Region:Middle East

Author(s):Dev

Product Code:KRAD6418

Pages:83

Published On:December 2025

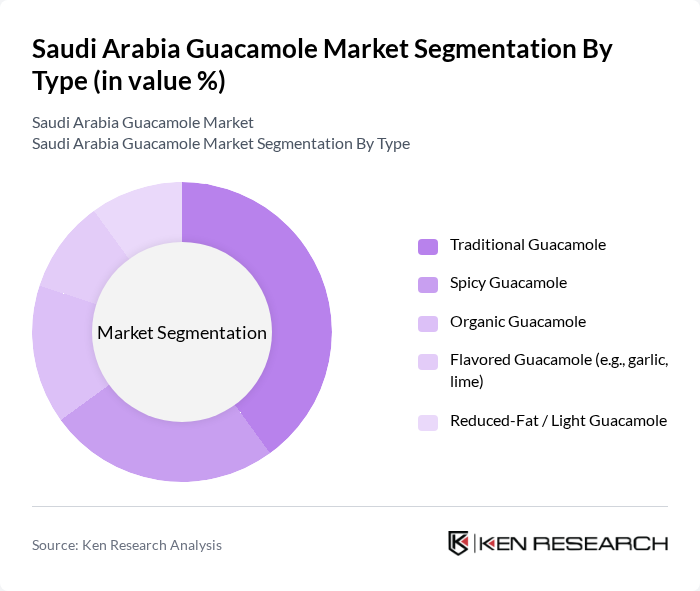

By Type:The guacamole market can be segmented into various types, including Traditional Guacamole, Spicy Guacamole, Organic Guacamole, Flavored Guacamole (e.g., garlic, lime), and Reduced-Fat / Light Guacamole. Each type caters to different consumer preferences and dietary needs, in line with global trends toward clean-label, convenient, and flavor-varied avocado products.

The Traditional Guacamole segment dominates the market due to its classic appeal and widespread acceptance among consumers, mirroring global consumption patterns where conventional recipes account for the majority of volume. It is often preferred for its authentic taste and versatility in various dishes, from dips to sandwich spreads and toppings. The growing trend of health-conscious eating and interest in clean-label products has also led to an increase in demand for organic options, although Traditional Guacamole remains the favorite. Spicy Guacamole is gaining traction, particularly among younger consumers who seek bold flavors and experiment with fusion cuisine. Overall, the market is witnessing a shift towards healthier and more diverse options, including organic and reduced-fat variants, but Traditional Guacamole continues to lead.

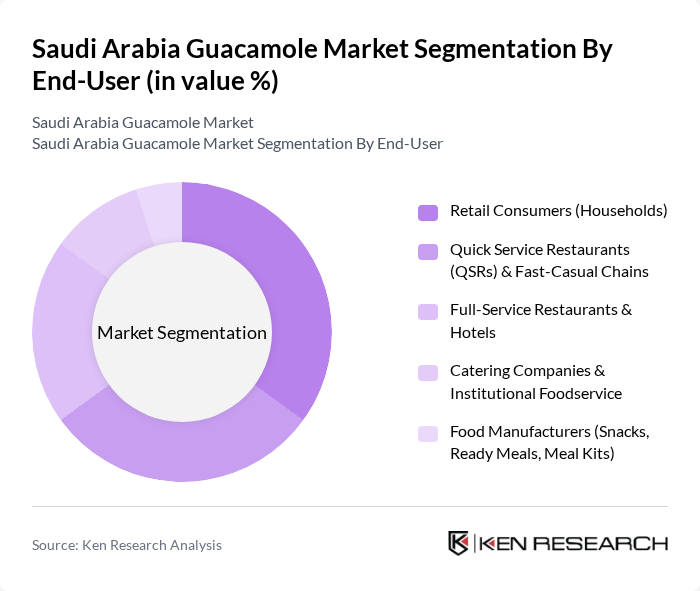

By End-User:The market can be segmented based on end-users, including Retail Consumers (Households), Quick Service Restaurants (QSRs) & Fast-Casual Chains, Full-Service Restaurants & Hotels, Catering Companies & Institutional Foodservice, and Food Manufacturers (Snacks, Ready Meals, Meal Kits). This aligns with global guacamole usage patterns where both household consumption and foodservice channels are key growth drivers.

The Retail Consumers segment is the largest end-user category, driven by the increasing trend of home cooking, social occasions at home, and snacking with convenient ready-to-eat dips and spreads. Households are increasingly purchasing guacamole for its perceived health benefits, alignment with plant-forward diets, and versatility in meals such as wraps, salads, and breakfast dishes. Quick Service Restaurants and Fast-Casual Chains also play a significant role, as they incorporate guacamole and avocado toppings into burgers, sandwiches, tacos, and bowls, appealing to a younger, urban demographic and expatriate consumers. Full-Service Restaurants and Hotels are gradually increasing their offerings of guacamole-based dishes, particularly in Mexican, Tex?Mex, and contemporary fusion concepts, while the catering segment is growing as corporate events, entertainment, and social gatherings become more common. Food manufacturers are beginning to integrate guacamole into snacks, ready meals, and meal kits in line with global convenience trends.

The Saudi Arabia Guacamole Market is characterized by a dynamic mix of regional and international players. Leading participants such as Calavo Growers, Inc., Fresh Del Monte Produce Inc., Yucatan Foods (Landec Corporation / Flagstone Foods), Wholly Guacamole (MegaMex Foods LLC), Cabo Fresh (Lantmannen Unibake / Sabra-style Brand Owners), Westfalia Fruit International, Mission Produce, Inc., Frontera Foods, Inc., Sabra Dipping Company, LLC, Mexican Original / Aztec Mexican Products Saudi Arabia, Almunajem Foods, Americana Restaurants (Saudi Arabia), Saudi Marketing Company (Farm Superstores), Panda Retail Company, Carrefour Saudi Arabia (Majid Al Futtaim Retail) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia guacamole market is poised for significant growth, driven by increasing health consciousness and the rising popularity of plant-based diets. As consumers continue to seek nutritious and convenient food options, the demand for guacamole is expected to rise. Additionally, the expansion of the food service industry will further enhance market opportunities. Innovations in product offerings and sustainable practices will likely shape the future landscape, making guacamole a staple in both retail and food service sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Guacamole Spicy Guacamole Organic Guacamole Flavored Guacamole (e.g., garlic, lime) Reduced-Fat / Light Guacamole |

| By End-User | Retail Consumers (Households) Quick Service Restaurants (QSRs) & Fast-Casual Chains Full-Service Restaurants & Hotels Catering Companies & Institutional Foodservice Food Manufacturers (Snacks, Ready Meals, Meal Kits) |

| By Packaging Type | Flexible Pouches Rigid Plastic Tubs & Trays Glass Jars Single-Serve Cups/Sachets Bulk Foodservice Packs |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores & Small Grocers Specialty & Gourmet Stores Online Grocery & E-commerce Platforms Foodservice Distributors & HoReCa Supply |

| By Region | Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah, Madinah) Eastern Region (incl. Dammam, Al Khobar) Southern & Northern Regions |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) Expat vs. Saudi Nationals Lifestyle (Health-Conscious, Convenience Seekers, Food Explorers) |

| By Product Form | Fresh / Chilled (Refrigerated) Frozen Shelf-Stable (HPP / Pasteurized / Ambient) Guacamole-Based Dips & Spreads (Blends with Sour Cream, Yogurt, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Grocery Chains | 120 | Store Managers, Category Buyers |

| Food Service Industry | 90 | Restaurant Owners, Executive Chefs |

| Health and Wellness Consumers | 80 | Health-conscious Shoppers, Nutritionists |

| Importers and Distributors | 70 | Supply Chain Managers, Import Specialists |

| Food Product Manufacturers | 60 | Product Development Managers, Quality Assurance Officers |

The Saudi Arabia Guacamole Market is valued at approximately USD 8 million, reflecting its growth driven by the rising popularity of Mexican cuisine, health consciousness, and the trend of snacking with ready-to-eat dips.