Region:Middle East

Author(s):Shubham

Product Code:KRAD5422

Pages:92

Published On:December 2025

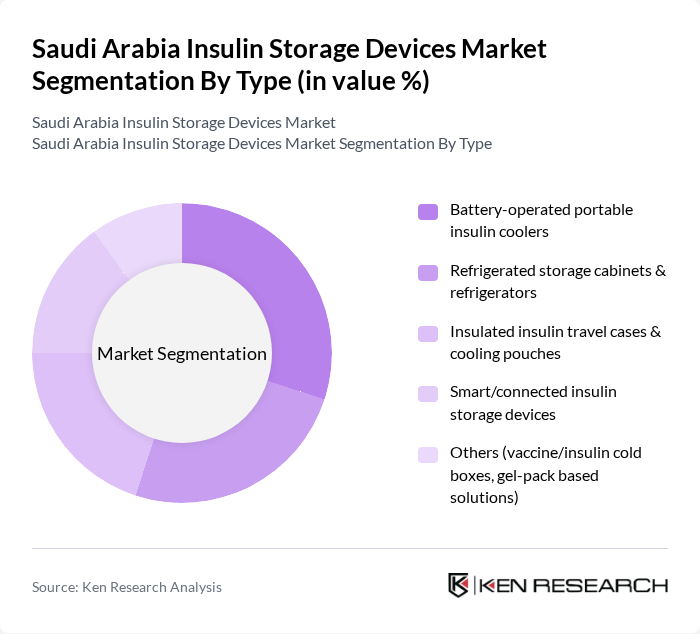

By Type:The market is segmented into various types of insulin storage devices, including battery-operated portable insulin coolers, refrigerated storage cabinets & refrigerators, insulated insulin travel cases & cooling pouches, smart/connected insulin storage devices, and others such as vaccine/insulin cold boxes and gel-pack based solutions. This structure aligns with global insulin storage devices segmentations where battery-operated and portable solutions account for the largest share due to flexibility and ability to maintain recommended insulin temperature ranges. Among these, battery-operated portable insulin coolers are gaining traction due to their convenience and ease of use for patients on the go and for home-based diabetes management. The demand for smart/connected devices is also rising as they offer advanced features like continuous temperature monitoring, mobile app connectivity, and alerts, which appeal to tech?savvy consumers and support better adherence and cold?chain assurance.

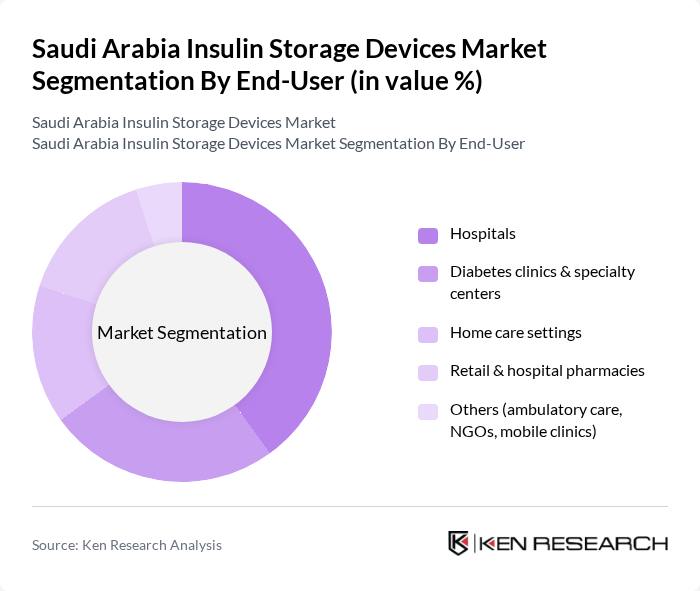

By End-User:The end-user segmentation includes hospitals, diabetes clinics & specialty centers, home care settings, retail & hospital pharmacies, and others such as ambulatory care, NGOs, and mobile clinics. Hospitals are the leading end-users due to their need for reliable insulin storage solutions for inpatients and outpatient services, in line with the overall dominance of institutional settings in Saudi Arabia’s diabetes and medical devices usage. Diabetes clinics and specialty centers also contribute significantly to the market as they require specialized storage for insulin and other temperature?sensitive medications, while expanding home?based care and self?management of diabetes is steadily increasing demand for compact, user?friendly, and portable storage options in home care and pharmacy channels.

The Saudi Arabia Insulin Storage Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, BD (Becton, Dickinson and Company), Medtronic plc, F. Hoffmann-La Roche Ltd, PHC Holdings Corporation (PHCbi biomedical refrigerators), Haier Biomedical, Godrej Appliances (InsuliCool range), Helmer Scientific, Arctiko A/S, Vestfrost Solutions, Cooluli / portable insulin cooler brands, Local Saudi cold-chain and medical refrigeration suppliers, Regional GCC medical device distributors active in insulin storage contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insulin storage devices market in Saudi Arabia appears promising, driven by ongoing technological innovations and increasing healthcare investments. The government’s commitment to enhancing healthcare infrastructure is expected to facilitate better access to these devices, particularly in underserved areas. Additionally, the integration of telemedicine and remote monitoring solutions will likely enhance patient engagement and adherence to diabetes management protocols, ultimately improving health outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery-operated portable insulin coolers Refrigerated storage cabinets & refrigerators Insulated insulin travel cases & cooling pouches Smart/connected insulin storage devices Others (vaccine/insulin cold boxes, gel-pack based solutions) |

| By End-User | Hospitals Diabetes clinics & specialty centers Home care settings Retail & hospital pharmacies Others (ambulatory care, NGOs, mobile clinics) |

| By Distribution Channel | Hospital & institutional tenders (e.g., NUPCO) Retail pharmacy chains Online pharmacies & e-commerce platforms Direct sales to hospitals/clinics Medical device distributors & wholesalers |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Al Khobar) Western Region (incl. Jeddah, Makkah, Madinah) Southern Region |

| By Device Features | Active temperature control & monitoring Digital displays & user-friendly interfaces Connectivity & mobile app integration Battery backup & power autonomy Others (alarm systems, data logging, portability) |

| By Brand Preference | Local Saudi & GCC brands Multinational medical device brands Emerging tech/start-up solutions Private-label & unbranded imports |

| By Price Range | Economy/budget devices (mass market) Mid-range devices Premium & smart connected devices Institutional-grade cold chain equipment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 80 | Endocrinologists, Diabetes Educators |

| Insulin Users | 120 | Patients using insulin storage devices |

| Manufacturers and Distributors | 60 | Product Managers, Sales Directors |

| Pharmacy Sector | 50 | Pharmacists, Pharmacy Managers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Policy Analysts |

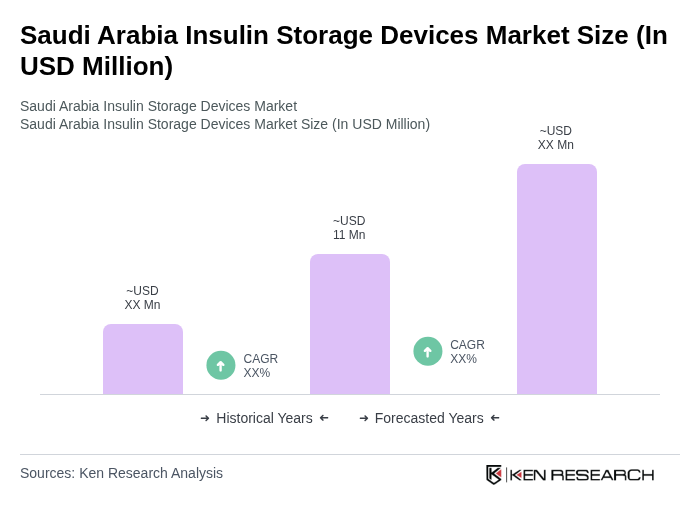

The Saudi Arabia Insulin Storage Devices Market is valued at approximately USD 11 million, reflecting a growing demand driven by the increasing prevalence of diabetes and advancements in technology for insulin storage solutions.