Region:Middle East

Author(s):Dev

Product Code:KRAD0480

Pages:99

Published On:August 2025

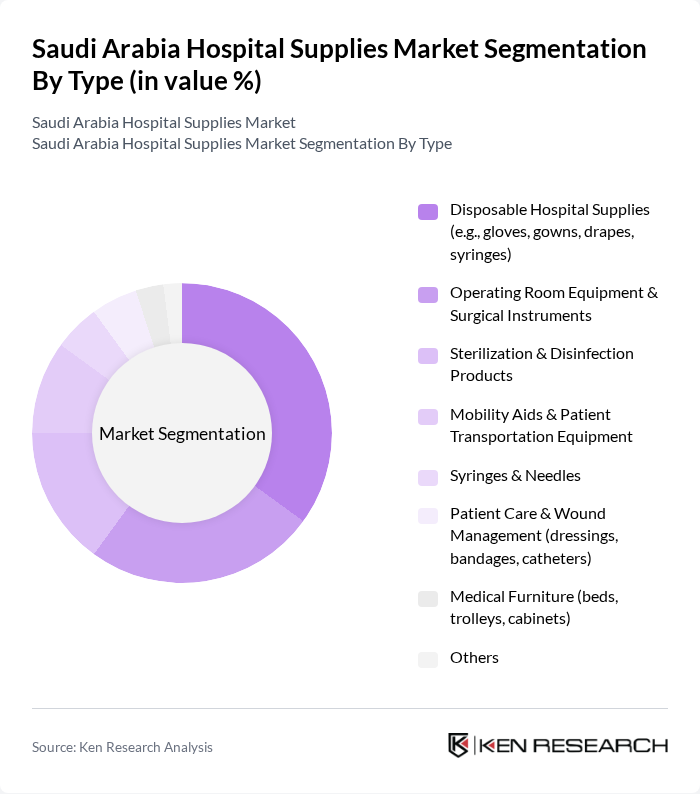

By Type:The market is segmented into various types of hospital supplies, including disposable hospital supplies, operating room equipment, sterilization products, mobility aids, syringes, patient care products, medical furniture, and others. Disposable hospital supplies, such as gloves and syringes, are currently dominating the market due to their essential role in infection control and patient safety. The increasing focus on hygiene and safety in healthcare settings has led to a surge in demand for these products.

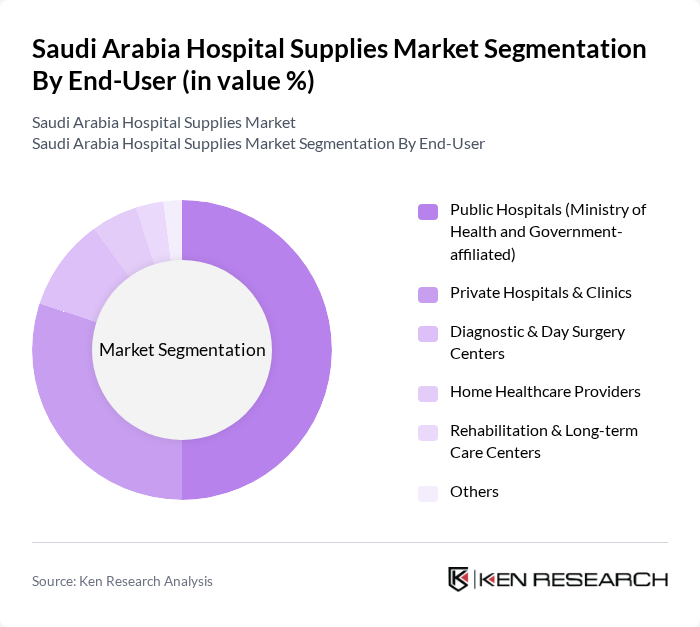

By End-User:The end-user segmentation includes public hospitals, private hospitals, diagnostic centers, home healthcare providers, rehabilitation centers, and others. Public hospitals are the leading segment due to the government's significant investment in healthcare infrastructure and services. The increasing patient load in public facilities drives the demand for various hospital supplies, ensuring that these institutions remain well-equipped to handle healthcare needs.

The Saudi Arabia Hospital Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), 3M Health Care, Johnson & Johnson MedTech (including Ethicon), Baxter International, B. Braun Melsungen AG, Cardinal Health, Medtronic, Fresenius Kabi, Terumo Corporation, Smith & Nephew, Abbott Laboratories, Mölnlycke Health Care, Kimberly-Clark Professional, Nihon Kohden Corporation, Drägerwerk AG & Co. KGaA, Philips (Health Systems), GE HealthCare, Siemens Healthineers, Al Maarefa Medical Co. (Saudi distributor/manufacturer), Al Faisaliah Medical Systems (AFMS) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia hospital supplies market appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. The integration of digital health solutions and telemedicine is expected to reshape service delivery, enhancing patient outcomes. Additionally, the focus on preventive healthcare will likely lead to increased demand for diagnostic and monitoring equipment, further stimulating market growth. As the healthcare landscape evolves, suppliers must adapt to these trends to remain competitive and meet the changing needs of healthcare providers.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Hospital Supplies (e.g., gloves, gowns, drapes, syringes) Operating Room Equipment & Surgical Instruments Sterilization & Disinfection Products Mobility Aids & Patient Transportation Equipment Syringes & Needles Patient Care & Wound Management (dressings, bandages, catheters) Medical Furniture (beds, trolleys, cabinets) Others |

| By End-User | Public Hospitals (Ministry of Health and Government-affiliated) Private Hospitals & Clinics Diagnostic & Day Surgery Centers Home Healthcare Providers Rehabilitation & Long-term Care Centers Others |

| By Distribution Channel | Direct Tendering (MOH, GHC & Government Procurement) Authorized Distributors/Dealers Hospital Group Purchasing & Wholesalers E-commerce & Digital Procurement Platforms Others |

| By Application | Surgical Procedures Emergency & Critical Care Diagnostics & Infection Control Routine Patient Care & Nursing Others |

| By Product Class | Consumables & Disposables Durable Equipment Capital Equipment Others |

| By Brand Positioning | Premium Brands Mid-Tier Brands Value/Budget Brands Others |

| By Regulatory Compliance | SFDA-Approved/Registered Products CE-Marked Products FDA-Cleared/Approved Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Surgical Supplies Procurement | 100 | Procurement Managers, Hospital Administrators |

| Diagnostic Equipment Usage | 80 | Radiologists, Laboratory Managers |

| Patient Care Supplies | 90 | Nursing Supervisors, Supply Chain Coordinators |

| Pharmaceutical Supplies | 70 | Pharmacy Directors, Inventory Managers |

| Healthcare Facility Management | 60 | Facility Managers, Operations Directors |

The Saudi Arabia Hospital Supplies Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by increasing healthcare demands, a rising population burdened with chronic diseases, and government initiatives to enhance healthcare infrastructure under Vision 2030 reforms.