Region:Middle East

Author(s):Rebecca

Product Code:KRAD4217

Pages:89

Published On:December 2025

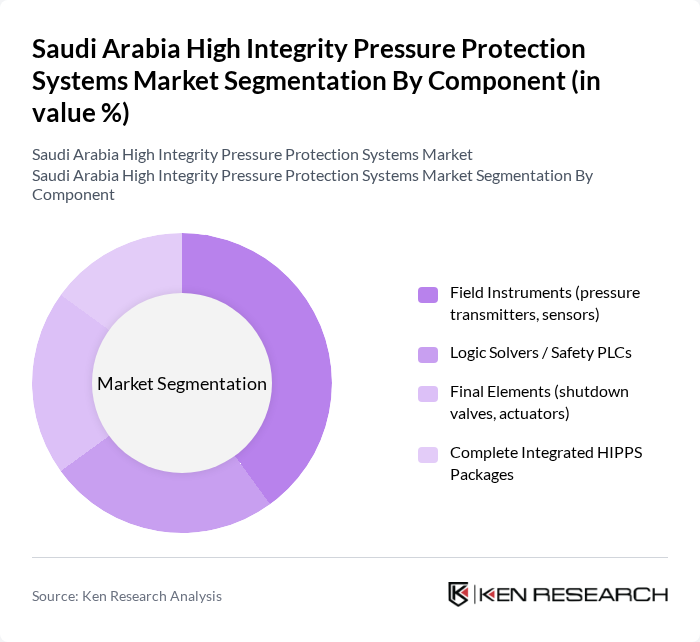

By Component:The components of high integrity pressure protection systems include various essential elements that ensure safety and operational efficiency. The dominant sub-segment in this category is Field Instruments, which includes pressure transmitters and sensors, as these are required in multiple voting architectures (for example, 2oo3 configurations) to achieve targeted Safety Integrity Levels (SIL) in line with IEC 61508/61511. These instruments are critical for real-time monitoring and control, making them indispensable in high-risk environments such as oil and gas operations, petrochemical complexes, and high?pressure gas transmission networks. The increasing emphasis on safety regulations, third?party certification for SIL?rated devices, and the need for precise, digital measurements with diagnostics and predictive maintenance capabilities are driving the demand for these components.

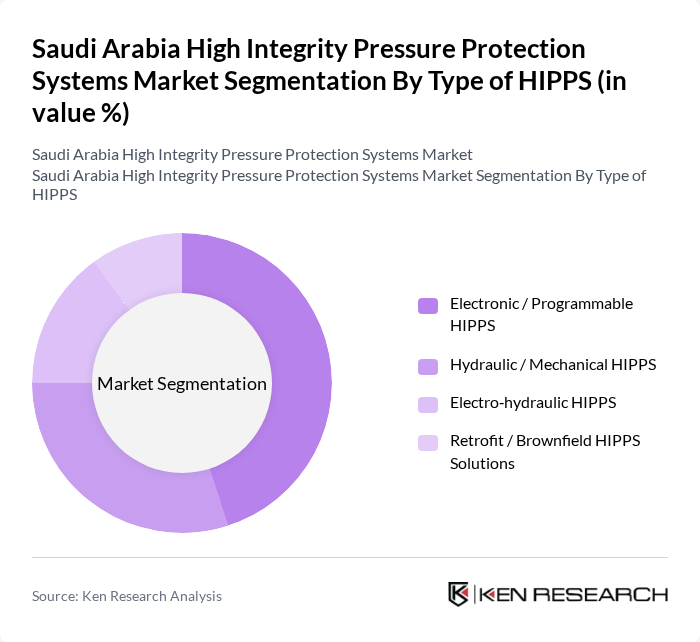

By Type of HIPPS:The types of high integrity pressure protection systems are categorized based on their operational mechanisms. The Electronic / Programmable HIPPS sub-segment is currently leading the market due to its flexibility, the ability to implement complex logic in SIL?rated safety PLCs, and advanced features that allow for better integration with distributed control systems (DCS), asset management platforms, and plant?wide safety instrumented systems. The growing trend towards digitalization and Industrial Internet of Things (IIoT) in industrial processes, along with cyber?secure remote monitoring, advanced diagnostics, and lifecycle management tools, is further propelling the adoption of electronic solutions, making them a preferred choice among operators seeking enhanced safety, reduced flaring, and improved uptime and efficiency.

The Saudi Arabia High Integrity Pressure Protection Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Emerson Electric Co., Yokogawa Electric Corporation, Schneider Electric SE, ABB Ltd., Rockwell Automation, Inc., HIMA Paul Hildebrandt GmbH (HIMA Group), IMI Critical Engineering, Mokveld Valves B.V., Schlumberger Limited (SLB), Baker Hughes Company, Schneider Electric Systems Saudi Arabia Co. Ltd., Yokogawa Saudi Arabia Company, and Saudi Aramco (as an in-house developer and integrator of advanced safety systems) contribute to innovation, geographic expansion, and service delivery in this space. Recent initiatives such as HIMA’s establishment of a dedicated entity in Saudi Arabia and IMI’s development of HIPPS solutions for hydrogen applications further underscore the country’s role as a key hub for advanced pressure protection technologies in the Middle East.

The future of the high integrity pressure protection systems market in Saudi Arabia appears promising, driven by technological advancements and a commitment to safety. As industries increasingly adopt IoT and AI technologies, predictive maintenance and real-time monitoring will enhance system reliability. Furthermore, the government's focus on diversifying the economy through renewable energy projects will create new opportunities for innovative safety solutions, ensuring that the market remains dynamic and responsive to evolving industrial needs and safety standards.

| Segment | Sub-Segments |

|---|---|

| By Component | Field Instruments (pressure transmitters, sensors) Logic Solvers / Safety PLCs Final Elements (shutdown valves, actuators) Complete Integrated HIPPS Packages |

| By Type of HIPPS | Electronic / Programmable HIPPS Hydraulic / Mechanical HIPPS Electro?hydraulic HIPPS Retrofit / Brownfield HIPPS Solutions |

| By Industry | Oil & Gas (onshore and offshore) Refining & Petrochemicals Chemicals & Fertilizers Power Generation & Water Desalination Other Process Industries |

| By Application | Upstream (wellhead and flowlines) Midstream (pipelines, gas processing) Downstream (refineries, petrochemical plants) Gas Distribution & Storage |

| By Safety Integrity Level (SIL) | SIL 2 SIL 3 SIL 4 and above (where applicable) |

| By Service Offering | Engineering, Design & Consulting Installation & Commissioning Operation, Maintenance & Testing Retrofit, Upgrade & Lifecycle Services |

| By Region | Eastern Province (oil & gas and petrochemical cluster) Central Region (including Riyadh area) Western Region (including Red Sea industrial hubs) Southern & Northern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Upstream Operations | 120 | Safety Engineers, Operations Managers |

| Midstream Pipeline Safety | 90 | Compliance Officers, Project Managers |

| Downstream Refinery Safety Systems | 80 | Plant Managers, Safety Compliance Specialists |

| Manufacturers of Pressure Protection Systems | 70 | Product Development Managers, Sales Directors |

| Regulatory Bodies and Safety Authorities | 60 | Policy Makers, Regulatory Compliance Officers |

The Saudi Arabia High Integrity Pressure Protection Systems market is valued at approximately USD 30 million, making it the largest national market in the Middle East and Africa region, which collectively ranges between USD 6070 million.