Region:Middle East

Author(s):Shubham

Product Code:KRAA8905

Pages:90

Published On:November 2025

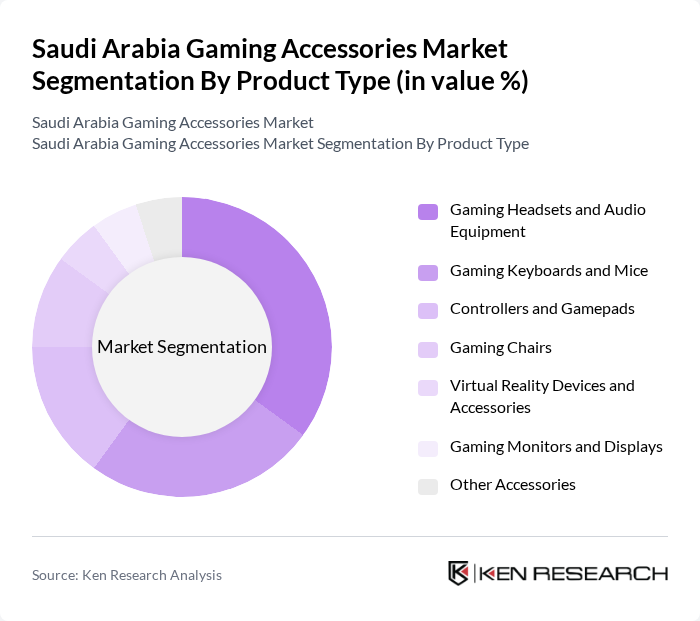

By Product Type:The product type segmentation includes various categories of gaming accessories that cater to different gaming needs and preferences. The subsegments include Gaming Headsets and Audio Equipment, Gaming Keyboards and Mice, Controllers and Gamepads, Gaming Chairs, Virtual Reality Devices and Accessories, Gaming Monitors and Displays, and Other Accessories. Among these, Gaming Headsets and Audio Equipment dominate the market due to the increasing demand for immersive audio experiences in gaming. The keyboards and mice segment is also growing rapidly, driven by the rise of e-sports and the need for precise controls.

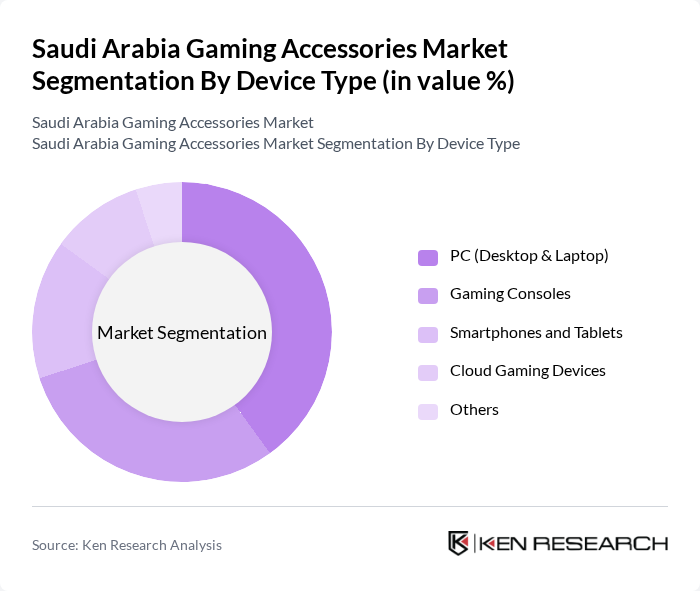

By Device Type:The device type segmentation encompasses various platforms on which gaming accessories are utilized. This includes PC (Desktop & Laptop), Gaming Consoles, Smartphones and Tablets, Cloud Gaming Devices, and Others. The PC segment is currently leading the market, driven by the popularity of PC gaming and the demand for high-performance accessories that enhance gameplay. The smartphone and tablet segment is also growing, reflecting the increasing use of mobile gaming in the region.

The Saudi Arabia Gaming Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Logitech International S.A., Razer Inc., Corsair Gaming Inc., GN Store Nord A/S (SteelSeries), HP Inc. (HyperX Division), ASUSTeK Computer Inc., Micro-Star International Co., Ltd. (MSI), AOC International Limited, Dell Technologies Inc., HP Inc., Turtle Beach Corporation, BenQ Corporation, Kingston Technology Corporation, Cooler Master Technology Corp., BenQ ZOWIE (BenQ subsidiary) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia gaming accessories market is poised for significant growth, driven by technological advancements and a burgeoning gaming culture. As the government continues to support digital entertainment initiatives, the market is likely to see increased investment in local content and infrastructure. Furthermore, the rise of mobile gaming and the integration of augmented reality technologies will create new avenues for accessory innovation, enhancing user engagement and experience in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gaming Headsets and Audio Equipment Gaming Keyboards and Mice Controllers and Gamepads Gaming Chairs Virtual Reality Devices and Accessories Gaming Monitors and Displays Other Accessories |

| By Device Type | PC (Desktop & Laptop) Gaming Consoles Smartphones and Tablets Cloud Gaming Devices Others |

| By Distribution Channel | Online Retail (E-commerce Platforms) Specialty Gaming Stores Department Stores Direct Sales and Brand Stores Others |

| By Price Range | Budget (Entry-Level) Mid-Range Premium Luxury (High-End Professional) Others |

| By End-User Segment | Casual Gamers Professional and Competitive Gamers Gaming Cafes and eSports Venues Educational Institutions Corporate and Enterprise Users |

| By Gaming Platform | PC Gaming Console Gaming (PlayStation, Xbox) Mobile Gaming Cloud Gaming Others |

| By Consumer Demographics | Children (6-12 years) Teenagers (13-19 years) Young Adults (20-35 years) Adults (36+ years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Gaming Accessories | 100 | Retail Managers, Sales Executives |

| Consumer Preferences in Gaming | 120 | Casual Gamers, Hardcore Gamers |

| Distribution Channels Analysis | 80 | Distributors, Wholesalers |

| Market Trends and Innovations | 60 | Product Developers, Marketing Managers |

| Impact of E-commerce on Sales | 70 | E-commerce Managers, Digital Marketing Specialists |

The Saudi Arabia Gaming Accessories Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing popularity of gaming, eSports, and enhanced internet connectivity in the region.