Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0013

Pages:98

Published On:August 2025

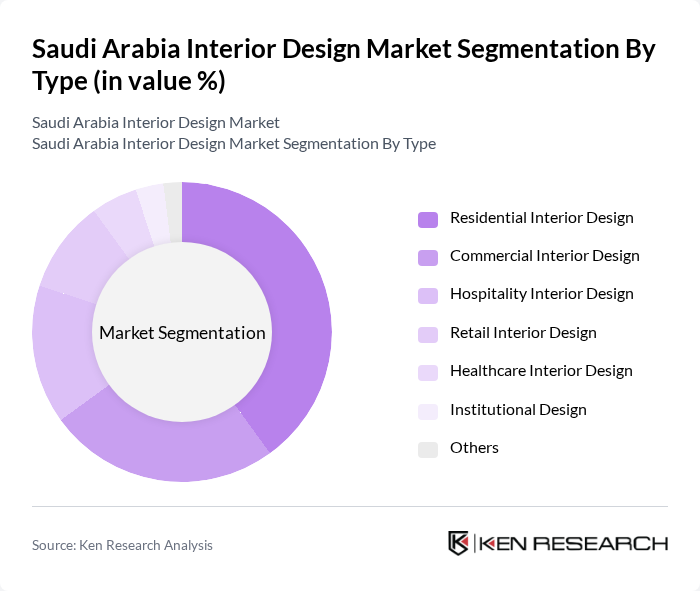

By Type:The segmentation by type includes various categories such as Residential Interior Design, Commercial Interior Design, Hospitality Interior Design, Retail Interior Design, Healthcare Interior Design, Institutional Design, and Others. Among these, Residential Interior Design is currently the leading sub-segment, driven by the increasing number of housing projects and a growing trend towards personalized living spaces. The demand for unique and functional designs in homes has surged, reflecting changing consumer preferences and lifestyle choices .

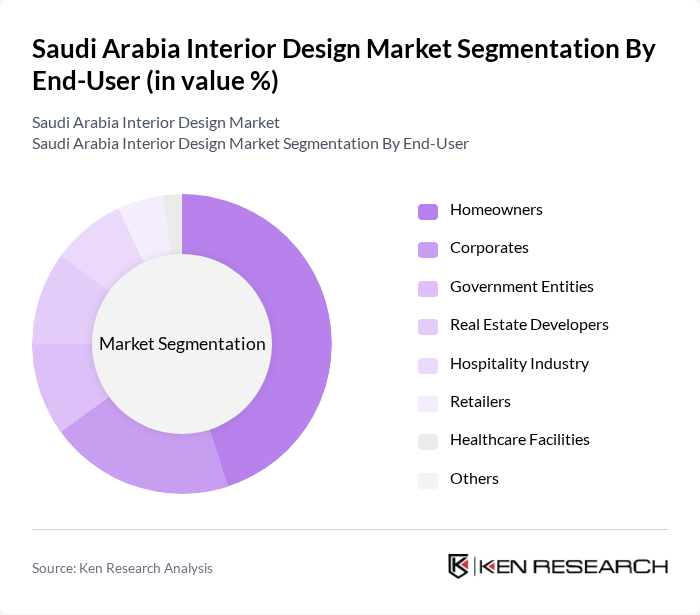

By End-User:The end-user segmentation includes Homeowners, Corporates, Government Entities, Real Estate Developers, Hospitality Industry, Retailers, Healthcare Facilities, and Others. Homeowners represent the largest segment, as the growing middle class seeks to invest in home improvements and personalized designs. This trend is further fueled by the increasing availability of design services and products tailored to individual preferences, making it a key driver in the market .

The Saudi Arabia Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almimar Interiors, Zuhair Fayez Partnership, Algedra Interior Design, Omrania, Dar Al-Handasah, Khatib & Alami, Dewan Architects + Engineers, Gensler, HOK, Perkins & Will, AECOM, MZ Architects, KEO International Consultants, Buro Happold, and Zaha Hadid Architects contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia interior design market is poised for significant growth, driven by urbanization, rising disposable incomes, and government infrastructure initiatives. As the demand for innovative and sustainable design solutions increases, firms will need to adapt to changing consumer preferences. The integration of technology in design processes and the focus on eco-friendly materials will shape the future landscape. Additionally, the expansion of luxury residential projects and commercial spaces will create new avenues for growth, ensuring a dynamic market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Interior Design Commercial Interior Design Hospitality Interior Design Retail Interior Design Healthcare Interior Design Institutional Design Others |

| By End-User | Homeowners Corporates Government Entities Real Estate Developers Hospitality Industry Retailers Healthcare Facilities Others |

| By Application | Residential Spaces Commercial Spaces Hospitality Spaces Retail Spaces Healthcare Spaces Educational Spaces Public Spaces Outdoor Spaces |

| By Design Style | Contemporary Traditional Industrial Eclectic Islamic/Arabesque |

| By Material Used | Wood Metal Glass Fabric Stone/Marble Composite Materials |

| By Service Type | Consultation Services Design Services Project Management Installation Services Turnkey Solutions |

| By Pricing Tier | Luxury Mid-Range Budget Value Segment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Interior Design Projects | 150 | Homeowners, Interior Designers |

| Commercial Space Design | 120 | Business Owners, Facility Managers |

| Hospitality Sector Design | 90 | Hotel Managers, Interior Architects |

| Retail Space Renovations | 60 | Retail Managers, Visual Merchandisers |

| Trends in Sustainable Design | 50 | Sustainability Consultants, Design Innovators |

The Saudi Arabia Interior Design Market is valued at approximately USD 3.8 billion, driven by urbanization, rising disposable incomes, and a preference for modern living spaces. This growth reflects significant investments in infrastructure and real estate development across the country.