Region:Middle East

Author(s):Rebecca

Product Code:KRAD6187

Pages:80

Published On:December 2025

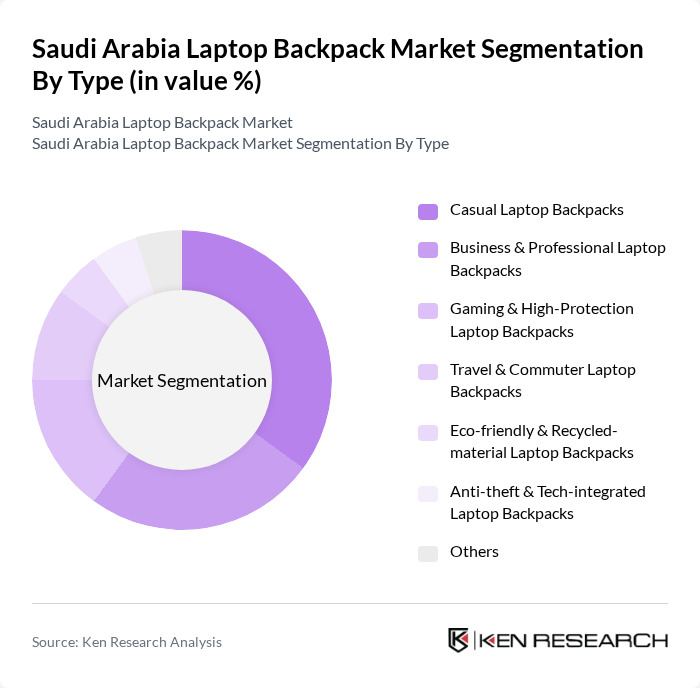

By Type:The market is segmented into various types of laptop backpacks, each catering to different consumer preferences and needs. The subsegments include Casual Laptop Backpacks, Business & Professional Laptop Backpacks, Gaming & High-Protection Laptop Backpacks, Travel & Commuter Laptop Backpacks, Eco-friendly & Recycled-material Laptop Backpacks, Anti-theft & Tech-integrated Laptop Backpacks, and Others. Casual Laptop Backpacks account for a significant share of demand due to their versatility and appeal to a broad audience, including students and young professionals who prioritize style, everyday functionality, and affordable price points. Business & Professional Laptop Backpacks are gaining traction among office workers and corporate buyers that emphasize organization, premium materials, and compatibility with business travel, while Gaming & High-Protection Laptop Backpacks benefit from rising sales of gaming laptops and demand for enhanced padding and shock resistance. Travel & Commuter Laptop Backpacks serve frequent travelers and daily commuters seeking lightweight, carry-on-compliant designs, whereas Eco-friendly & Recycled-material Laptop Backpacks and Anti-theft & Tech-integrated Laptop Backpacks represent faster-growing niches driven by sustainability awareness and demand for features such as RFID-blocking pockets, USB ports, and integrated power-bank sleeves.

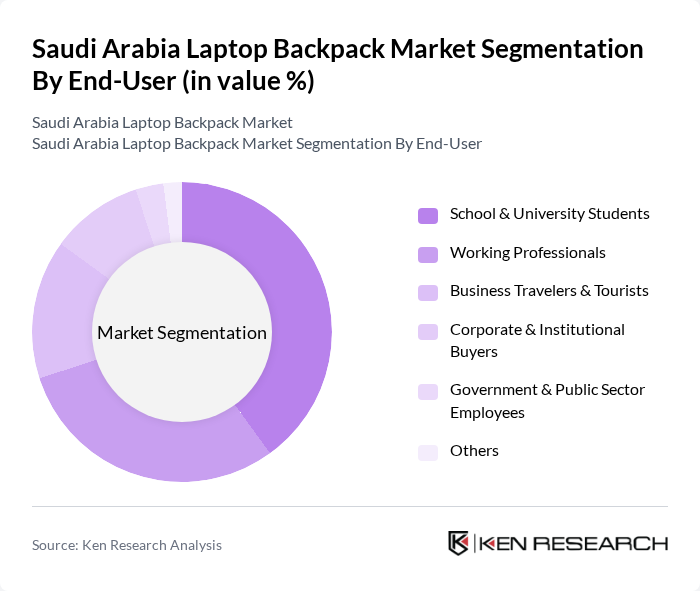

By End-User:The end-user segmentation includes School & University Students, Working Professionals, Business Travelers & Tourists, Corporate & Institutional Buyers, Government & Public Sector Employees, and Others. School & University Students represent the largest segment, driven by the increasing number of educational institutions, expanding higher education enrollment, and the growing trend of using laptops and tablets for academic purposes. This demographic values affordability, comfort, and design, making it a key focus for manufacturers that offer lightweight, durable, and fashion-forward backpack ranges targeted at youth. Working Professionals and Business Travelers & Tourists also form substantial demand pools, supported by flexible work models, business travel, and the need for organized, travel-ready laptop storage solutions.

The Saudi Arabia Laptop Backpack Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., Targus Inc., Thule Group AB, HP Inc. (HP Laptop Backpacks), Dell Technologies Inc. (Dell Laptop Backpacks), Lenovo Group Limited (Lenovo Laptop Backpacks), SwissGear (Wenger / Victorinox Swiss Army), Osprey Packs, Inc., Eastpak (VF Corporation), Herschel Supply Company, Inateck Technology Co., Ltd., Amazon Basics (Amazon.com, Inc.), Fjällräven (Fenix Outdoor AB), The North Face (VF Corporation), Adidas AG contribute to innovation, geographic expansion, and service delivery in this space. These brands compete on durability, ergonomic design, material quality, and feature-rich offerings, while also leveraging both brick-and-mortar distribution and fast-growing e-commerce channels across Saudi Arabia’s major urban centers.

The future of the Saudi Arabia laptop backpack market appears promising, driven by technological advancements and changing consumer preferences. As the youth population continues to grow, with over 65% under the age of 30, there will be an increasing demand for innovative and stylish backpacks. Additionally, the integration of smart technology into backpack designs, such as built-in charging ports, is expected to gain traction. Companies that adapt to these trends and focus on sustainability will likely capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Laptop Backpacks Business & Professional Laptop Backpacks Gaming & High-Protection Laptop Backpacks Travel & Commuter Laptop Backpacks Eco-friendly & Recycled-material Laptop Backpacks Anti-theft & Tech-integrated Laptop Backpacks Others |

| By End-User | School & University Students Working Professionals Business Travelers & Tourists Corporate & Institutional Buyers Government & Public Sector Employees Others |

| By Price Range | Economy (Value/Budget) Mass Premium (Mid-range) Premium/Branded Luxury & Designer Others |

| By Material | Nylon & Polyamide Polyester Genuine & Synthetic Leather Canvas & Fabric Blends Eco-friendly & Recycled Materials Others |

| By Distribution Channel | Online Marketplaces (e.g., Amazon.sa, Noon, Namshi) Brand E-commerce & Direct-to-Consumer Platforms Modern Trade & Hypermarkets (e.g., Carrefour, Lulu, Panda) Specialty Electronics & IT Retailers (e.g., Jarir, Extra, Virgin Megastore) Traditional Stores & Wholesalers |

| By Brand Positioning | Global Premium & Lifestyle Brands International Mass & Value Brands Local & Regional Brands Private Label & Retail-owned Brands |

| By User Demographics | Age Group (Teenagers, Young Adults, Middle-aged, Seniors) Gender (Unisex, Male-focused, Female-focused) Income Level (Low, Middle, Upper-middle, High) Lifestyle & Usage Pattern (Urban Commuters, Frequent Travelers, Gamers, Students) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Laptop Backpacks | 150 | Students, Young Professionals |

| Retail Insights from Backpack Sellers | 100 | Store Managers, Sales Representatives |

| Market Trends in E-commerce Sales | 80 | E-commerce Managers, Digital Marketing Specialists |

| Brand Perception Studies | 70 | Brand Managers, Marketing Analysts |

| Usage Patterns Among Professionals | 90 | Corporate Employees, IT Professionals |

The Saudi Arabia Laptop Backpack Market is valued at approximately USD 65 million, reflecting a significant growth driven by the increasing adoption of laptops among students and professionals, as well as the rising demand for stylish and functional backpacks.