Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2355

Pages:98

Published On:October 2025

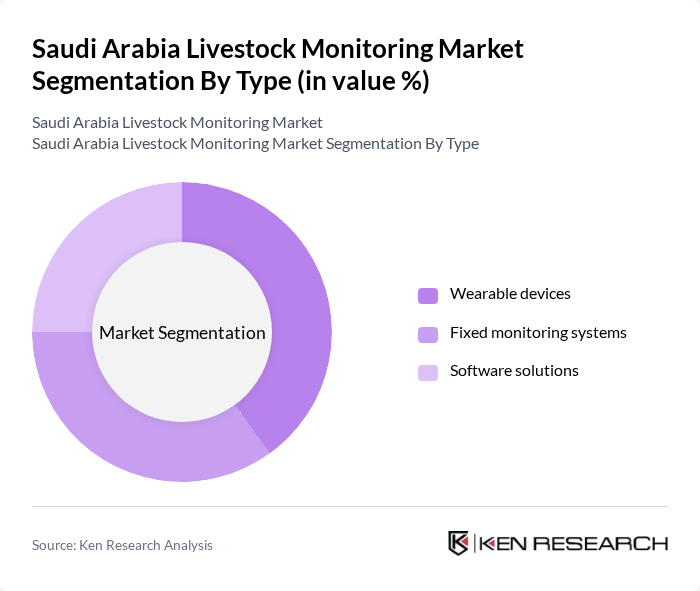

By Type:The market is segmented into three main types: Wearable devices, Fixed monitoring systems, and Software solutions. Each of these subsegments plays a crucial role in enhancing livestock management practices. Wearable devices are increasingly popular due to their ability to provide real-time health and location data, while fixed monitoring systems offer comprehensive solutions for larger operations. Software solutions are essential for data analysis and management, making them indispensable in modern livestock farming .

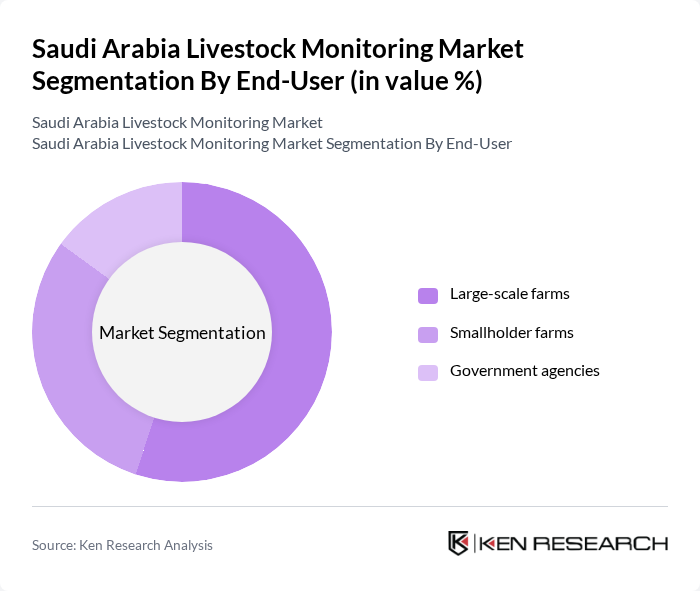

By End-User:The end-user segmentation includes Large-scale farms, Smallholder farms, and Government agencies. Large-scale farms dominate the market due to their capacity to invest in advanced monitoring technologies, which significantly enhance productivity and efficiency. Smallholder farms are gradually adopting these technologies as costs decrease, while government agencies play a pivotal role in promoting livestock monitoring through regulations and support programs .

The Saudi Arabia Livestock Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allflex Livestock Intelligence (MSD Animal Health), Zoetis Inc., Merck Animal Health, DeLaval, Cargill, Inc., Trimble Inc., Dairymaster, GEA Group AG, Afimilk Ltd., BouMatic, Lely, Neogen Corporation, Fancom BV, Fullwood Packo, Sensaphone contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia livestock monitoring market appears promising, driven by technological advancements and increasing government support. In future, the integration of AI and IoT is expected to revolutionize livestock management, enhancing productivity and animal welfare. Additionally, the growing emphasis on sustainability and traceability will further shape market dynamics, encouraging farmers to adopt innovative monitoring solutions that align with consumer preferences and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable devices Fixed monitoring systems Software solutions |

| By End-User | Large-scale farms Smallholder farms Government agencies |

| By Application | Health monitoring Feeding management Breeding management Milk harvesting Disease detection and prevention |

| By Distribution Channel | Direct sales Online platforms Distributors |

| By Livestock Type | Bovine (Cattle) Poultry Other Animals (Sheep, Goats, Camels) |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region |

| By Price Range | Budget Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cattle Monitoring Practices | 60 | Livestock Farmers, Veterinary Technicians |

| Sheep and Goat Health Monitoring | 50 | Farm Managers, Animal Health Specialists |

| Technology Adoption in Livestock | 40 | Agri-tech Providers, IT Managers in Agriculture |

| Regulatory Compliance in Livestock Monitoring | 40 | Policy Makers, Agricultural Consultants |

| Market Trends in Livestock Products | 50 | Market Analysts, Industry Experts |

The Saudi Arabia Livestock Monitoring Market is valued at approximately USD 110 million, reflecting a significant growth trend driven by technological advancements and increasing demand for food security and animal health monitoring.