Saudi Arabia Maritime Satellite Communication Market Overview

- The Saudi Arabia Maritime Satellite Communication Market is valued at USD 170 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for reliable communication solutions in maritime operations, especially in the oil and gas sector, which relies heavily on satellite connectivity for remote monitoring, data transmission, and operational safety. The market is further propelled by the adoption of high-throughput VSAT systems and the expansion of digital fleet management, predictive maintenance, and cloud-based applications, reflecting the sector’s shift toward data-driven operations and enhanced crew welfare .

- Key hubs for maritime satellite communication in Saudi Arabia include major port cities such as Jeddah, Dammam, and Yanbu, which dominate due to their strategic locations along the Red Sea and Arabian Gulf. These cities serve as critical centers for maritime activities, facilitating trade, logistics, and offshore operations, thereby driving the demand for advanced satellite communication services .

- In 2023, the Saudi government implemented the “Maritime Safety and Communication Systems Regulation, 2023” issued by the Saudi Ports Authority (Mawani). This regulation mandates the installation of certified satellite communication systems on all commercial vessels operating in Saudi waters, with compliance requirements covering system standards, emergency response integration, and periodic inspection. The regulation aims to enhance navigation safety, ensure continuous connectivity for emergency response, and align with international maritime safety conventions.

Saudi Arabia Maritime Satellite Communication Market Segmentation

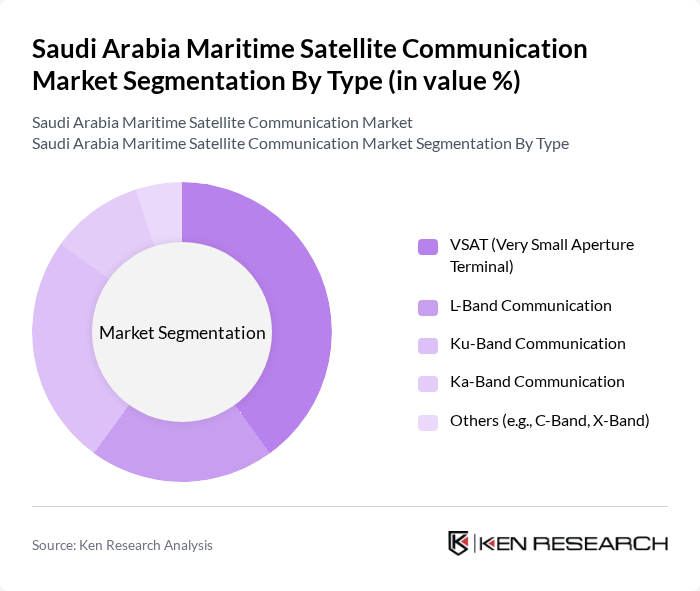

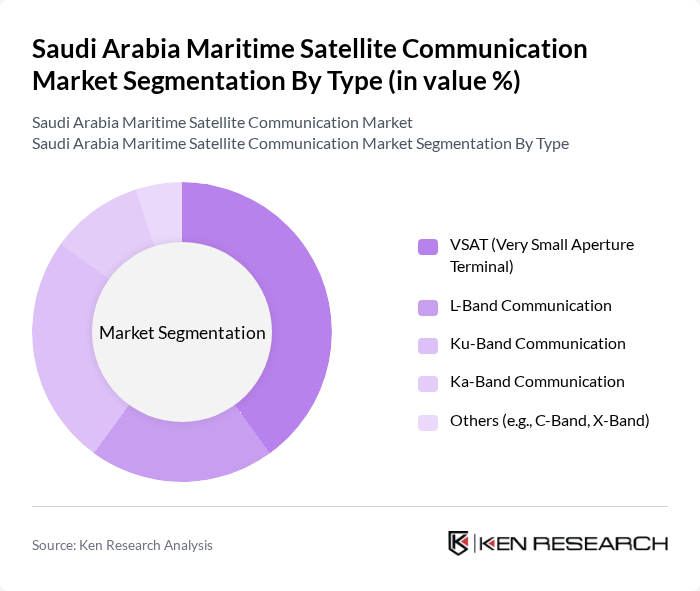

By Type:The market is segmented into various satellite communication technologies, including VSAT (Very Small Aperture Terminal), L-Band Communication, Ku-Band Communication, Ka-Band Communication, and Others (such as C-Band and X-Band). VSAT systems dominate due to their ability to deliver high-throughput, always-on broadband connectivity, essential for modern maritime operations. L-Band solutions are preferred for smaller vessels and backup communications, while Ku-Band and Ka-Band are increasingly adopted for higher data rates and spectral efficiency, supporting bandwidth-intensive applications like real-time monitoring, video conferencing, and cloud-based fleet management .

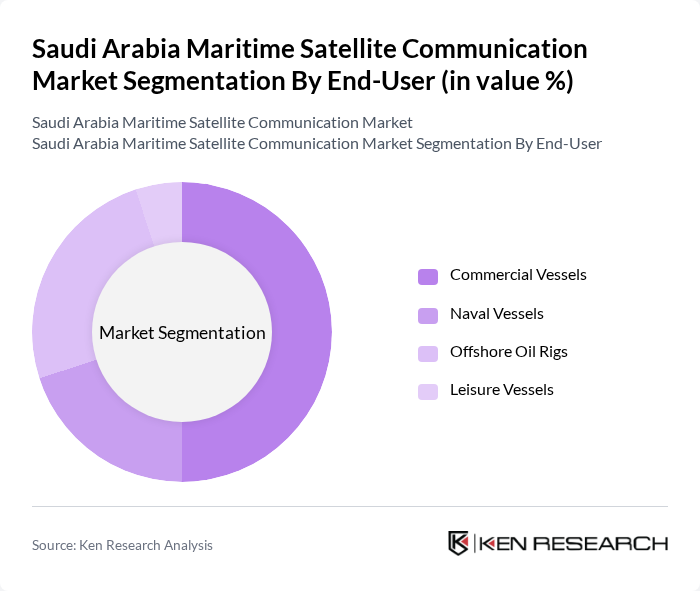

By End-User:The end-user segmentation includes Commercial Vessels, Naval Vessels, Offshore Oil Rigs, and Leisure Vessels. Commercial vessels represent the largest segment, driven by the need for robust connectivity to support logistics, navigation, and crew welfare. Naval vessels are rapidly adopting advanced satellite solutions for secure, mission-critical communications. Offshore oil rigs require high-capacity, reliable links for remote monitoring and operational safety, while leisure vessels increasingly demand connectivity for passenger experience and safety compliance .

Saudi Arabia Maritime Satellite Communication Market Competitive Landscape

The Saudi Arabia Maritime Satellite Communication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Inmarsat Global Limited, Iridium Communications Inc., SES S.A., Eutelsat Communications S.A., Viasat Inc., Speedcast International Limited, Marlink AS, Thuraya Telecommunications Company, Intelsat S.A., Telesat Canada, KVH Industries, Inc., NSSLGlobal Ltd, ST Engineering iDirect, Hughes Network Systems, LLC, and Orange Business Services contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Maritime Satellite Communication Market Industry Analysis

Growth Drivers

- Increasing Demand for Reliable Communication at Sea:The maritime sector in Saudi Arabia is witnessing a surge in demand for reliable communication systems, driven by the need for safety and operational efficiency. In future, the maritime industry is projected to handle over 300 million tons of cargo, necessitating robust communication solutions. The International Maritime Organization (IMO) emphasizes that effective communication can reduce maritime accidents by up to 30%, highlighting the critical need for advanced satellite communication systems in this growing sector.

- Expansion of Maritime Trade and Shipping Activities:Saudi Arabia's strategic location along major shipping routes has led to a significant increase in maritime trade activities. In future, the volume of goods transported via maritime routes is expected to exceed 400 million tons, reflecting a 5% annual growth. This expansion necessitates enhanced communication capabilities to manage logistics and ensure compliance with international shipping regulations, thereby driving the demand for maritime satellite communication services.

- Technological Advancements in Satellite Communication:The maritime satellite communication landscape is evolving rapidly, with advancements in technology enhancing service quality and accessibility. In future, the introduction of high-throughput satellites (HTS) is expected to increase data transmission rates by up to 50%, enabling real-time data sharing and improved operational efficiency. This technological evolution is crucial for maritime operators seeking to leverage data analytics and IoT applications, further propelling market growth.

Market Challenges

- High Costs of Satellite Communication Services:One of the significant barriers to the adoption of satellite communication in the maritime sector is the high cost associated with these services. In future, the average cost of satellite communication services is projected to be around $1,500 per month for vessels, which can be prohibitive for smaller operators. This financial burden limits the accessibility of advanced communication technologies, hindering overall market growth and adoption rates.

- Limited Coverage in Remote Maritime Areas:Despite advancements in satellite technology, coverage gaps remain a challenge, particularly in remote maritime regions. In future, it is estimated that over 20% of maritime routes will still experience inadequate satellite coverage, affecting communication reliability. This limitation poses risks for maritime operations, as vessels may face difficulties in maintaining contact with shore-based operations, thereby impacting safety and operational efficiency.

Saudi Arabia Maritime Satellite Communication Market Future Outlook

The future of the Saudi Arabia maritime satellite communication market appears promising, driven by increasing investments in maritime infrastructure and technology. As the government prioritizes digital transformation, the integration of advanced communication systems will enhance operational efficiency and safety. Furthermore, the growing emphasis on cybersecurity will lead to the development of more secure communication protocols, ensuring data integrity. These trends indicate a robust market evolution, positioning Saudi Arabia as a leader in maritime communication solutions in the region.

Market Opportunities

- Growth in the Fishing and Shipping Industries:The fishing industry in Saudi Arabia is projected to grow by 10% annually, creating a substantial demand for reliable communication solutions. Enhanced satellite communication can facilitate better monitoring and compliance with regulations, thus presenting a lucrative opportunity for service providers to cater to this expanding market segment.

- Increasing Adoption of IoT in Maritime Operations:The integration of IoT technologies in maritime operations is expected to rise significantly, with an estimated 30% of vessels adopting IoT solutions in future. This trend will drive demand for advanced satellite communication systems capable of supporting real-time data transmission, creating opportunities for innovative service offerings in the maritime sector.