Region:Asia

Author(s):Shubham

Product Code:KRAC4290

Pages:96

Published On:October 2025

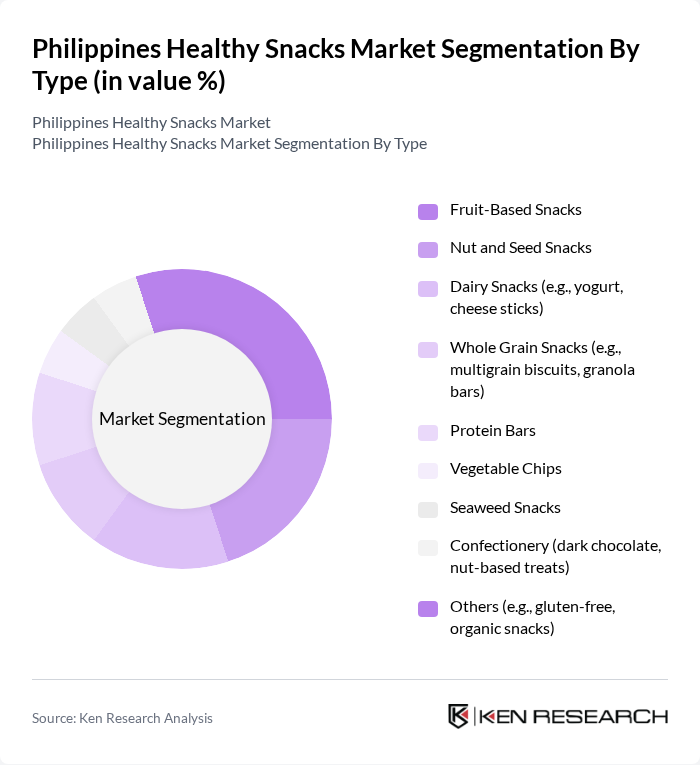

By Type:The healthy snacks market in the Philippines is segmented into fruit-based snacks, nut and seed snacks, dairy snacks, whole grain snacks, protein bars, vegetable chips, seaweed snacks, confectionery, and others. Fruit-based snacks and nut and seed snacks are particularly popular due to their perceived health benefits, convenience, and alignment with local flavor preferences. Consumers increasingly seek snacks that offer nutritional value, such as high fiber, protein, and natural ingredients, driving demand for these sub-segments. The market also reflects growing interest in plant-based, gluten-free, and clean-label products, with manufacturers innovating to meet evolving consumer expectations .

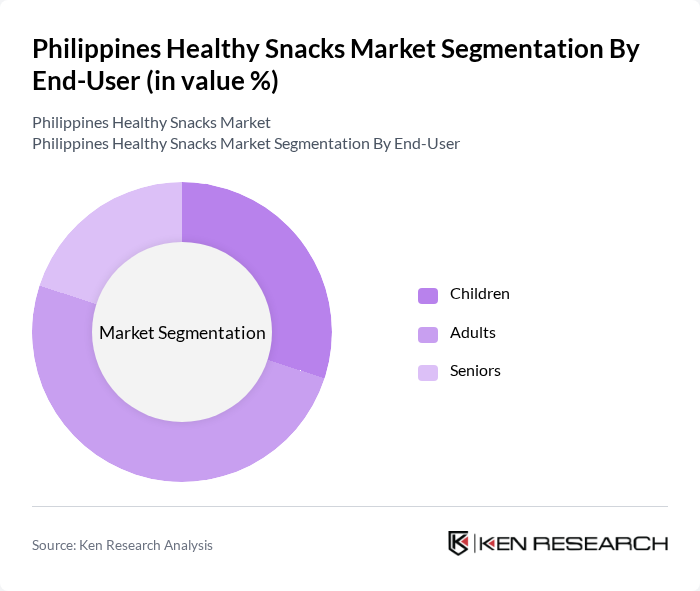

By End-User:The end-user segmentation of the healthy snacks market includes children, adults, and seniors. Adults represent the largest consumer group, driven by heightened awareness of health and wellness, and a preference for snacks that support specific dietary goals such as low-calorie, high-protein, and nutrient-dense options. Children and seniors also contribute significantly, with parents seeking healthier snack alternatives for children and seniors opting for nutritious choices tailored to their dietary needs. The market is increasingly shaped by demand for functional snacks that address energy, weight management, and meal replacement needs .

The Philippines Healthy Snacks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Monde Nissin Corporation, Universal Robina Corporation, Del Monte Philippines, Inc., Nestlé Philippines, Inc., CDO Foodsphere, Inc., Liwayway Marketing Corporation (Oishi), Jack 'n Jill (URC), Gardenia Bakeries (Philippines), Inc., Healthy Options, Corp., The Good Seed, Snack Factory, The Green Grocer, NutriAsia, Inc., Fitbar Philippines, Dizon Farms contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthy snacks market in the Philippines appears promising, driven by evolving consumer preferences and increasing health awareness. As more Filipinos prioritize nutrition, the market is likely to see a rise in innovative product offerings that cater to diverse dietary needs. Additionally, the expansion of e-commerce and retail channels will enhance accessibility, allowing brands to reach a broader audience. Collaborations with health influencers and educational campaigns will further support market growth, fostering a culture of health-conscious snacking among consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruit-Based Snacks Nut and Seed Snacks Dairy Snacks (e.g., yogurt, cheese sticks) Whole Grain Snacks (e.g., multigrain biscuits, granola bars) Protein Bars Vegetable Chips Seaweed Snacks Confectionery (dark chocolate, nut-based treats) Others (e.g., gluten-free, organic snacks) |

| By End-User | Children Adults Seniors |

| By Sales Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Health Food Stores Food Specialty Stores Small Grocery Stores Others (forecourts, etc.) |

| By Packaging Type | Pouches Jars Cartons Single-Serve Packs Family Packs Bulk Packaging |

| By Price Range | Premium Mid-Range Economy |

| By Nutritional Content | High Protein Low Sugar Gluten-Free Organic |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Healthy Snack Sales | 120 | Store Managers, Category Buyers |

| Consumer Preferences for Healthy Snacks | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Distribution Channels for Healthy Snacks | 100 | Distributors, Wholesalers |

| Market Trends in Healthy Snack Consumption | 120 | Nutritionists, Dietitians |

| Product Development Insights | 80 | R&D Managers, Product Innovators |

The Philippines Healthy Snacks Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by rising health consciousness and demand for nutritious snack options among consumers.