Region:Middle East

Author(s):Dev

Product Code:KRAD5102

Pages:100

Published On:December 2025

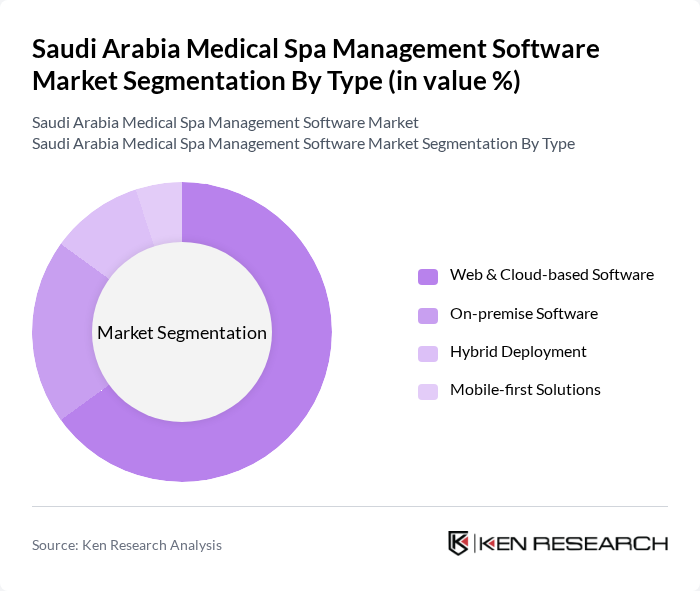

By Type:The market is segmented into various types of software solutions that cater to the specific needs of medical spas. The subsegments include Web & Cloud-based Software, On-premise Software, Hybrid Deployment, and Mobile-first Solutions. Each type offers unique features and benefits, appealing to different operational preferences and business models.

The Web & Cloud-based Software segment is leading the market due to its flexibility, scalability, subscription-based pricing, and ease of remote access. Across Middle East and Africa, web and cloud-based platforms account for over two-thirds of medical spa management software revenues, reflecting strong preference for browser-based and SaaS solutions. Medical spas in Saudi Arabia increasingly prefer cloud solutions for real-time data access, multi-branch management, integrated online booking, and remote performance monitoring. The increasing use of mobile interfaces, client apps, and SMS/WhatsApp integrations is also gaining traction, as businesses seek to enhance customer engagement, reminders, and loyalty programs through mobile-first experiences. Overall, the demand for integrated, cloud-native, and user-friendly platforms that combine appointment management, CRM, analytics, and payment processing is driving the growth of this segment.

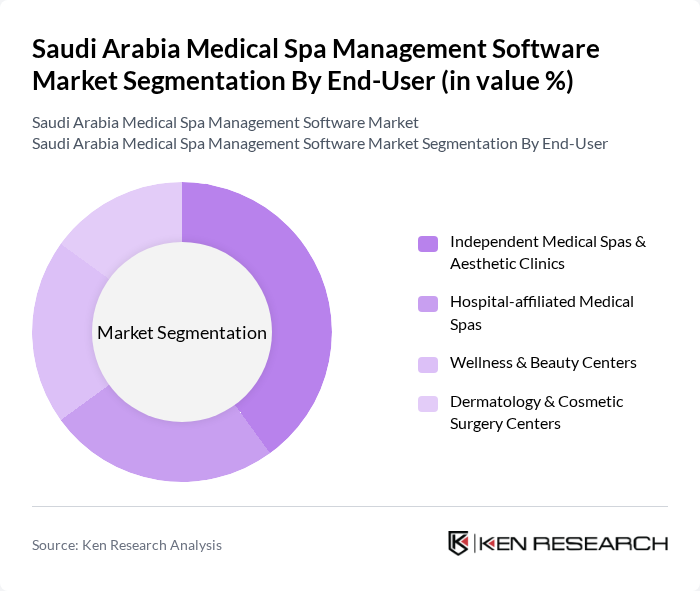

By End-User:The market is segmented based on the end-users of the software, which include Independent Medical Spas & Aesthetic Clinics, Hospital-affiliated Medical Spas, Wellness & Beauty Centers, and Dermatology & Cosmetic Surgery Centers. Each end-user category has distinct operational needs and software requirements.

Independent Medical Spas & Aesthetic Clinics dominate the market, supported by the rapid expansion of stand-alone medical spa and aesthetics brands in Saudi Arabia that focus on injectables, skin rejuvenation, laser treatments, and body contouring, and therefore require comprehensive systems for appointment scheduling, treatment records, consent management, and marketing automation. These establishments often adopt specialized software rather than generic clinic systems to manage memberships, packages, gift cards, and dynamic pricing. Hospital-affiliated Medical Spas are also significant users, leveraging their clinical reputation and integrated electronic medical record environments to attract higher-value clients and complex procedures, often requiring interfaces between spa software and hospital information systems. Wellness & Beauty Centers and Dermatology & Cosmetic Surgery Centers increasingly integrate spa-management-style platforms for omnichannel booking, CRM, and targeted promotions as they broaden their aesthetics portfolios and participate in Saudi Arabia’s growing wellness tourism ecosystem.

The Saudi Arabia Medical Spa Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zenoti, Vagaro Inc., Mindbody Inc., Squarespace Inc. (Acuity Scheduling), AestheticsPro Online, SimpleSpa, Miosalon, Reservio, Millennium Systems International (Meevo), Meditab Software Inc. (IMS / Aesthetic Module), Glamplus, Phorest Salon Software, Timely Limited (Timely), Schedulicity, Appointy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical spa management software market in Saudi Arabia appears promising, driven by increasing consumer awareness and technological advancements. As the market evolves, the integration of artificial intelligence and machine learning will enhance service personalization and operational efficiency. Additionally, the growing trend of telemedicine will likely expand the scope of services offered by medical spas, creating new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Web & Cloud-based Software On-premise Software Hybrid Deployment Mobile-first Solutions |

| By End-User | Independent Medical Spas & Aesthetic Clinics Hospital-affiliated Medical Spas Wellness & Beauty Centers Dermatology & Cosmetic Surgery Centers |

| By Functional Module | Appointment & Resource Scheduling Client Relationship Management (CRM) & Marketing Automation Billing, Payments & POS Analytics, Reporting & Business Intelligence Inventory & Supply Management |

| By Deployment Model | SaaS (Subscription-based) Perpetual License Managed / Hosted Services Open-source / Custom-built |

| By Customer Size | Single-location Spas & Clinics Small Chains (2–5 Locations) Large Chains (6+ Locations) Enterprise Groups & Hospital Networks |

| By Geographic Presence | Central Region (Riyadh & Surrounding) Western Region (Jeddah, Makkah, Madinah) Eastern Region (Dammam, Al Khobar) Southern & Northern Regions |

| By Integration Capability | Integration with EMR/EHR Systems Integration with Payment Gateways & POS Integration with CRM/Marketing & Social Media API-based Custom Integrations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Spa Owners | 60 | Business Owners, Spa Managers |

| Healthcare Professionals | 60 | Doctors, Aesthetic Practitioners |

| Wellness Consultants | 40 | Consultants, Industry Experts |

| Potential Customers | 120 | Health-conscious Individuals, Spa Visitors |

| Regulatory Authorities | 40 | Policy Makers, Health Inspectors |

The Saudi Arabia Medical Spa Management Software Market is valued at approximately USD 0.9 million, reflecting a growing demand for wellness and aesthetic services, driven by increased consumer spending on non-invasive cosmetic procedures and wellness therapies.