Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7208

Pages:86

Published On:December 2025

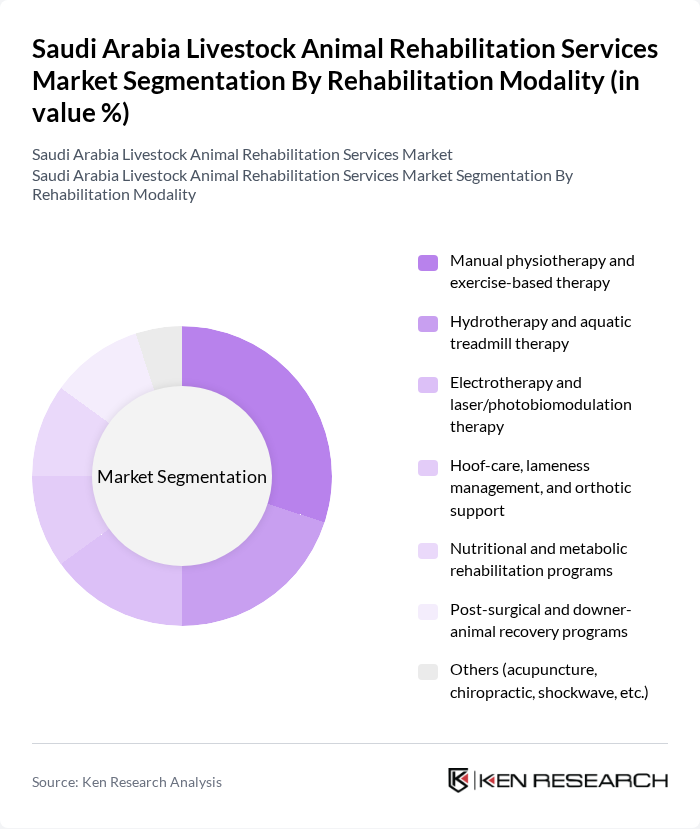

By Rehabilitation Modality:The rehabilitation modality segment includes various approaches to animal rehabilitation, each catering to specific needs and conditions of livestock. The subsegments include Manual physiotherapy and exercise-based therapy, Hydrotherapy and aquatic treadmill therapy, Electrotherapy and laser/photobiomodulation therapy, Hoof-care, lameness management, and orthotic support, Nutritional and metabolic rehabilitation programs, Post-surgical and downer-animal recovery programs, and Others (acupuncture, chiropractic, shockwave, etc.). This structure is consistent with global veterinary rehabilitation services practice, where multimodal physical rehabilitation, pain management, and lameness-focused interventions are commonly grouped as key service lines. Among these, Manual physiotherapy and exercise-based therapy is the leading subsegment, driven by its central role in treating musculoskeletal and lameness-related conditions, relatively low capital intensity compared to equipment-heavy modalities, and its widespread acceptance among veterinarians and livestock owners as a first-line rehabilitation option.

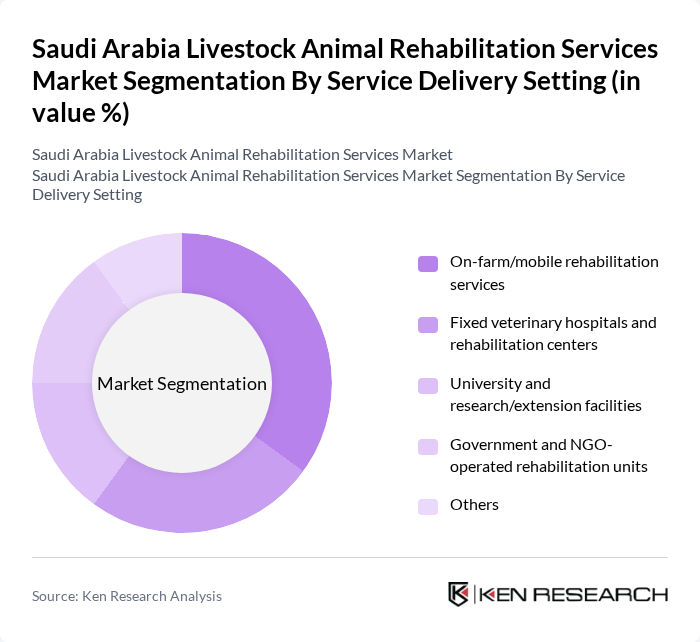

By Service Delivery Setting:This segment categorizes the rehabilitation services based on where they are delivered. The subsegments include On-farm/mobile rehabilitation services, Fixed veterinary hospitals and rehabilitation centers, University and research/extension facilities, Government and NGO-operated rehabilitation units, and Others. This reflects the typical delivery pattern in production animal health in Saudi Arabia, where field-based veterinary and extension services from government, universities, and private providers play a major role in herd-level interventions and follow-up care. The On-farm/mobile rehabilitation services subsegment is currently leading the market, as it offers convenience, reduced animal transport stress, and immediate herd-level care to livestock, which is crucial for timely recovery, continuity of production, and biosecurity in commercial operations.

The Saudi Arabia Livestock Animal Rehabilitation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Environment, Water and Agriculture (animal health & extension services), Saudi Veterinary Medical Society, King Faisal University Veterinary Teaching Hospital (Al-Ahsa), King Abdulaziz University Faculty of Veterinary Medicine, Riyadh Veterinary Hospital (Riyadh), Al-Kharj Veterinary Clinic and Large Animal Services (Al-Kharj), Al-Qassim Veterinary Services Center (Al-Qassim Region), Eastern Province Veterinary Clinic and Farm Services (Dammam / Al-Hasa), Jeddah Veterinary Clinic and Livestock Services (Jeddah), National Agricultural Development Company (NADEC) – Veterinary & Herd Health Services, Almarai Company – Dairy Herd Veterinary & Rehabilitation Programs, Al Safi Danone – Livestock Health and Rehabilitation Services, Saudi Arabian Agricultural Bank Livestock Support Programs, Saudi Livestock Investment Company (Saudi LIG) – Animal Health & Welfare Initiatives, Private mobile large-animal veterinary and rehabilitation service providers (selected regional operators) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the livestock animal rehabilitation services market in Saudi Arabia appears promising, driven by increasing consumer awareness and government support. As the demand for high-quality livestock products continues to rise, the need for effective rehabilitation services will become more pronounced. Innovations in technology and telemedicine are expected to enhance service delivery, making rehabilitation more accessible. Furthermore, collaboration between veterinary services and agricultural sectors will likely foster a more integrated approach to livestock health, ensuring sustainable growth in the industry.

| Segment | Sub-Segments |

|---|---|

| By Rehabilitation Modality | Manual physiotherapy and exercise-based therapy Hydrotherapy and aquatic treadmill therapy Electrotherapy and laser/photobiomodulation therapy Hoof-care, lameness management, and orthotic support Nutritional and metabolic rehabilitation programs Post-surgical and downer-animal recovery programs Others (acupuncture, chiropractic, shockwave, etc.) |

| By Service Delivery Setting | On-farm/mobile rehabilitation services Fixed veterinary hospitals and rehabilitation centers University and research/extension facilities Government and NGO-operated rehabilitation units Others |

| By Livestock Type | Dairy cattle Beef cattle and feedlot animals Sheep Goats Equine (horses, camels, and racing animals) Poultry Others (camelids, breeding stock, show animals) |

| By Clinical Indication | Musculoskeletal disorders and lameness Neurological conditions Post-operative rehabilitation Injury and trauma recovery Metabolic and production-related disorders Heat-stress and environmental stress-related recovery Others |

| By Duration of Engagement | Short-term, case-based rehabilitation plans Long-term rehabilitation programs Preventive and maintenance-care contracts Others |

| By Region | Riyadh and Central Region Eastern Province Makkah and Western Region Southern Region (Asir, Jazan, Najran, etc.) Northern Region (Al-Jouf, Tabuk, Northern Borders, etc.) |

| By Payment and Contract Model | Fee-for-service (per visit/procedure) Herd-level or farm subscription contracts Government-subsidized or program-funded services Insurance-reimbursed rehabilitation services Others (bundled packages with herd-health services) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Rehabilitation Services | 120 | Veterinarians, Animal Health Technicians |

| Livestock Farm Owners | 100 | Farm Managers, Livestock Producers |

| Animal Welfare Organizations | 80 | Animal Welfare Advocates, Policy Makers |

| Government Regulatory Bodies | 50 | Regulatory Officials, Agricultural Policy Analysts |

| Livestock Feed and Health Product Suppliers | 90 | Product Managers, Sales Representatives |

The Saudi Arabia Livestock Animal Rehabilitation Services Market is valued at approximately USD 1.1 billion, reflecting growth driven by increased livestock production, awareness of animal welfare, and advancements in veterinary rehabilitation techniques.