Region:Middle East

Author(s):Dev

Product Code:KRAD7613

Pages:83

Published On:December 2025

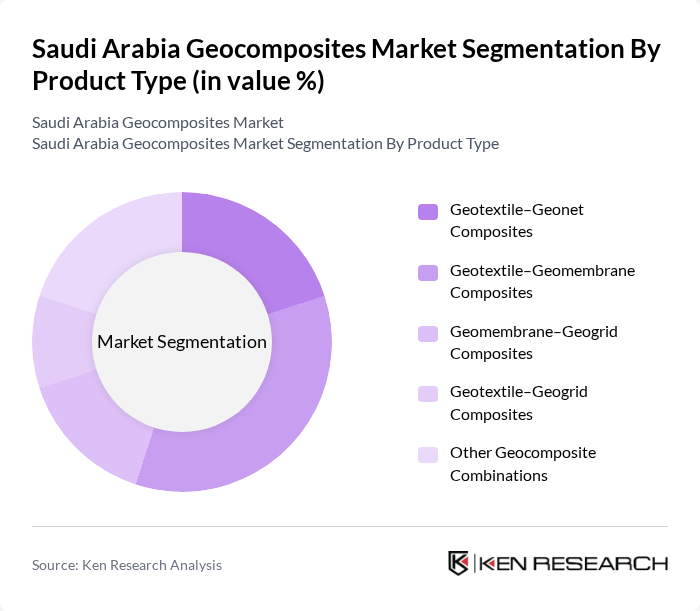

By Product Type:The product type segmentation includes various combinations of geocomposites, each serving specific functions in construction and environmental applications, in line with global and Middle East and Africa market practices. The dominant subsegment is Geotextile–Geomembrane Composites, which are widely used in landfill and water management applications due to their excellent barrier and protection properties when used as composite liners and covers. This subsegment is favored for its versatility and effectiveness in preventing contamination in landfills, wastewater lagoons, and industrial ponds, making it a preferred choice among contractors, environmental engineers, and project owners in Saudi Arabia’s waste management and water infrastructure projects.

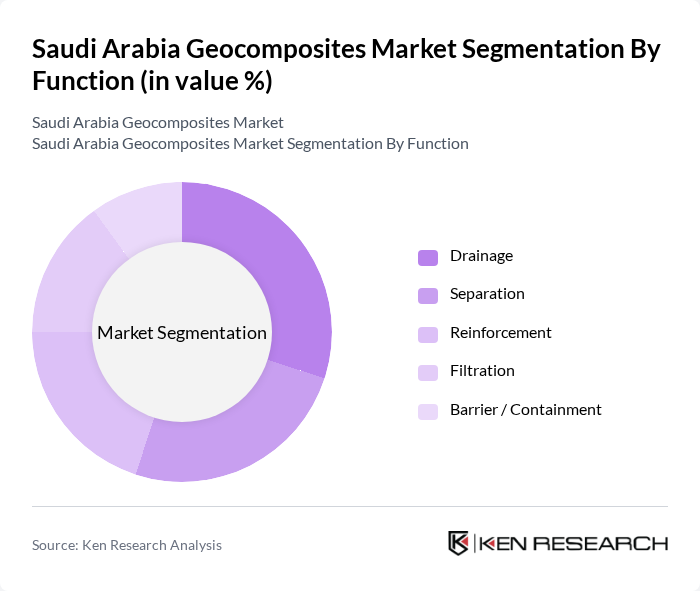

By Function:The function segmentation categorizes geocomposites based on their primary roles in construction and environmental management, consistent with global classifications that group geocomposites into drainage, separation, reinforcement, filtration, and barrier/containment functions. The leading subsegment is Drainage, which is crucial for managing water flow, relieving pore water pressure, and preventing erosion in applications such as roads, railways, retaining structures, and landfill caps and liners. This function is particularly important in road construction and landfill management in Saudi Arabia’s arid climate, where effective drainage systems are essential to maintain structural integrity, reduce maintenance costs, and ensure environmental safety around waste disposal and industrial facilities.

The Saudi Arabia Geocomposites Market is characterized by a dynamic mix of regional and international players. Leading participants such as ALYAF Industrial Company Ltd. (Saudi Arabia), Solmax, TenCate Geosynthetics (Koninklijke Ten Cate BV), Maccaferri (Officine Maccaferri S.p.A.), NAUE GmbH & Co. KG, HUESKER Group, AGRU Kunststofftechnik GmbH (AGRU), Fibertex Nonwovens A/S, Terram (part of Berry Global / Terram Geosynthetics), Geofabrics Australasia Pty Ltd, Propex Operating Company, LLC (Propex Geosolutions), CETCO (Colloid Environmental Technologies Company), Sika AG, ABG Geosynthetics, Global Synthetics / Other Active GCC Distributors contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia geocomposites market is poised for significant growth, driven by ongoing infrastructure projects and a shift towards sustainable construction practices. As urbanization accelerates, the demand for innovative materials that enhance environmental performance will increase. Additionally, the integration of smart technologies in construction will further propel the adoption of geocomposites. With government support and rising awareness, the market is expected to evolve, presenting new opportunities for manufacturers and stakeholders in the future.

| Segment | Sub-Segments |

|---|---|

| By Product Type (Geocomposites) | Geotextile–Geonet Composites Geotextile–Geomembrane Composites Geomembrane–Geogrid Composites Geotextile–Geogrid Composites Other Geocomposite Combinations |

| By Function | Drainage Separation Reinforcement Filtration Barrier / Containment |

| By Application | Road & Highway Construction Railways Landfills & Waste Management Water Management (Canals, Reservoirs, Drainage) Erosion Control & Slope Stabilization Tunnels & Underground Structures Others |

| By Polymer Material | Polypropylene (PP) Polyester (PET) High-Density Polyethylene (HDPE) Low-Density & Linear Low-Density Polyethylene (LDPE / LLDPE) Others |

| By Region | Central Region (Including Riyadh) Eastern Region (Including Dammam, Jubail) Western Region (Including Jeddah, Makkah, Madinah) Southern Region |

| By Distribution Channel | Direct Sales to Project Owners & EPC Contractors Distributors / Local Trading Companies Online / E-Procurement Portals Others |

| By Customer Type | Government & Municipal Authorities EPC & Infrastructure Contractors Industrial & Energy Project Owners Real Estate & Private Developers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Development Projects | 100 | Project Managers, Civil Engineers |

| Environmental Remediation Applications | 80 | Environmental Consultants, Site Managers |

| Landfill and Waste Management | 70 | Waste Management Officers, Regulatory Compliance Managers |

| Geotechnical Engineering Firms | 60 | Geotechnical Engineers, Research Scientists |

| Landscaping and Erosion Control | 90 | Landscape Architects, Urban Planners |

The Saudi Arabia Geocomposites Market is valued at approximately USD 6.5 million, reflecting its share within the broader GCC geocomposites market. This valuation is based on a five-year historical analysis of market trends and growth factors.