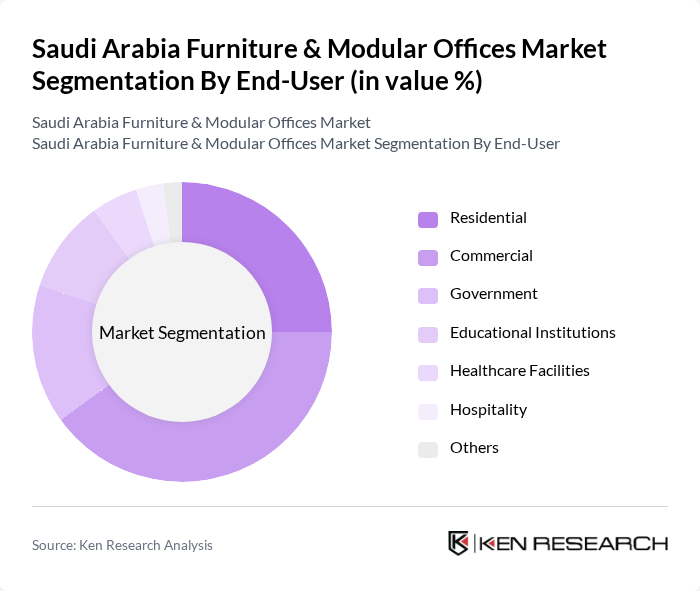

By End-User:The end-user segmentation includes residential, commercial, government, educational institutions, healthcare facilities, hospitality, and others. The commercial segment is the largest, driven by the growth of businesses and the need for modern office spaces. The healthcare and educational sectors are also significant contributors, as they require specialized furniture to meet their operational needs.

The Saudi Arabia Furniture & Modular Offices Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Al-Futtaim Group, Home Centre, Pan Emirates, Abdul Latif Jameel Group, Al-Muhaidib Group, Al-Hokair Group, Al-Jazira Furniture, Royal Furniture, Al-Mansour Furniture, Al-Suwaidi Group, Al-Muhaidib Furniture, Al-Faisaliah Group, Al-Rajhi Group, Al-Sahra Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia furniture and modular offices market is poised for significant transformation driven by evolving consumer preferences and technological advancements. As remote working becomes more prevalent, demand for flexible office solutions will rise, prompting manufacturers to innovate. Additionally, the focus on sustainability will lead to increased interest in eco-friendly materials and practices. Companies that adapt to these trends and invest in smart technology integration will likely gain a competitive edge, positioning themselves favorably in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Furniture Home Furniture Modular Office Solutions Outdoor Furniture Custom Furniture Eco-Friendly Furniture Others |

| By End-User | Residential Commercial Government Educational Institutions Healthcare Facilities Hospitality Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Showrooms Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Wood Metal Plastic Fabric Glass Others |

| By Design Style | Modern Traditional Contemporary Minimalist Industrial Others |

| By Functionality | Multi-Functional Ergonomic Modular Fixed Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Modular Office Solutions | 150 | Office Managers, Facility Coordinators |

| Residential Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Furniture Procurement | 120 | Procurement Managers, Business Owners |

| Trends in Sustainable Furniture | 80 | Sustainability Officers, Product Designers |

| Consumer Preferences in Office Furniture | 90 | Employees, HR Managers |

The Saudi Arabia Furniture & Modular Offices Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by urbanization, a booming real estate sector, and increasing demand for modern office spaces.