Region:Middle East

Author(s):Shubham

Product Code:KRAD5455

Pages:84

Published On:December 2025

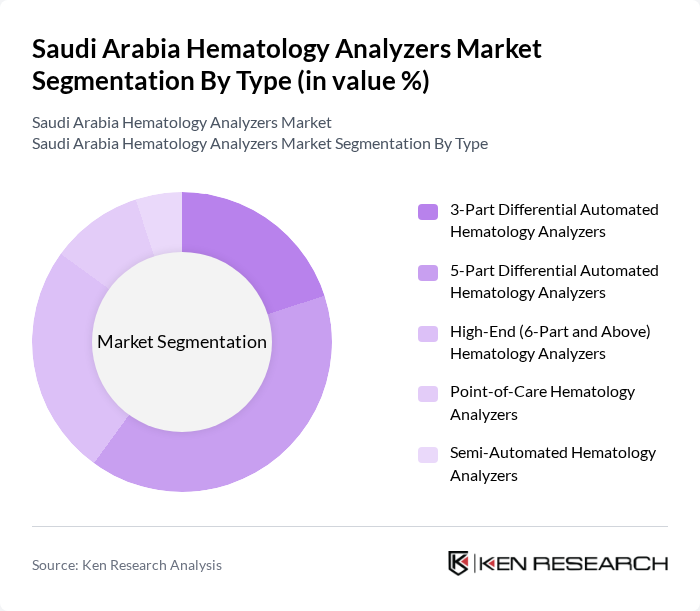

By Type:The hematology analyzers market can be segmented into various types, including 3-Part Differential Automated Hematology Analyzers, 5-Part Differential Automated Hematology Analyzers, High-End (6-Part and Above) Hematology Analyzers, Point-of-Care Hematology Analyzers, and Semi-Automated Hematology Analyzers. Among these, the 5-Part Differential Automated Hematology Analyzers are currently dominating the market due to their advanced capabilities in providing detailed white blood cell differentials and red cell and platelet parameters, which are essential for accurate diagnosis and treatment planning in oncology, hematology, and general internal medicine. The increasing adoption of these analyzers in hospitals and medium-to-large laboratories is driven by their efficiency, higher throughput, integration with laboratory information systems, and reliability in delivering comprehensive hematological data, while demand for high-end 6-part analyzers is rising in tertiary centers that require more advanced morphology and research-grade analysis.

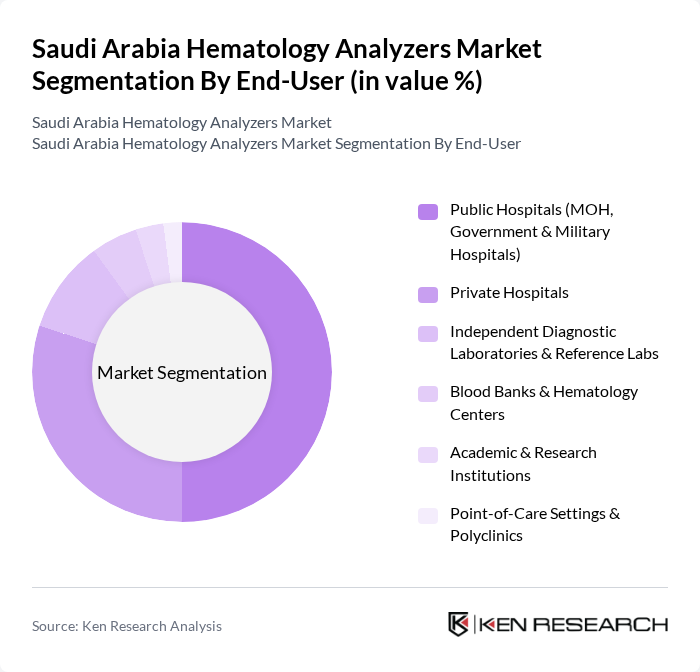

By End-User:The end-user segmentation includes Public Hospitals (MOH, Government & Military Hospitals), Private Hospitals, Independent Diagnostic Laboratories & Reference Labs, Blood Banks & Hematology Centers, Academic & Research Institutions, and Point-of-Care Settings & Polyclinics. Public hospitals are the leading end-users of hematology analyzers, aligned with the broader pattern of hospitals being the dominant end-user segment in hematology analyzer adoption globally, supported by large patient volumes, centralized laboratory networks, and government-funded procurement in Saudi Arabia. The demand for accurate and timely blood testing in public hospitals is crucial for effective patient management in emergency, oncology, surgery, and chronic disease clinics, thereby solidifying their position as the dominant end-user segment, while private hospitals and independent laboratories are increasingly investing in automated analyzers to improve turnaround times and support growing outpatient and preventive screening services.

The Saudi Arabia Hematology Analyzers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sysmex Corporation, Abbott Laboratories, Siemens Healthineers, Beckman Coulter, Inc. (Danaher Corporation), Roche Diagnostics, HORIBA Medical (HORIBA, Ltd.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Mindray), Nihon Kohden Corporation, Boule Diagnostics AB, Ortho Clinical Diagnostics (QuidelOrtho Corporation), Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Abaxis, Inc. (Zoetis Inc.), Diatron MI Zrt. (A STRATEC Biomedical Company), Swelab Instruments (Boule Diagnostics Brand) contribute to innovation, geographic expansion, and service delivery in this space, reflecting the same global vendor set that dominates the worldwide hematology analyzers market.

The future of the hematology analyzers market in Saudi Arabia appears promising, driven by ongoing technological advancements and increased healthcare investments. The integration of artificial intelligence and automation in diagnostic processes is expected to enhance accuracy and efficiency. Additionally, the expansion of healthcare infrastructure under Saudi Vision 2030 will likely facilitate greater access to advanced diagnostic tools, improving patient outcomes and fostering innovation in hematology diagnostics across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Part Differential Automated Hematology Analyzers Part Differential Automated Hematology Analyzers High-End (6-Part and Above) Hematology Analyzers Point-of-Care Hematology Analyzers Semi-Automated Hematology Analyzers |

| By End-User | Public Hospitals (MOH, Government & Military Hospitals) Private Hospitals Independent Diagnostic Laboratories & Reference Labs Blood Banks & Hematology Centers Academic & Research Institutions Point-of-Care Settings & Polyclinics |

| By Application | Complete Blood Count (CBC) Testing Hemoglobin & Anemia Profiling Leukemia & Hematologic Malignancy Workup Coagulation & Bleeding Disorder Assessment (with Linked Analyzers) Infection & Inflammation Monitoring Others |

| By Region | Central Region (Riyadh & Surrounding Provinces) Western Region (Makkah, Madinah & Jeddah Corridor) Eastern Region (Dammam, Al Khobar & Industrial Belt) Southern Region Northern Region |

| By Technology | Electrical Impedance-Based Hematology Analyzers Flow Cytometry-Based Hematology Analyzers Laser Scatter / Optical Detection Technology Integrated Hematology–Coagulation Platforms Others |

| By Distribution Channel | Direct Sales by Multinational OEMs Local Authorized Distributors & Agents Group Purchasing Organizations & Tender-Based Procurement Online & E-Procurement Portals Others |

| By Pricing Model | Capital Equipment Purchase (Outright Sale) Reagent-Rental / Cost-per-Test Contracts Leasing & Managed Service Agreements Pay-Per-Use & Outcome-Linked Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Laboratories | 120 | Laboratory Managers, Clinical Pathologists |

| Diagnostic Centers | 90 | Operations Managers, Technical Directors |

| Healthcare Procurement Departments | 80 | Procurement Officers, Supply Chain Managers |

| Hematology Equipment Distributors | 70 | Sales Representatives, Product Managers |

| Research Institutions | 60 | Research Scientists, Laboratory Technicians |

The Saudi Arabia Hematology Analyzers Market is valued at approximately USD 20 million, reflecting a historical analysis and benchmarking against the country's hematology diagnostics outlook. This valuation highlights the market's growth potential driven by increasing demand for hematological testing.