Region:Middle East

Author(s):Shubham

Product Code:KRAA8689

Pages:87

Published On:November 2025

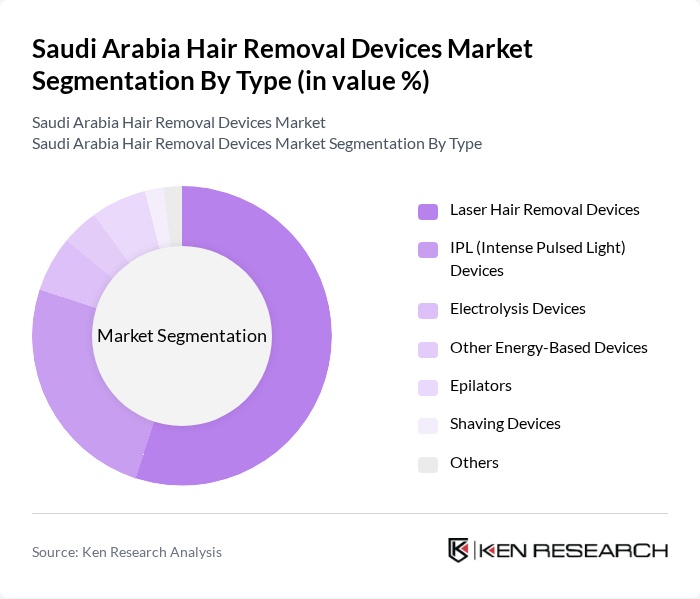

By Type:The market is segmented into various types of hair removal devices, including Laser Hair Removal Devices, IPL (Intense Pulsed Light) Devices, Electrolysis Devices, Other Energy-Based Devices, Epilators, Shaving Devices, and Others. Among these, Laser Hair Removal Devices are gaining significant traction due to their effectiveness, long-lasting results, and increasing adoption in both home and professional settings. The growing preference for advanced, pain-free solutions and the availability of portable devices have accelerated demand for laser and IPL technologies.

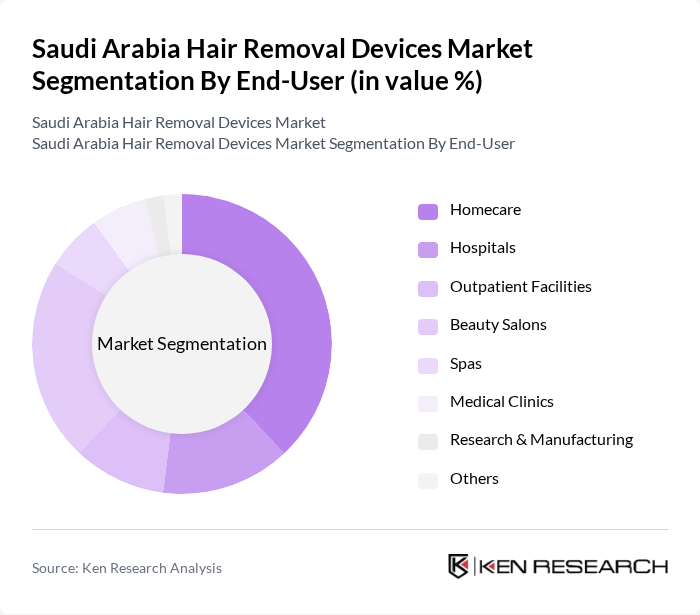

By End-User:The end-user segmentation includes Homecare, Hospitals, Outpatient Facilities, Beauty Salons, Spas, Medical Clinics, Research & Manufacturing, and Others. The Homecare segment leads the market, driven by the convenience of at-home treatments, the availability of user-friendly devices, and heightened consumer focus on personal grooming. Professional segments such as beauty salons and clinics continue to see strong demand due to the popularity of advanced laser and IPL treatments.

The Saudi Arabia Hair Removal Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips (Koninklijke Philips N.V.), Braun (Procter & Gamble Co.), Panasonic Holdings Corporation, Remington (Spectrum Brands Holdings, Inc.), Tria Beauty, Inc., Silk'n (Home Skinovations Ltd.), Cynosure, LLC, Lumenis Ltd., Alma Lasers Ltd., Cutera, Inc., Venus Concept Inc., LUTRONIC Corporation, Beurer GmbH, Iluminage Beauty, Inc., Sensica (Sensica Ltd.), DEESS (Shenzhen GSD Tech Co., Ltd.), Kenzzi, UltraShape Ltd. (Syneron Medical Ltd.), Veet (Reckitt Benckiser Group plc), Nair (Church & Dwight Co., Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hair removal devices market in Saudi Arabia appears promising, driven by evolving consumer preferences and technological advancements. As disposable incomes rise, more consumers are likely to invest in high-quality hair removal solutions. Additionally, the trend towards at-home beauty treatments is expected to gain momentum, with consumers seeking convenience and cost-effectiveness. Companies that innovate and adapt to these trends will likely capture significant market share, enhancing their competitive positioning in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Laser Hair Removal Devices IPL (Intense Pulsed Light) Devices Electrolysis Devices Other Energy-Based Devices Epilators Shaving Devices Others |

| By End-User | Homecare Hospitals Outpatient Facilities Beauty Salons Spas Medical Clinics Research & Manufacturing Others |

| By Gender | Female Male Unisex |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Technology | Laser Technology Light-Based Technology Mechanical Technology Others |

| By Application | Home Use Professional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Hair Removal Device Users | 100 | Women aged 18-45, Regular users of hair removal devices |

| Beauty Salon Professionals | 60 | Beauty therapists, Salon owners, and Managers |

| Retailers of Personal Care Products | 40 | Store Managers, Product Buyers, and Sales Representatives |

| Dermatologists and Skin Care Experts | 40 | Licensed dermatologists, Aesthetic practitioners |

| Online Shoppers of Beauty Products | 80 | Frequent online shoppers, Users of e-commerce platforms |

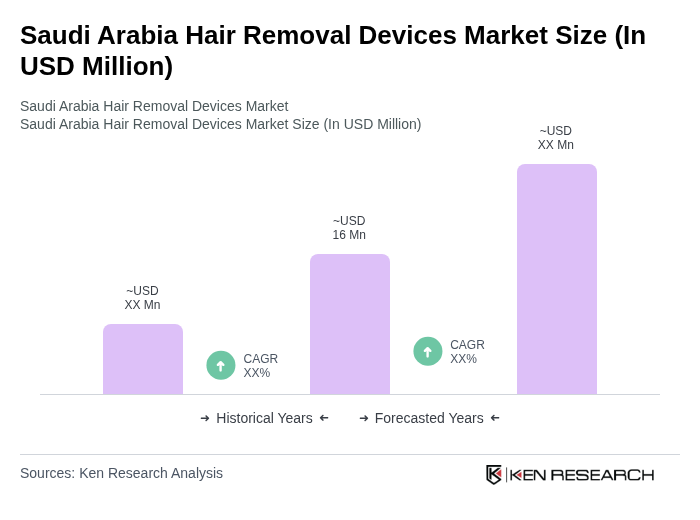

The Saudi Arabia Hair Removal Devices Market is valued at approximately USD 16 million, reflecting a five-year historical analysis. This growth is attributed to increasing consumer awareness of personal grooming and the demand for at-home hair removal solutions.