Region:Middle East

Author(s):Rebecca

Product Code:KRAA9424

Pages:83

Published On:November 2025

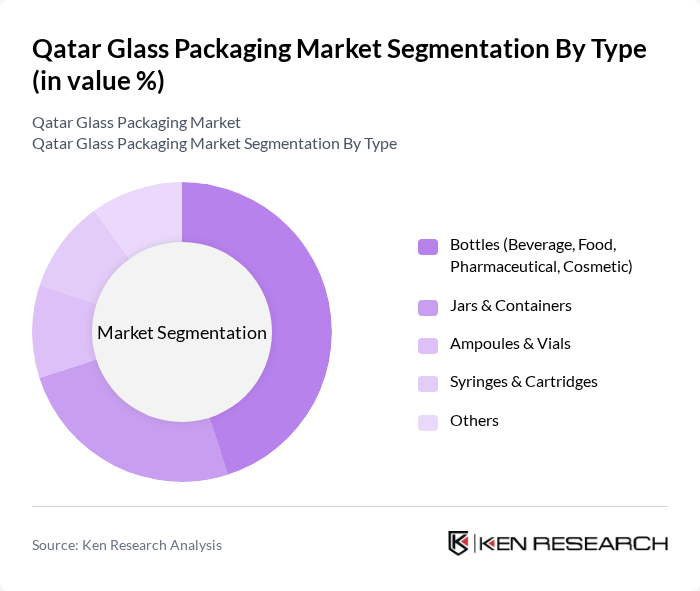

By Type:The market is segmented into various types of glass packaging products, including bottles, jars, ampoules, syringes, and others. Among these, bottles—particularly those used for beverages, food, pharmaceuticals, and cosmetics—dominate the market due to their versatility and widespread usage. The increasing consumer preference for glass bottles over plastic alternatives, driven by health and environmental concerns, has solidified their leading position in the market .

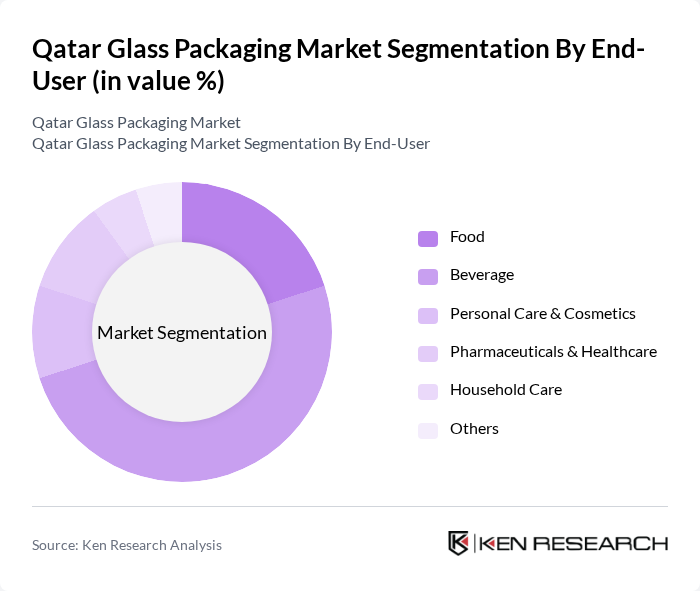

By End-User:The end-user segmentation includes food, beverage, personal care and cosmetics, pharmaceuticals and healthcare, household care, and others. The beverage sector is the leading end-user, driven by the rising demand for bottled drinks and the shift towards healthier packaging options. The trend of consumers opting for glass packaging for beverages due to its ability to preserve taste and quality has significantly influenced this segment's growth .

The Qatar Glass Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Glass Industries, Gulf Glass Manufacturing Company, Al Jazeera Glass Products, Qatar Glass Company, National Glass Industries, Doha Glass Company, Al Faleh Glass Factory, Qatar Packaging Company, Al Mufeed Glass Factory, Qatar Industrial Manufacturing Company, Qatar Glassworks, Al Maktab Al Aam for Glass, Qatar Glass Recycling Company, Al Mufeed Group, and Qatar Eco Glass contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar glass packaging market appears promising, driven by increasing environmental awareness and a shift towards sustainable practices. As the food and beverage sector continues to expand, the demand for glass packaging is expected to rise, supported by innovations in manufacturing and recycling technologies. Additionally, collaborations with eco-friendly brands will likely enhance market penetration. However, manufacturers must navigate challenges such as production costs and competition from alternative materials to capitalize on these opportunities effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Bottles (Beverage, Food, Pharmaceutical, Cosmetic) Jars & Containers Ampoules & Vials Syringes & Cartridges Others |

| By End-User | Food Beverage Personal Care & Cosmetics Pharmaceuticals & Healthcare Household Care Others |

| By Distribution Channel | Direct Sales Distributors Retail Outlets E-commerce Wholesale Others |

| By Region | Doha Al Rayyan Al Wakrah Others |

| By Application | Packaging for Beverages Packaging for Food Products Packaging for Cosmetics & Personal Care Packaging for Pharmaceuticals & Healthcare Packaging for Household Products Others |

| By Material Type | Type I (Borosilicate Glass) Type II (Treated Soda-Lime Glass) Type III (Soda-Lime Glass) Type IV (General Purpose Glass) Others |

| By Sustainability Initiatives | Recycled Glass Products Eco-Friendly Manufacturing Processes Carbon Footprint Reduction Strategies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 100 | Packaging Managers, Brand Strategists |

| Pharmaceutical Glass Packaging | 60 | Quality Control Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 70 | Product Development Managers, Marketing Executives |

| Logistics and Distribution | 50 | Supply Chain Managers, Operations Directors |

| Recycling and Sustainability Initiatives | 40 | Sustainability Officers, Environmental Compliance Managers |

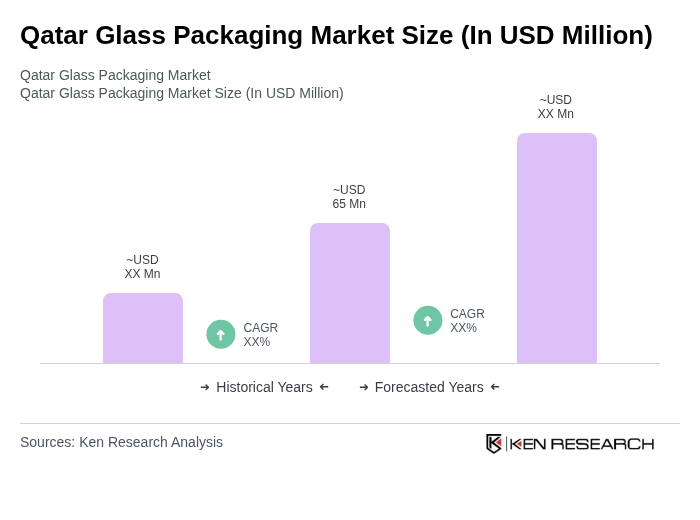

The Qatar Glass Packaging Market is valued at approximately USD 65 million, reflecting a historical analysis over five years. This growth is driven by increasing demand for sustainable packaging solutions and the expansion of the food and beverage industry.