Region:Middle East

Author(s):Shubham

Product Code:KRAD0797

Pages:89

Published On:August 2025

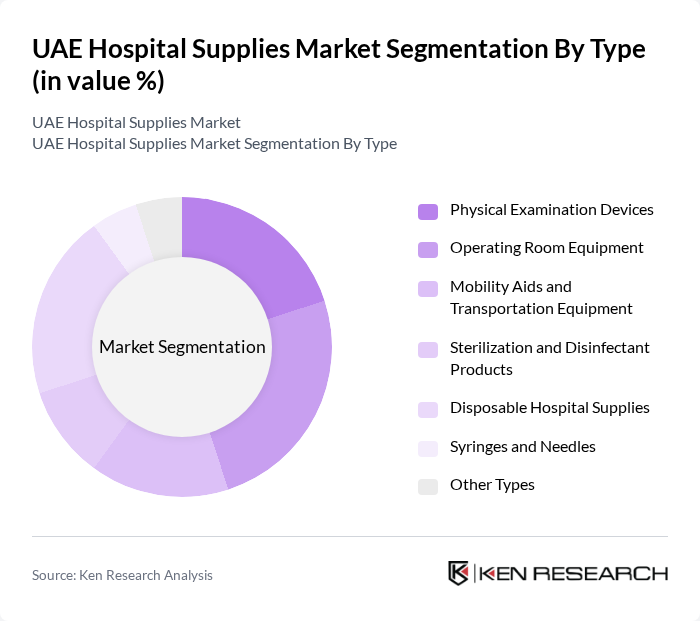

By Type:The market is segmented into various types of hospital supplies, including Physical Examination Devices, Operating Room Equipment, Mobility Aids and Transportation Equipment, Sterilization and Disinfectant Products, Disposable Hospital Supplies, Syringes and Needles, and Other Types. Each of these subsegments plays a crucial role in the overall healthcare delivery system, with specific applications and demand drivers such as the increased adoption of diagnostic and monitoring devices, minimally invasive surgical equipment, and infection control products.

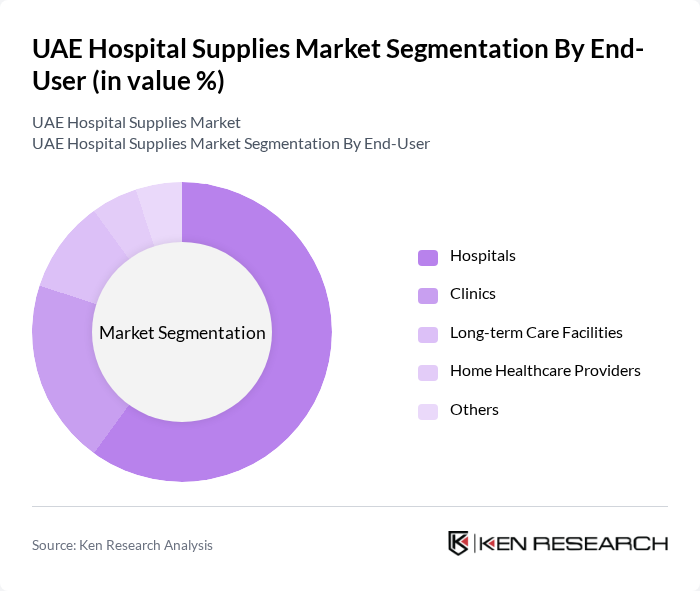

By End-User:The end-user segmentation includes Hospitals, Clinics, Long-term Care Facilities, Home Healthcare Providers, and Others. Hospitals are the primary consumers of hospital supplies due to their extensive needs for a wide range of medical devices and equipment, while clinics and long-term care facilities also contribute significantly to the market. The increasing prevalence of chronic diseases and the expansion of specialized healthcare centers further drive demand across all end-user segments.

The UAE Hospital Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Medical Devices Company (ADMD), Gulf Medical Co. Ltd., Al Zahrawi Medical Supplies LLC, Al Maqam Medical Supplies LLC, Al Hayat Pharmaceuticals, Al Sayegh Brothers Trading LLC, Al Jalila Foundation, Al Fajer Medical Company, Medtronic UAE, Becton Dickinson (BD) UAE, GE Healthcare UAE, Siemens Healthineers UAE, Philips Healthcare UAE, Abbott Laboratories UAE, and 3M Gulf Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE hospital supplies market appears promising, driven by technological advancements and a growing emphasis on preventive healthcare. As the healthcare sector continues to evolve, the integration of digital health solutions and telemedicine is expected to reshape service delivery. Furthermore, the increasing focus on sustainability will likely influence product development, encouraging suppliers to innovate and adapt to changing consumer preferences, ultimately enhancing market growth and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Examination Devices Operating Room Equipment Mobility Aids and Transportation Equipment Sterilization and Disinfectant Products Disposable Hospital Supplies Syringes and Needles Other Types |

| By End-User | Hospitals Clinics Long-term Care Facilities Home Healthcare Providers Others |

| By Distribution Channel | Direct Sales Distributors and Wholesalers Online Sales Retail Pharmacies Others |

| By Application | Surgical Procedures Diagnostic Testing Patient Care Emergency Services Others |

| By Product Class | Class I Medical Devices Class II Medical Devices Class III Medical Devices Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Brand Recognition | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Managers | 60 | Procurement Managers, Supply Chain Directors |

| Healthcare Facility Administrators | 50 | Facility Managers, Operations Directors |

| Suppliers of Medical Equipment | 40 | Sales Managers, Product Line Managers |

| Distributors of Hospital Supplies | 40 | Distribution Managers, Logistics Coordinators |

| Healthcare Professionals | 50 | Doctors, Nurses, Clinical Managers |

The UAE Hospital Supplies Market is valued at approximately USD 4.3 billion, driven by increasing demand for advanced medical technologies, healthcare infrastructure investments, and a growing population requiring enhanced healthcare services.