Region:Middle East

Author(s):Rebecca

Product Code:KRAB7378

Pages:89

Published On:October 2025

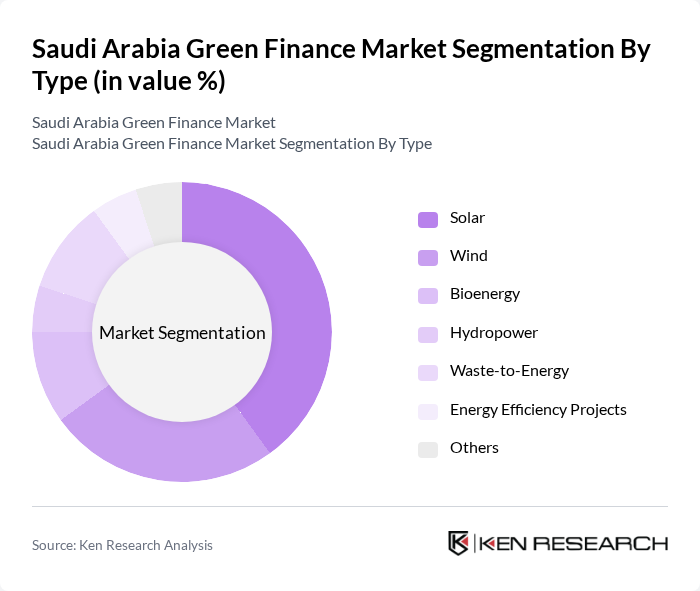

By Type:The market is segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Energy Efficiency Projects, and Others. Among these, Solar energy projects are leading due to the country's abundant sunlight and government incentives promoting solar installations. Wind energy is also gaining traction, particularly in coastal areas, while Bioenergy and Waste-to-Energy projects are increasingly recognized for their potential in waste management and energy generation.

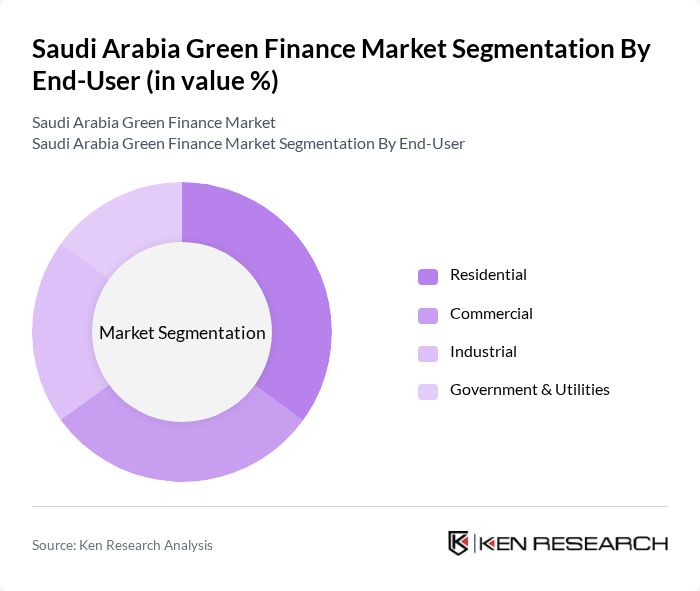

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential sector is witnessing significant growth due to increasing consumer interest in solar energy solutions for homes. Commercial entities are also investing in green technologies to enhance sustainability and reduce operational costs. The Industrial sector is gradually adopting green finance solutions, while Government & Utilities play a crucial role in driving large-scale renewable projects.

The Saudi Arabia Green Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Investment Bank, National Commercial Bank, Al Rajhi Bank, Samba Financial Group, Riyad Bank, Arab National Bank, Banque Saudi Fransi, Saudi British Bank, Gulf International Bank, Alinma Bank, Saudi Electricity Company, Saudi Aramco, ACWA Power, First Abu Dhabi Bank, International Finance Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia green finance market appears promising, driven by increasing government initiatives and a growing commitment to sustainability. As the Kingdom continues to diversify its economy away from oil dependency, investments in renewable energy and green technologies are expected to rise significantly. Furthermore, collaboration with international organizations will enhance knowledge transfer and funding opportunities, fostering innovation. The integration of advanced technologies, such as AI, will also streamline green finance solutions, making them more accessible and efficient for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Energy Efficiency Projects Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Financing Mechanism | Green Bonds Loans Grants Equity Financing |

| By Project Size | Small Scale Medium Scale Large Scale |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Bonds Issuance | 100 | Investment Bankers, Financial Analysts |

| Sustainable Investment Funds | 80 | Fund Managers, Portfolio Analysts |

| Corporate Green Financing | 70 | CFOs, Sustainability Officers |

| Renewable Energy Projects | 60 | Project Managers, Energy Analysts |

| Environmental NGOs Engagement | 50 | NGO Directors, Policy Advocates |

The Saudi Arabia Green Finance Market is valued at approximately USD 10 billion, driven by government initiatives to diversify the economy and invest in renewable energy projects, alongside rising awareness of climate change and sustainable development.