Region:Middle East

Author(s):Rebecca

Product Code:KRAC0209

Pages:85

Published On:August 2025

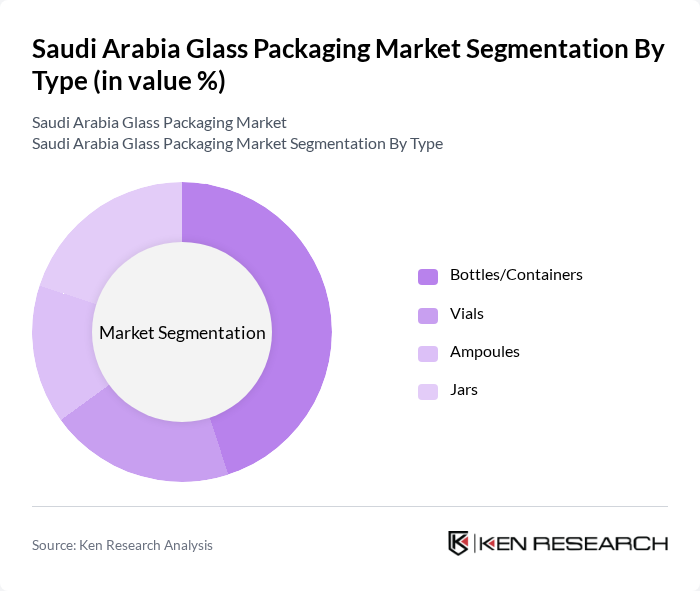

By Type:The glass packaging market can be segmented into various types, including bottles/containers, vials, ampoules, and jars. Each of these subsegments serves distinct purposes across different industries. Bottles and containers are the most widely used, primarily due to their versatility in packaging beverages, food products, and pharmaceuticals. Vials and ampoules are essential in the pharmaceutical sector for their safety and sterility, while jars are commonly used for food and cosmetic products .

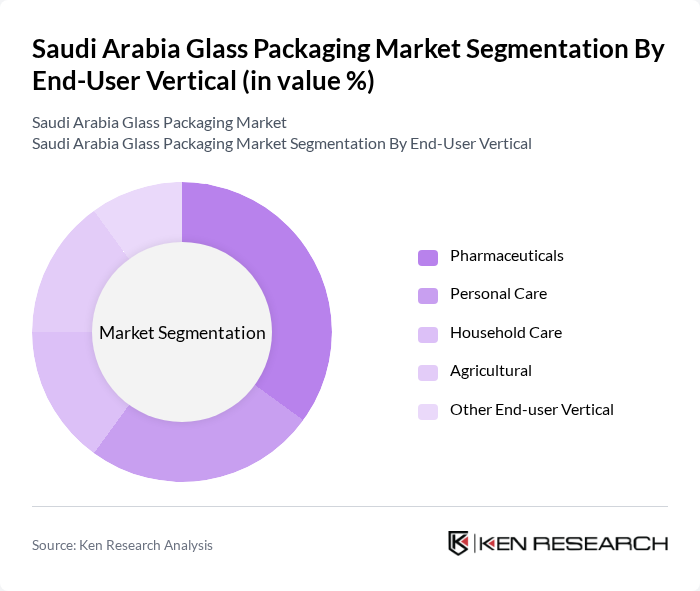

By End-User Vertical:The end-user verticals for glass packaging include pharmaceuticals, personal care, household care, agricultural, and other sectors. The pharmaceutical sector is particularly significant, as it requires high-quality glass packaging to ensure product safety and integrity. The food and beverage sector also represents a major share, driven by the demand for premium and sustainable packaging. Personal care and household care sectors are increasingly adopting glass packaging for its aesthetic appeal and recyclability .

The Saudi Arabia Glass Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Glass Company Ltd., Arabian United Float Glass Company, Middle East Glass Manufacturing Company, National Glass Industries Co., Ardagh Packaging Group PLC, Saudi International Glass Company, Al-Jazira Factory for Glass Products, Al Watania for Industries, Al-Muhaidib Glass, Obeikan Glass Company, Al-Fozan Group, Sonoco Products Company, Al-Suwaidi Industrial Services, Al-Rajhi Group, and Al-Babtain Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia glass packaging market appears promising, driven by a strong emphasis on sustainability and innovation. As consumer preferences shift towards eco-friendly solutions, manufacturers are likely to invest in advanced production technologies to enhance efficiency and reduce costs. Additionally, the growth of e-commerce is expected to create new avenues for glass packaging, as online retailers seek sustainable options to meet consumer demands. Overall, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles/Containers Vials Ampoules Jars |

| By End-User Vertical | Pharmaceuticals Personal Care Household Care Agricultural Other End-user Vertical |

| By Distribution Channel | Direct Sales Retail Outlets E-commerce Distributors |

| By Application | Packaging for Beverages Packaging for Food Products Packaging for Cosmetics Packaging for Pharmaceuticals |

| By Price Range | Economy Mid-range Premium |

| By Material Type | Clear Glass Green Glass Amber Glass |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Product Development Leads |

| Pharmaceutical Glass Containers | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Cosmetic Glass Packaging | 50 | Brand Managers, Supply Chain Coordinators |

| Industrial Glass Packaging | 40 | Operations Managers, Procurement Officers |

| Recycling and Sustainability Initiatives | 40 | Sustainability Managers, Environmental Compliance Officers |

The Saudi Arabia Glass Packaging Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing demand for sustainable packaging solutions, particularly in the food and beverage sectors.