Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5125

Pages:91

Published On:October 2025

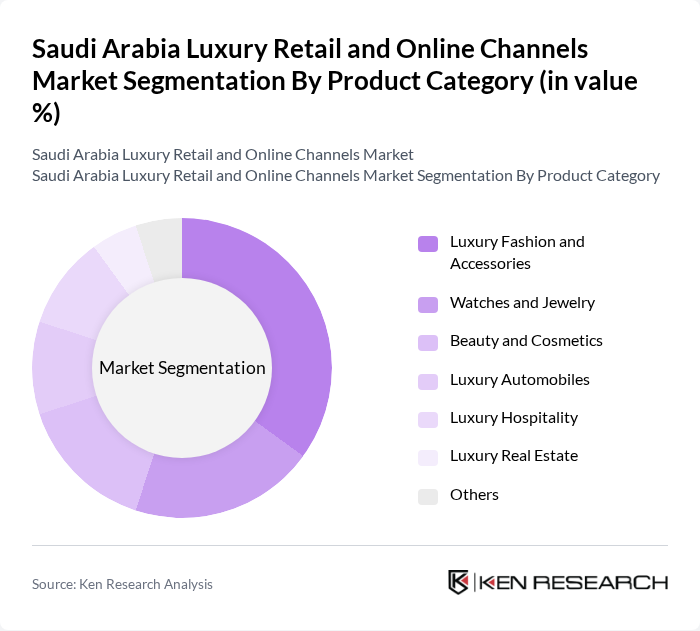

By Product Category:

The product categories in the luxury retail market include Luxury Fashion and Accessories, Watches and Jewelry, Beauty and Cosmetics, Luxury Automobiles, Luxury Hospitality, Luxury Real Estate, and Others. Among these,Luxury Fashion and Accessoriesdominate the market due to the increasing trend of fashion consciousness among consumers, particularly the youth. The demand for high-end apparel and accessories is driven by social media influence, celebrity endorsements, and the proliferation of digital retail channels, making this segment a key player in the luxury retail landscape.

By Consumer Demographics:

The consumer demographics in the luxury retail market are segmented by Age Groups (18-30, 31-45, 46-60, 60+), Income Level (High Net Worth, Ultra High Net Worth), Gender (Male, Female), and Lifestyle Factors. The segment ofAge Groups 31-45is currently leading the market, as this demographic is characterized by higher disposable incomes and a strong inclination towards luxury spending. This age group is also more likely to engage in online shopping, further driving the growth of luxury retail in the digital space. The market is also shaped by a rising number of high-net-worth and ultra-high-net-worth individuals, with Saudi Arabia ranking among the top countries in the region for millionaire and affluent populations.

The Saudi Arabia Luxury Retail and Online Channels Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chalhoub Group, Al Tayer Group, The Luxury Closet, Harvey Nichols, Saks Fifth Avenue, Sephora, Damas Jewellery, Michael Kors Holdings Limited, Burberry Group PLC, Estée Lauder Companies Inc., Al-Futtaim Group, Landmark Group, Majid Al Futtaim, VF Corporation, GMG (Gulf Marketing Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury retail market in Saudi Arabia appears promising, driven by a combination of rising disposable incomes and a growing preference for online shopping. As the government continues to promote tourism and economic diversification, luxury brands are likely to see increased demand. Additionally, the integration of advanced technologies in retail, such as augmented reality and AI-driven personalization, will enhance customer experiences, making luxury shopping more appealing and accessible to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Luxury Fashion and Accessories Watches and Jewelry Beauty and Cosmetics Luxury Automobiles Luxury Hospitality Luxury Real Estate Others |

| By Consumer Demographics | Age Groups (18-30, 31-45, 46-60, 60+) Income Level (High Net Worth, Ultra High Net Worth) Gender (Male, Female) Lifestyle Factors |

| By Retail Channels | High-end Department Stores Luxury Boutiques Online Platforms Duty-free Shops Mono-brand Stores |

| By Geographic Regions | Riyadh Jeddah Eastern Province Other Regions |

| By Brand Origin | International Luxury Brands Local Luxury Brands |

| By Price Positioning | Premium Luxury Ultra Luxury Accessible Luxury |

| By Distribution Mode | Direct-to-Consumer Multi-brand Retailers E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Retail | 120 | Brand Managers, Retail Executives |

| Luxury Cosmetics and Fragrances | 90 | Product Development Managers, Marketing Directors |

| High-End Jewelry and Watches | 60 | Sales Managers, Customer Experience Managers |

| Online Luxury Retail Platforms | 80 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Insights on Luxury Purchases | 150 | Affluent Consumers, Market Researchers |

The Saudi Arabia Luxury Retail and Online Channels Market is valued at approximately USD 10 billion, driven by increasing disposable incomes, a growing affluent population, and a shift towards online shopping, particularly among younger consumers.