Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7705

Pages:83

Published On:October 2025

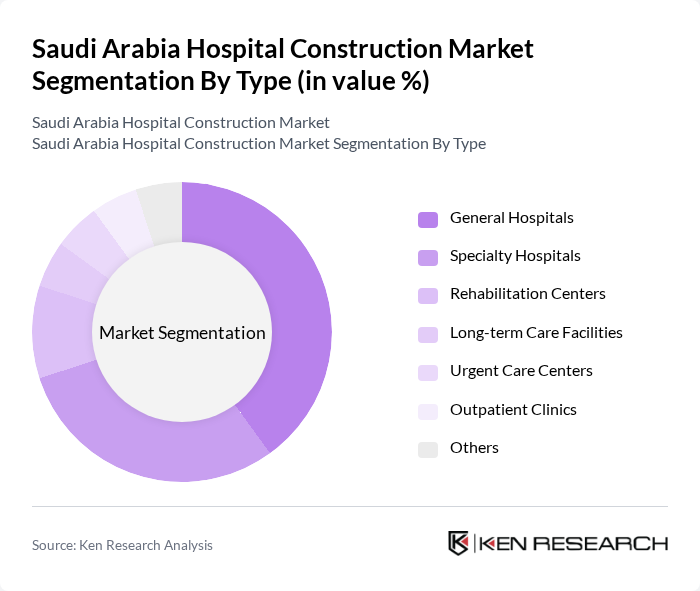

By Type:The market is segmented into various types of healthcare facilities, including General Hospitals, Specialty Hospitals, Rehabilitation Centers, Long-term Care Facilities, Urgent Care Centers, Outpatient Clinics, and Others. Among these, General Hospitals and Specialty Hospitals are the most prominent due to their comprehensive services and specialized care, respectively. The increasing prevalence of chronic diseases and the demand for specialized treatments are driving the growth of these segments.

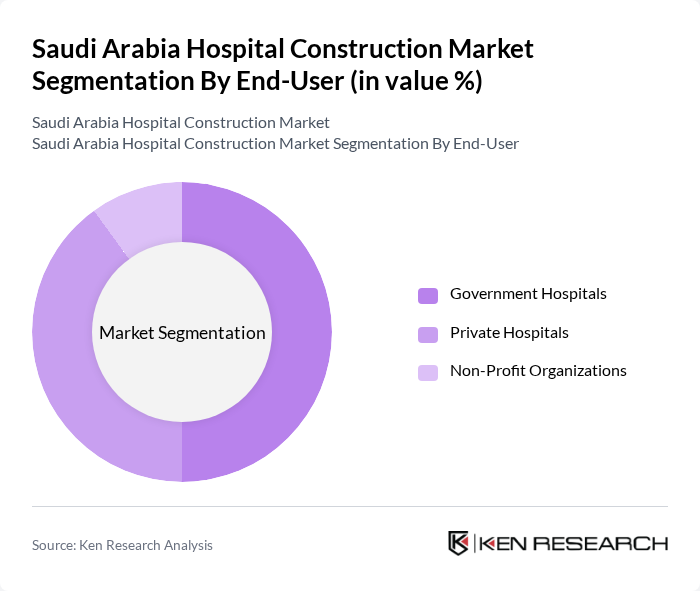

By End-User:The market is categorized into Government Hospitals, Private Hospitals, and Non-Profit Organizations. Government Hospitals dominate the market due to substantial funding and support from the Saudi government, which aims to enhance public healthcare services. Private Hospitals are also significant, driven by the increasing demand for quality healthcare and specialized services. Non-Profit Organizations play a vital role in providing affordable healthcare solutions, particularly in underserved areas.

The Saudi Arabia Hospital Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Binladin Group, El Seif Engineering Contracting Company, Al Habtoor Group, Al-Futtaim Engineering, Nesma & Partners Contracting Co. Ltd., Al Rajhi Construction, Al-Mabani General Contractors, Al-Khodari & Sons Company, Al-Omran Group, Al-Babtain Group, Al-Jazira Group, Al-Muhaidib Group, Al-Suwaidi Industrial Services, Al-Faisaliah Group, Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia hospital construction market appears promising, driven by ongoing government investments and a focus on healthcare innovation. As the population continues to grow, the demand for modern healthcare facilities will increase, prompting further construction initiatives. Additionally, the integration of smart technologies and sustainable practices in hospital design will likely shape the industry, enhancing operational efficiency and patient care. Collaborative efforts between public and private sectors will also play a crucial role in addressing infrastructure needs.

| Segment | Sub-Segments |

|---|---|

| By Type | General Hospitals Specialty Hospitals Rehabilitation Centers Long-term Care Facilities Urgent Care Centers Outpatient Clinics Others |

| By End-User | Government Hospitals Private Hospitals Non-Profit Organizations |

| By Investment Source | Government Funding Private Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Construction Methodology | Traditional Construction Modular Construction Design-Build |

| By Location | Urban Areas Rural Areas |

| By Policy Support | Subsidies Tax Incentives Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Construction Projects | 100 | Hospital Administrators, Government Officials |

| Private Healthcare Facility Developments | 80 | Healthcare Investors, Facility Managers |

| Specialized Medical Units Construction | 60 | Architects, Project Managers |

| Healthcare Infrastructure Policy Impact | 50 | Healthcare Policy Analysts, Economists |

| Construction Technology Adoption in Healthcare | 70 | Construction Engineers, Technology Providers |

The Saudi Arabia Hospital Construction Market is valued at approximately USD 15 billion, driven by increasing healthcare demands, government investments, and the expansion of private healthcare facilities. This growth reflects a commitment to enhancing healthcare infrastructure across the nation.