Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2354

Pages:90

Published On:October 2025

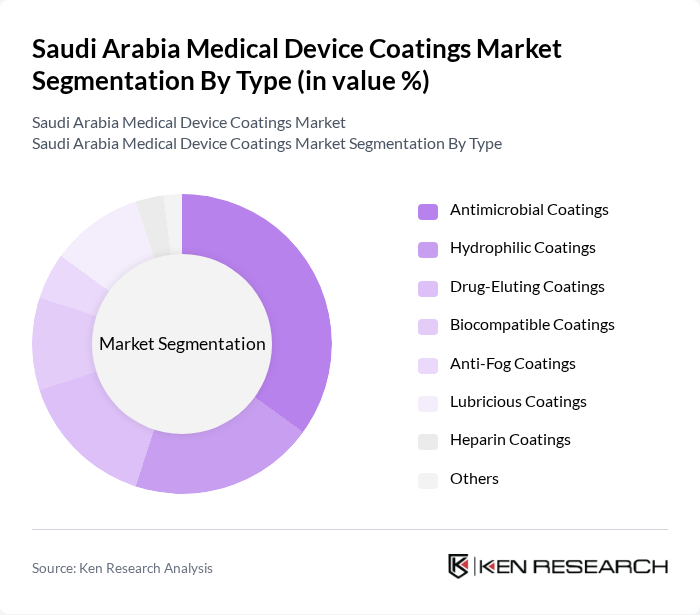

By Type:The market is segmented into various types of coatings, including Antimicrobial Coatings, Hydrophilic Coatings, Drug-Eluting Coatings, Biocompatible Coatings, Anti-Fog Coatings, Lubricious Coatings, Heparin Coatings, and Others. Among these, Antimicrobial Coatings are gaining significant traction due to their ability to prevent infections associated with medical devices. The increasing prevalence of hospital-acquired infections (HAIs) is driving healthcare providers to adopt these coatings to enhance patient safety and reduce healthcare costs.

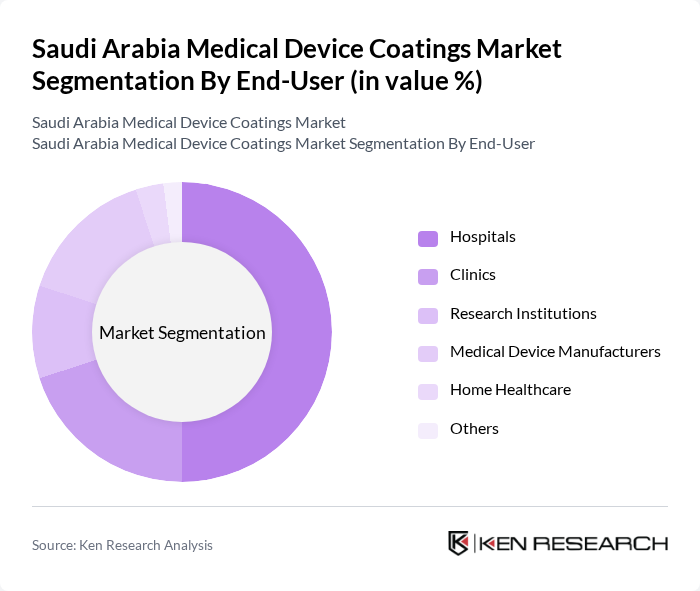

By End-User:The end-user segmentation includes Hospitals, Clinics, Research Institutions, Medical Device Manufacturers, Home Healthcare, and Others. Hospitals are the leading end-users, driven by the increasing number of surgical procedures and the need for advanced medical devices that ensure patient safety. The growing trend of minimally invasive surgeries is also contributing to the demand for specialized coatings that enhance the performance of surgical instruments and implants.

The Saudi Arabia Medical Device Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Surmodics Inc., Sono-Tek Corporation, DSM Biomedical, Hydromer Inc., Biocoat Inc., Freudenberg Medical Europe GmbH, Harland Medical Systems, Covalon Technologies Ltd., AST Products, Inc., Specialty Coating Systems, Inc., B. Braun Melsungen AG, Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Zimmer Biomet Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia medical device coatings market appears promising, driven by ongoing investments in healthcare infrastructure and technological innovations. As the government continues to prioritize healthcare improvements, the demand for advanced coatings is expected to rise. Additionally, the integration of sustainable practices and biocompatible materials will likely shape the market landscape, fostering collaborations between local manufacturers and international players to enhance product offerings and meet evolving healthcare needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Antimicrobial Coatings Hydrophilic Coatings Drug-Eluting Coatings Biocompatible Coatings Anti-Fog Coatings Lubricious Coatings Heparin Coatings Others |

| By End-User | Hospitals Clinics Research Institutions Medical Device Manufacturers Home Healthcare Others |

| By Application | Surgical Instruments Implants Catheters Stents Diagnostic Devices Guidewires Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Material Type | Polymeric Coatings Metallic Coatings Ceramic Coatings Composite Coatings Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 100 | Product Managers, R&D Directors |

| Healthcare Providers | 80 | Procurement Officers, Clinical Managers |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Coating Technology Suppliers | 70 | Sales Managers, Technical Support Engineers |

| Industry Experts and Consultants | 60 | Market Analysts, Healthcare Consultants |

The Saudi Arabia Medical Device Coatings Market is valued at approximately USD 210 million, reflecting a significant growth driven by the demand for advanced medical devices and increased healthcare expenditures.