Region:Middle East

Author(s):Rebecca

Product Code:KRAD5045

Pages:94

Published On:December 2025

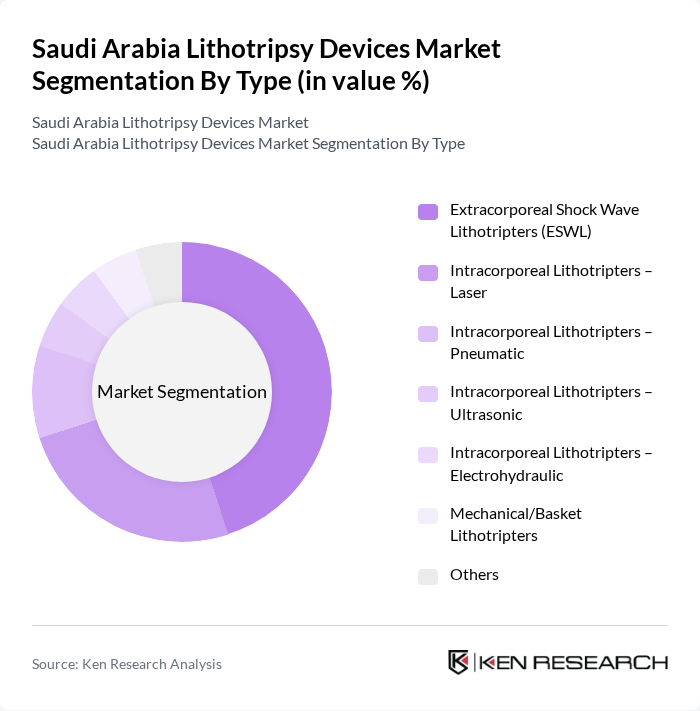

By Type:The lithotripsy devices market can be segmented into various types, including Extracorporeal Shock Wave Lithotripters (ESWL), Intracorporeal Lithotripters (Laser, Pneumatic, Ultrasonic, Electrohydraulic), Mechanical/Basket Lithotripters, and Others. Among these, ESWL is the most widely used due to its non-invasive nature and effectiveness in treating kidney stones. Global market analyses consistently show extracorporeal shock wave lithotripsy devices accounting for the largest revenue share among lithotripsy types, reflecting their widespread clinical adoption. The increasing preference for outpatient procedures, shorter recovery times, and ongoing improvements in imaging guidance and energy modulation in ESWL technology have further solidified its dominance in the market.

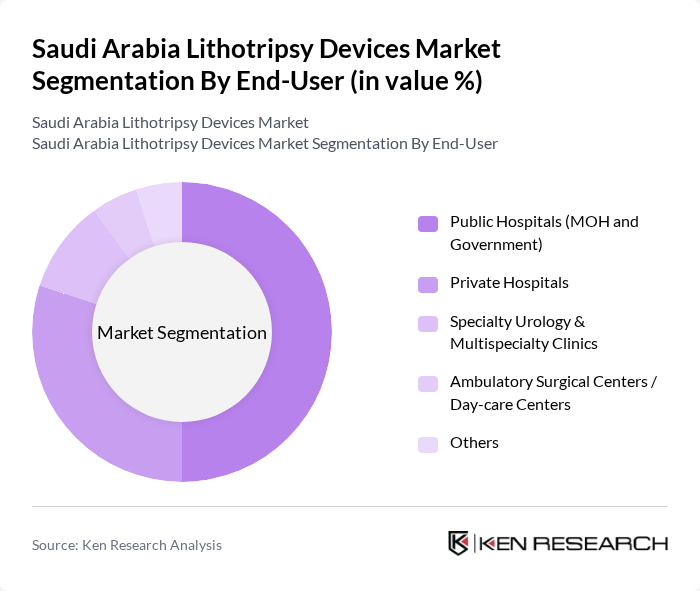

By End-User:The end-user segmentation includes Public Hospitals (MOH and Government), Private Hospitals, Specialty Urology & Multispecialty Clinics, Ambulatory Surgical Centers / Day-care Centers, and Others. Public hospitals are the leading end-users due to their extensive patient base, centralized procurement, and government funding, which allows for the acquisition and replacement of advanced lithotripsy devices, particularly in large tertiary facilities. The increasing number of private hospitals and specialty urology clinics, along with expanding urology departments and day-care surgery units, also contributes to the growing demand for these devices across the country.

The Saudi Arabia Lithotripsy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, Boston Scientific Corporation, Dornier MedTech GmbH, STORZ MEDICAL AG, Olympus Corporation, Karl Storz SE & Co. KG, Richard Wolf GmbH, EDAP TMS S.A., Lumenis Ltd., Cook Medical LLC, EMS Electro Medical Systems S.A., Direx Group, Allengers Medical Systems Ltd., Stryker Corporation, B. Braun Melsungen AG contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia lithotripsy devices market is poised for significant growth, driven by technological advancements and increasing healthcare investments. As the prevalence of kidney stones continues to rise, healthcare providers are likely to adopt more innovative, patient-friendly treatment options. The integration of artificial intelligence in lithotripsy devices is expected to enhance treatment precision, while the expansion of outpatient services will further facilitate access to these essential medical technologies, ensuring a robust market trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Extracorporeal Shock Wave Lithotripters (ESWL) Intracorporeal Lithotripters – Laser Intracorporeal Lithotripters – Pneumatic Intracorporeal Lithotripters – Ultrasonic Intracorporeal Lithotripters – Electrohydraulic Mechanical/Basket Lithotripters Others |

| By End-User | Public Hospitals (MOH and Government) Private Hospitals Specialty Urology & Multispecialty Clinics Ambulatory Surgical Centers / Day-care Centers Others |

| By Application | Kidney (Renal) Stones Ureteral Stones Bladder Stones Bile Duct / Biliary & Pancreatic Stones Others |

| By Technology | Extracorporeal Shock Wave Lithotripsy (ESWL) Intracorporeal Laser Lithotripsy Intracorporeal Pneumatic / Ultrasonic Lithotripsy Others |

| By Distribution Channel | Direct Sales to Hospitals & Large Chains Local Medical Device Distributors/Dealers Group Purchasing Organizations (GPOs) & Tenders Online / E-Procurement Portals Others |

| By Region | Central Region (Riyadh & Surrounding) Western Region (Makkah, Madinah, Jeddah) Eastern Region (Dammam, Al Khobar, Dhahran) Southern Region Northern Region |

| By Patient Demographics | Age Group (Pediatrics, Adults, Seniors) Gender (Male, Female) Insurance Status (Government-insured, Private-insured, Self-pay) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urology Clinics | 120 | Urologists, Clinic Managers |

| Hospitals with Urology Departments | 90 | Procurement Officers, Department Heads |

| Medical Device Distributors | 70 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 50 | Health Economists, Regulatory Affairs Managers |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Advocates |

The Saudi Arabia Lithotripsy Devices Market is valued at approximately USD 25 million, reflecting a five-year historical analysis. This valuation is influenced by the rising prevalence of kidney stones and advancements in medical technology.