Region:Middle East

Author(s):Shubham

Product Code:KRAD6739

Pages:92

Published On:December 2025

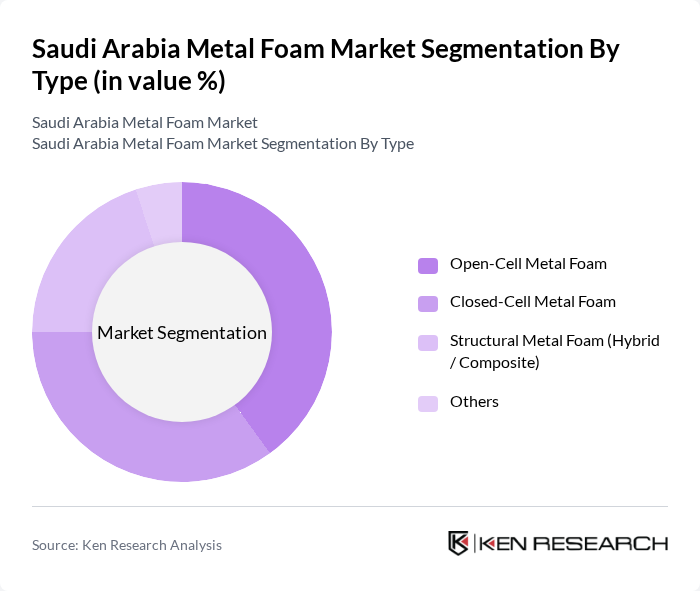

By Type:The market is segmented into Open-Cell Metal Foam, Closed-Cell Metal Foam, Structural Metal Foam (Hybrid / Composite), and Others. Open-Cell Metal Foam is gaining traction due to its superior sound absorption, filtration, and thermal management capabilities, making it popular in automotive, construction, HVAC, and industrial noise-control applications. Closed-Cell Metal Foam, known for its lightweight structure, high stiffness, and excellent energy absorption, is witnessing significant demand in impact protection, aerospace, defense, and protective packaging. Structural Metal Foam (hybrid/composite) is emerging as a versatile option for various applications, including crash protection, blast mitigation, armor systems, and load-bearing components where high strength-to-weight ratio is critical.

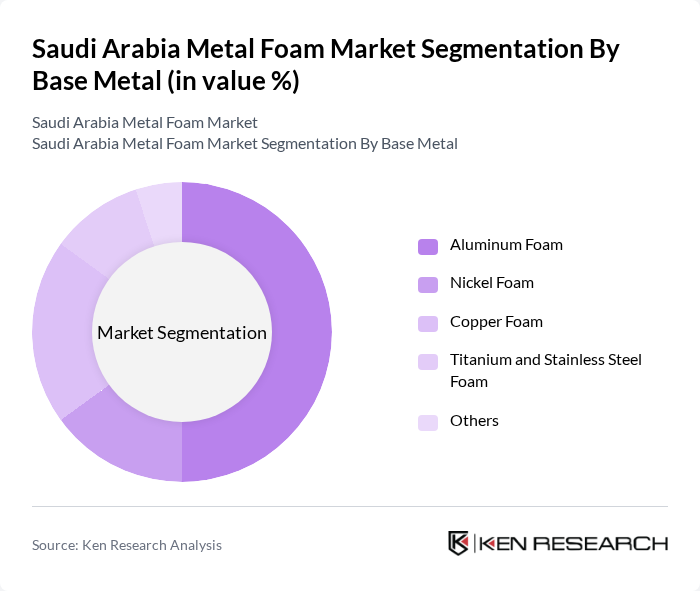

By Base Metal:The segmentation includes Aluminum Foam, Nickel Foam, Copper Foam, Titanium and Stainless Steel Foam, and Others. Aluminum Foam is the leading subsegment due to its lightweight, good corrosion resistance, and favorable strength-to-weight ratio, making it ideal for automotive body structures, transportation, construction panels, and general industrial applications. Nickel Foam is widely used as a current collector and support in batteries, fuel cells, and electrochemical systems, driven by investments in energy storage and clean energy technologies. Copper Foam is gaining popularity for its excellent thermal and electrical conductivity, particularly in heat exchangers, cooling systems, and thermal management solutions in electronics and energy infrastructure. Titanium and Stainless Steel Foams are preferred in high-performance and high-temperature applications, including aerospace, defense, filtration, and certain medical and industrial components where corrosion resistance and mechanical strength are essential.

The Saudi Arabia Metal Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cymat Technologies Ltd., ERG Aerospace Corporation, Alantum Corporation, Hollomet GmbH, Mott Corporation, PPI – Porous Products Inc., Aluinvent Zrt., Ultramet, Mayser GmbH & Co. KG, Thermacore International Inc., Rigid Cell International, Duocel® Metal Foam (ERG Brand), Saudi Basic Industries Corporation (SABIC), Saudi Arabian Oil Company (Saudi Aramco) – Advanced Materials & R&D Units, Saudi Arabian Industrial Investments Company (Dussur) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia metal foam market appears promising, driven by increasing investments in infrastructure and a growing emphasis on sustainability. As the government continues to promote advanced materials through various initiatives, the adoption of metal foam is likely to rise. Additionally, the integration of smart technologies in manufacturing processes will enhance product capabilities, making metal foam more appealing to industries seeking innovative solutions. Overall, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Open-Cell Metal Foam Closed-Cell Metal Foam Structural Metal Foam (Hybrid / Composite) Others |

| By Base Metal | Aluminum Foam Nickel Foam Copper Foam Titanium and Stainless Steel Foam Others |

| By Application | Thermal Management & Heat Exchangers Energy Absorption & Crash Protection Filtration & Catalytic Substrates Sound Absorption & Acoustic Panels Battery, Fuel Cell & Hydrogen Applications Others |

| By End-Use Industry | Automotive & Commercial Vehicles Aerospace & Defense Building & Construction Oil, Gas & Petrochemicals Power Generation & Renewable Energy Electronics & Industrial Machinery Others |

| By Manufacturing Process | Powder Metallurgy Melt Foaming / Gas Injection Investment Casting / Replication Additive Manufacturing & Advanced Processes Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Jubail) Western Region (including Jeddah, Makkah, Madinah) Southern & Northern Regions |

| By Sales Channel | Direct Sales to OEMs Industrial Distributors & Traders Engineering, Procurement & Construction (EPC) Channels Online / Project-Based Tendering Others |

| By Product Form | Panels & Sheets Blocks & Slabs Monoliths, Cores & Custom Shapes Inserts & Components Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Development Engineers, Procurement Managers |

| Construction Sector Utilization | 80 | Project Managers, Architects, Structural Engineers |

| Aerospace Material Innovations | 60 | R&D Managers, Aerospace Engineers |

| Consumer Electronics Integration | 70 | Product Managers, Design Engineers |

| Research Institutions and Academia | 50 | Professors, Research Scientists, Graduate Students |

The Saudi Arabia Metal Foam Market is valued at approximately USD 2.6 billion, driven by the increasing demand for lightweight, high-strength materials across various industries, including automotive, construction, and energy.