Region:Middle East

Author(s):Dev

Product Code:KRAD1783

Pages:99

Published On:November 2025

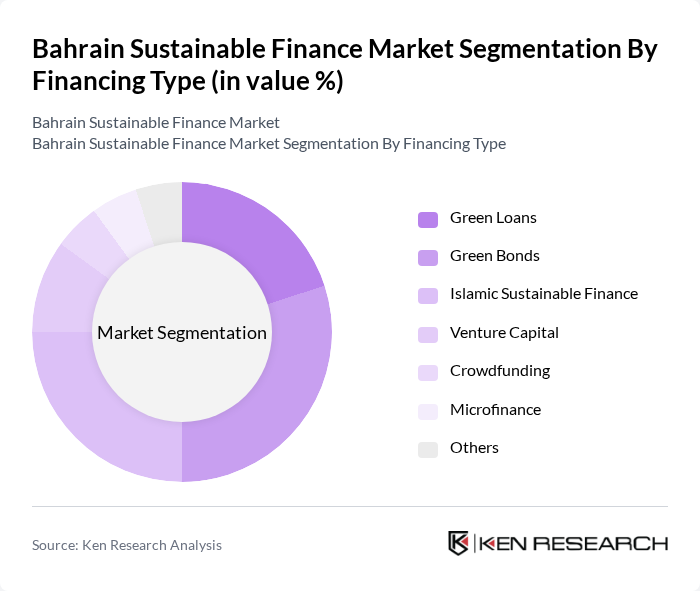

By Financing Type:The financing type segmentation includes various methods through which sustainable finance is facilitated. The subsegments are Green Loans, Green Bonds, Islamic Sustainable Finance, Venture Capital, Crowdfunding, Microfinance, and Others. Among these, Green Bonds have emerged as a leading subsegment due to their alignment with global sustainability goals and increasing investor interest in environmentally friendly projects. Bahrain’s financial institutions are actively expanding green bond offerings, supported by regulatory incentives and rising demand for climate-focused investments .

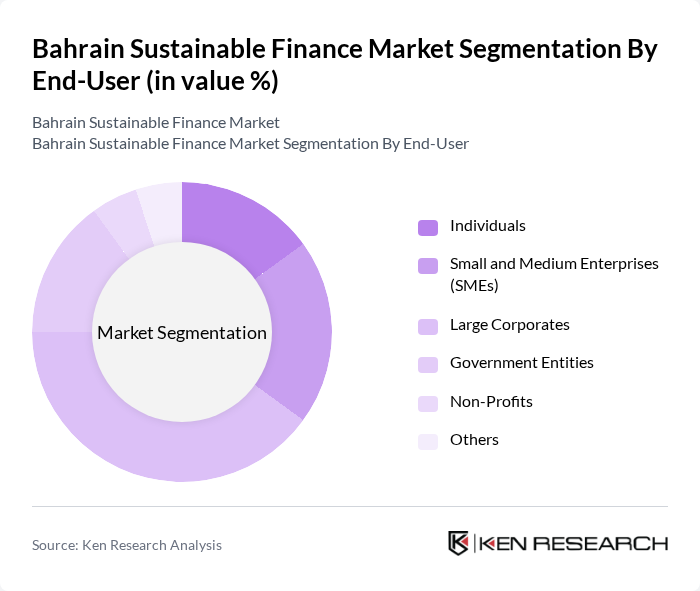

By End-User:This segmentation focuses on the various entities that utilize sustainable finance products. The subsegments include Individuals, Small and Medium Enterprises (SMEs), Large Corporates, Government Entities, Non-Profits, and Others. Large Corporates dominate this segment due to their significant capital requirements for sustainable projects and their increasing commitment to corporate social responsibility. SMEs and government entities are also showing increased participation, driven by targeted support programs and public-private partnerships .

The Bahrain Sustainable Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Islamic Bank, Al Baraka Banking Group, Gulf International Bank, National Bank of Bahrain, Bank of Bahrain and Kuwait, Bahrain Development Bank, Ithmaar Bank, Ahli United Bank, Kuwait Finance House (Bahrain), Arab Banking Corporation (Bank ABC), HSBC Bank Middle East, Standard Chartered Bank, Emirates NBD, Mashreq Bank, Abu Dhabi Islamic Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's sustainable finance market appears promising, driven by increasing government support and a growing commitment to environmental sustainability. As the country enhances its regulatory framework, more financial institutions are likely to develop innovative green products. Additionally, the collaboration with international organizations will facilitate knowledge transfer and investment, further strengthening the market. The integration of technology in finance will also play a pivotal role in streamlining processes and enhancing transparency, ultimately attracting more investors to sustainable initiatives.

| Segment | Sub-Segments |

|---|---|

| By Financing Type (Green Loans, Green Bonds, Islamic Sustainable Finance, Venture Capital, Crowdfunding, Microfinance, Others) | Green Loans Green Bonds Islamic Sustainable Finance Venture Capital Crowdfunding Microfinance Others |

| By End-User (Individuals, SMEs, Large Corporates, Government Entities, Non-Profits) | Individuals Small and Medium Enterprises (SMEs) Large Corporates Government Entities Non-Profits Others |

| By Sector (Renewable Energy, Energy Efficiency, Sustainable Agriculture, Green Buildings, Waste Management, Water Management, Others) | Renewable Energy Energy Efficiency Sustainable Agriculture Green Buildings Waste Management Water Management Others |

| By Investment Source (Domestic Banks, Foreign Direct Investment, Public-Private Partnerships, Government Schemes, Private Equity, Others) | Domestic Banks Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Private Equity Others |

| By Policy Support (Subsidies, Tax Exemptions, Credit Guarantees, Renewable Energy Certificates, Training Programs, Others) | Subsidies Tax Exemptions Credit Guarantees Renewable Energy Certificates (RECs) Training Programs Others |

| By Financing Purpose (Working Capital, Equipment Purchase, Business Expansion, R&D, Marketing, Others) | Working Capital Equipment Purchase Business Expansion Research and Development (R&D) Marketing Others |

| By Loan Size (Micro Loans, Small Loans, Medium Loans, Large Loans, Others) | Micro Loans (up to BHD 5,000) Small Loans (BHD 5,001 - BHD 20,000) Medium Loans (BHD 20,001 - BHD 100,000) Large Loans (over BHD 100,000) Others |

| By Duration (Short-term, Medium-term, Long-term, Others) | Short-term Financing (up to 1 year) Medium-term Financing (1-5 years) Long-term Financing (over 5 years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Bond Issuers | 45 | Finance Managers, Investment Analysts |

| Sustainable Investment Funds | 50 | Fund Managers, Portfolio Analysts |

| Corporate Sustainability Initiatives | 60 | Sustainability Officers, CSR Managers |

| Regulatory Bodies on Sustainable Finance | 40 | Policy Makers, Regulatory Analysts |

| Financial Institutions Offering Green Products | 70 | Product Development Managers, Risk Analysts |

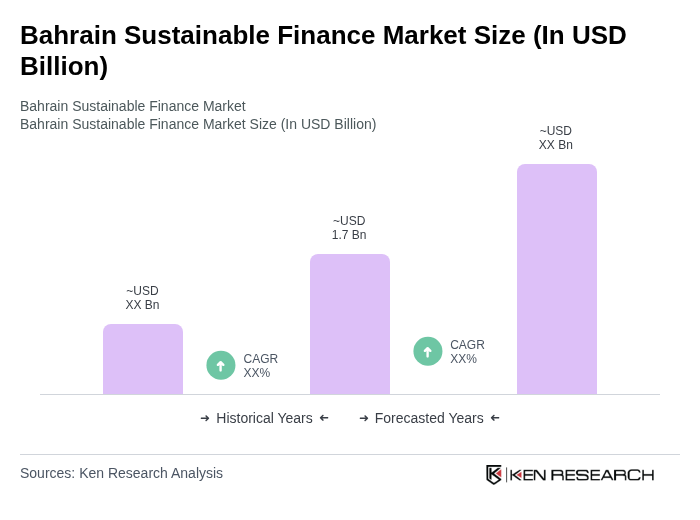

The Bahrain Sustainable Finance Market is valued at approximately USD 1.7 billion, driven by increasing awareness of environmental sustainability and government initiatives promoting green finance. This market reflects Bahrain's commitment to economic diversification and sustainability.