Region:Asia

Author(s):Shubham

Product Code:KRAD2460

Pages:95

Published On:January 2026

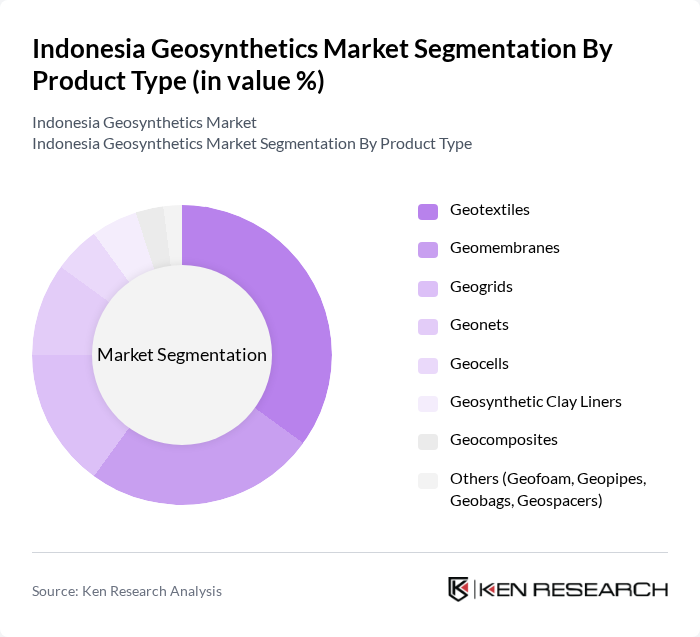

By Product Type:The product type segmentation includes various geosynthetic materials that serve different functions in construction and environmental applications. The primary subsegments are Geotextiles, Geomembranes, Geogrids, Geonets, Geocells, Geosynthetic Clay Liners, Geocomposites, and Others (Geofoam, Geopipes, Geobags, Geospacers). Geotextiles represent the leading segment in Indonesia in value terms, supported by their extensive use in road and railway construction, separation, filtration, and soil stabilization, as also reflected in regional and Indonesia-specific analyses that identify geotextiles as the dominant and fastest-growing product category. Geomembranes and geosynthetic clay liners are increasingly adopted for landfills, mining, and water containment, while geogrids and geocells are gaining traction in embankment reinforcement, slopes, and retaining structures, in line with the broader shift toward reinforced soil technologies in infrastructure works.

By Application:The application segmentation encompasses various sectors where geosynthetics are utilized, including Roadways and Railways, Waste Management and Landfills, Water Management (Canals, Ponds, Reservoirs), Erosion Control and Coastal Protection, Mining and Energy, Civil Construction (Foundations, Retaining Structures), and Others. Roadways and railways constitute the most significant application segment in Indonesia, underpinned by large-scale national road programs, toll road expansion, and transport corridors linked to the development of Nusantara and other strategic infrastructure. Waste management and landfills, along with water management projects (irrigation canals, reservoirs, ponds), are also key growth areas as geosynthetics are specified for lining, drainage, and protection functions to meet environmental and performance requirements.

The Indonesia Geosynthetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Geosynthetics Indonesia, TenCate Geosynthetics, GSE Environmental, Solmax International, HUESKER Synthetic GmbH, NAUE GmbH & Co. KG, Maccaferri Indonesia, Agru America, Inc., Fibertex Nonwovens, Geofabrics Australasia, Propex Global, Sika AG, AECOM, TERRAM (a Berry Global company), and other notable local and regional players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the geosynthetics market in Indonesia appears promising, driven by increasing infrastructure investments and a growing emphasis on sustainable practices. As the government continues to prioritize eco-friendly construction, the integration of innovative geosynthetic solutions is expected to rise. Additionally, advancements in technology, such as smart geosynthetics and IoT integration, will likely enhance product performance and durability, further propelling market growth. The focus on sustainability will shape the industry's trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Geotextiles Geomembranes Geogrids Geonets Geocells Geosynthetic Clay Liners Geocomposites Others (Geofoam, Geopipes, Geobags, Geospacers) |

| By Application | Roadways and Railways Waste Management and Landfills Water Management (Canals, Ponds, Reservoirs) Erosion Control and Coastal Protection Mining and Energy Civil Construction (Foundations, Retaining Structures) Others |

| By Material | Polypropylene (PP) Polyethylene (PE) Polyester (PET) Polyvinyl Chloride (PVC) Natural Fibers Others (Rubber, Bitumen, Fiberglass, Polystyrene) |

| By Primary Function | Stabilization Reinforcement Drainage Filtration Separation Barrier & Protection |

| By End-Use Sector | Infrastructure and Construction Environmental Engineering Mining and Energy Agriculture Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Development Projects | 120 | Project Managers, Civil Engineers |

| Geosynthetics Manufacturing Sector | 90 | Production Managers, Quality Control Officers |

| Environmental Protection Initiatives | 60 | Environmental Engineers, Sustainability Consultants |

| Construction Material Suppliers | 80 | Sales Managers, Procurement Officers |

| Research and Development in Geosynthetics | 50 | R&D Managers, Technical Directors |

The Indonesia Geosynthetics Market is valued at approximately USD 530 million, driven by increasing demand for sustainable construction materials and significant investments in infrastructure projects across the country.