Region:Middle East

Author(s):Rebecca

Product Code:KRAD7453

Pages:96

Published On:December 2025

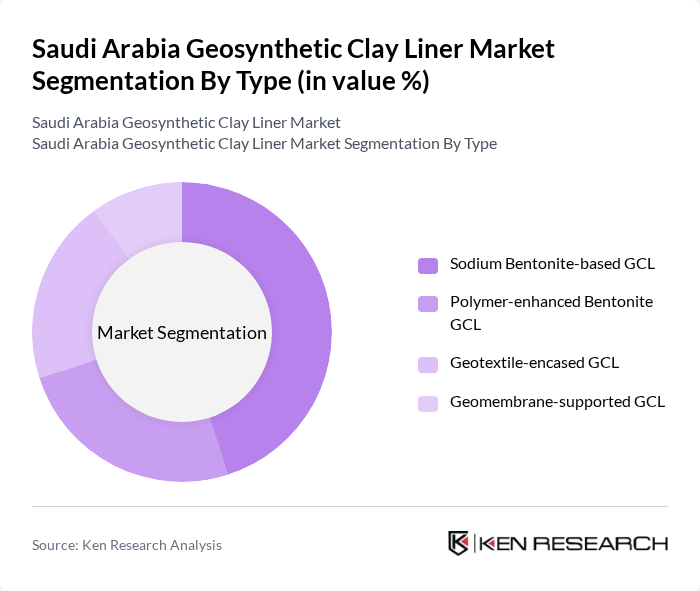

By Type:The market is segmented into various types of geosynthetic clay liners, each catering to specific applications and industry needs. The primary types include Sodium Bentonite-based GCL, Polymer-enhanced Bentonite GCL, Geotextile-encased GCL, and Geomembrane-supported GCL, in line with the global product mix of GCL systems. Sodium Bentonite-based GCL is the most widely used due to its excellent sealing properties, low hydraulic conductivity, and cost-effectiveness, making it a preferred choice for landfill base liners, capping systems, and general containment applications, especially where large-area coverage and rapid installation are required.

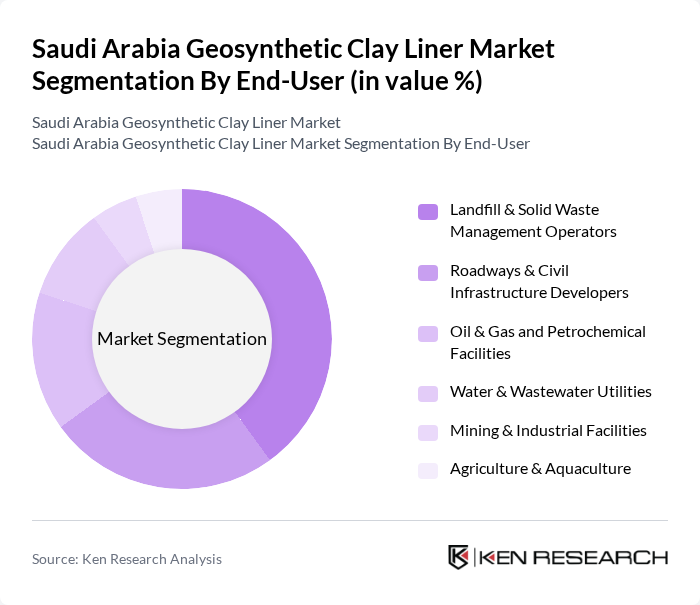

By End-User:The end-user segmentation includes various sectors utilizing geosynthetic clay liners, such as Landfill & Solid Waste Management Operators, Roadways & Civil Infrastructure Developers, Oil & Gas and Petrochemical Facilities, Water & Wastewater Utilities, Mining & Industrial Facilities, and Agriculture & Aquaculture. The Landfill & Solid Waste Management Operators segment leads the market, supported by the dominant share of landfill applications in GCL demand in Saudi Arabia and globally, driven by new sanitary landfill construction, closure and remediation of old dumpsites, and tighter standards on leachate control and groundwater protection.

The Saudi Arabia Geosynthetic Clay Liner Market is characterized by a dynamic mix of regional and international players. Leading participants such as CETCO (Minerals Technologies Inc.), NAUE GmbH & Co. KG, Solmax, HUESKER Synthetic GmbH, TenCate Geosynthetics, Maccaferri, AGRU, GSE Environmental, Geotex Gulf Factory (Saudi Arabia), Saudi Arabian Amiantit Company, Rowad International Geosynthetics (Rowad International Plastic Co.), Al-Bilad Concrete Pipe Co. Ltd. (Geosynthetics Division), Sika AG, Fibertex Nonwovens, Terram (Part of Berry Global) contribute to innovation, geographic expansion, and service delivery in this space, supported by global geosynthetics expertise and local distribution or project presence in the Kingdom.

The future of the Saudi Arabia geosynthetic clay liner market appears promising, driven by increasing environmental regulations and a shift towards sustainable construction practices. As urbanization accelerates, the demand for innovative solutions in waste management and land reclamation will likely rise. Additionally, advancements in technology will enhance the performance and application of GCLs, making them more appealing to contractors. The market is expected to evolve with a focus on eco-friendly materials and smart technologies, positioning GCLs as a vital component in future infrastructure projects.

| Segment | Sub-Segments |

|---|---|

| By Type | Sodium Bentonite-based GCL Polymer-enhanced Bentonite GCL Geotextile-encased GCL Geomembrane-supported GCL |

| By End-User | Landfill & Solid Waste Management Operators Roadways & Civil Infrastructure Developers Oil & Gas and Petrochemical Facilities Water & Wastewater Utilities Mining & Industrial Facilities Agriculture & Aquaculture |

| By Application | Containment & Wastewater Treatment Systems Landfills (Municipal & Industrial) Roadways & Civil Construction Oil & Chemical Storage Ponds and Lagoons Irrigation Canals, Reservoirs & Ponds |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Jubail) Western Region (including Jeddah, Makkah, Madinah, NEOM region) Southern Region Northern Region |

| By Material Composition | Bentonite with Woven/Nonwoven Geotextiles Bentonite with Geomembrane Composite Others (Hybrid and Customized Formulations) |

| By Installation Method | Factory-preassembled Panels On-site Panel Assembly and Seaming Mechanized Installation (e.g., Roll-out Systems) |

| By Project Type | Government-funded Environmental & Waste Projects Vision 2030 Mega & Gigaprojects (e.g., NEOM, Red Sea, Qiddiya) Industrial & Energy Sector Projects Municipal Infrastructure Projects Private Sector Real Estate & Commercial Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Projects Utilizing GCLs | 100 | Project Managers, Site Engineers |

| Waste Management Facilities | 80 | Facility Managers, Environmental Compliance Officers |

| Mining Operations | 70 | Operations Managers, Environmental Engineers |

| Civil Engineering Applications | 60 | Civil Engineers, Urban Planners |

| Regulatory Bodies and Compliance | 50 | Regulatory Officials, Policy Makers |

The Saudi Arabia Geosynthetic Clay Liner Market is valued at approximately USD 9 million, driven by increasing environmental regulations and the need for effective waste management solutions in various sectors, including landfill construction and civil engineering projects.