Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2398

Pages:80

Published On:October 2025

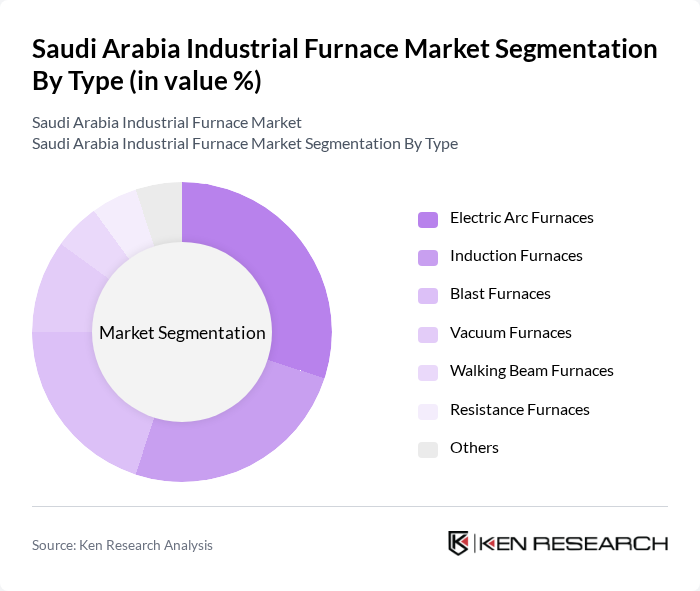

By Type:The market is segmented into various types of furnaces, including Electric Arc Furnaces, Induction Furnaces, Blast Furnaces, Vacuum Furnaces, Walking Beam Furnaces, Resistance Furnaces, and Others. Each type serves specific industrial needs, with Electric Arc and Induction Furnaces being particularly popular due to their efficiency and versatility in metal processing. Electric Arc Furnaces dominate due to their widespread use in steel production, while Blast Furnaces are increasingly adopted for large-scale metal processing .

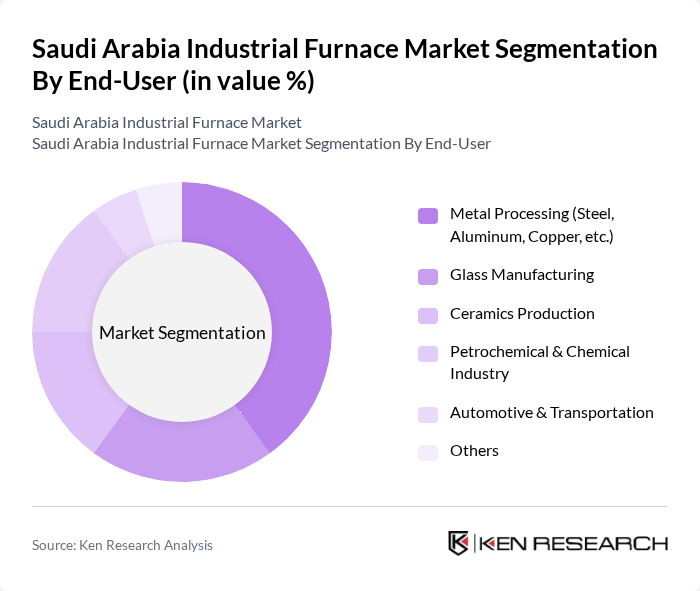

By End-User:The end-user segmentation includes Metal Processing (Steel, Aluminum, Copper, etc.), Glass Manufacturing, Ceramics Production, Petrochemical & Chemical Industry, Automotive & Transportation, and Others. The Metal Processing sector is the largest consumer of industrial furnaces, driven by the growing demand for steel and aluminum in construction and automotive applications. The petrochemical and glass manufacturing sectors are also significant contributors due to ongoing capacity expansions and modernization projects .

The Saudi Arabia Industrial Furnace Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fives Group, Tenova S.p.A., Andritz AG, Danieli & C. Officine Meccaniche S.p.A., Electrotherm (India) Ltd., Saudi Ceramics Company, Zamil Industrial Investment Company, Al-Fanar Company, Saudi Steel Pipe Company, Al-Jazira Factories for Steel Products Co. Ltd., Arabian Cement Company, National Industrialization Company (Tasnee), Saudi Arabian Oil Company (Saudi Aramco), Al-Babtain Power & Telecommunication Co., Al-Rajhi Steel, Eastern Province Cement Company, Saudi Basic Industries Corporation (SABIC) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia industrial furnace market is poised for significant transformation, driven by technological advancements and a strong focus on sustainability. As industries increasingly adopt smart technologies and automation, the integration of IoT in furnace operations is expected to enhance efficiency and reduce operational costs. Furthermore, the shift towards eco-friendly solutions will likely lead to the development of innovative furnace designs that comply with stringent environmental standards, positioning the market for robust growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Arc Furnaces Induction Furnaces Blast Furnaces Vacuum Furnaces Walking Beam Furnaces Resistance Furnaces Others |

| By End-User | Metal Processing (Steel, Aluminum, Copper, etc.) Glass Manufacturing Ceramics Production Petrochemical & Chemical Industry Automotive & Transportation Others |

| By Application | Melting Heat Treatment Casting Sintering Annealing Drying/Curing Others |

| By Fuel Type | Natural Gas Electricity Oil Biomass Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low-End Furnaces Mid-Range Furnaces High-End Furnaces Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Metal Processing Industry | 80 | Production Managers, Plant Engineers |

| Ceramics Manufacturing | 60 | Operations Directors, Quality Control Managers |

| Glass Production Sector | 55 | Technical Directors, Process Engineers |

| Research & Development in Furnace Technology | 45 | R&D Managers, Innovation Leads |

| Energy Efficiency Initiatives | 70 | Sustainability Officers, Energy Managers |

The Saudi Arabia Industrial Furnace Market is valued at approximately USD 160 million, driven by increasing demand in sectors such as metal processing, glass manufacturing, and petrochemicals, alongside ongoing industrialization and infrastructure projects in the country.