Region:Middle East

Author(s):Dev

Product Code:KRAC4788

Pages:81

Published On:October 2025

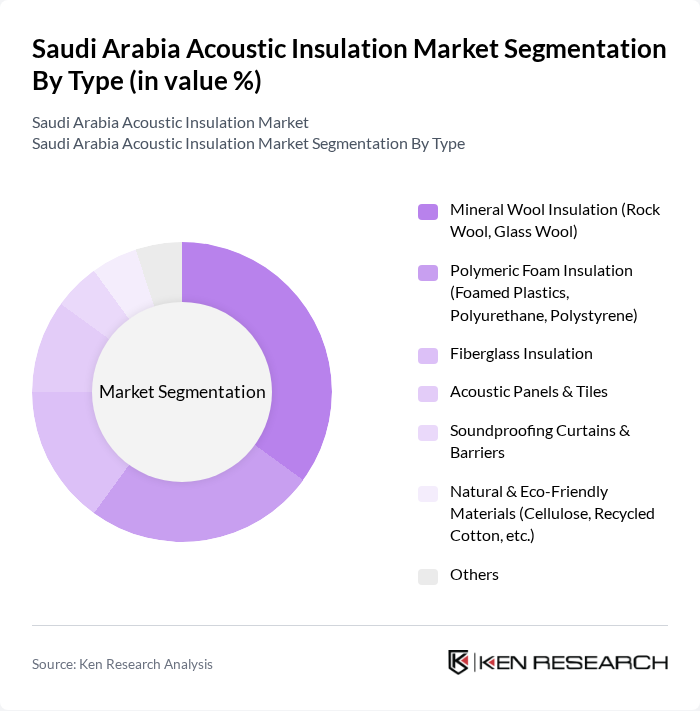

By Type:The market is segmented into various types of acoustic insulation materials, including Mineral Wool Insulation (Rock Wool, Glass Wool), Polymeric Foam Insulation (Foamed Plastics, Polyurethane, Polystyrene), Fiberglass Insulation, Acoustic Panels & Tiles, Soundproofing Curtains & Barriers, Natural & Eco-Friendly Materials (Cellulose, Recycled Cotton, etc.), and Others. Among these, Mineral Wool Insulation is the leading subsegment due to its excellent sound absorption properties and fire resistance, making it a preferred choice in both residential and commercial applications. Foamed plastics also account for a significant share, especially in commercial applications, due to their versatility and cost-effectiveness.

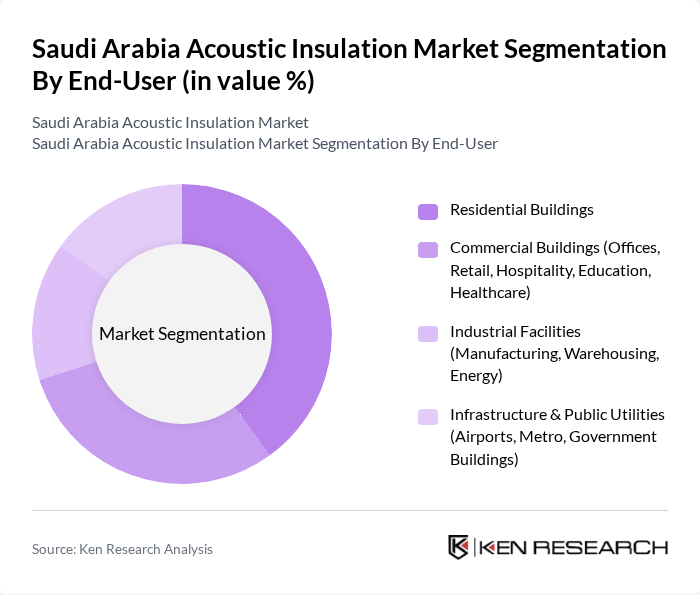

By End-User:The end-user segmentation includes Residential Buildings, Commercial Buildings (Offices, Retail, Hospitality, Education, Healthcare), Industrial Facilities (Manufacturing, Warehousing, Energy), and Infrastructure & Public Utilities (Airports, Metro, Government Buildings). The Residential Buildings segment is currently the dominant subsegment, driven by the increasing focus on home comfort and the rising number of housing projects across the country. Commercial buildings also represent a substantial share, reflecting the growth in office, hospitality, and healthcare construction.

The Saudi Arabia Acoustic Insulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rockwool International A/S, Saint-Gobain (including Saint-Gobain Isover Saudi Arabia), Owens Corning, Knauf Insulation (Knauf Insulation Saudi Arabia LLC), BASF SE, Armacell International S.A., Johns Manville, Kingspan Group (Kingspan Insulation LLC Saudi Arabia), Zamil Industrial Investment Co. (Zamil Insulation), Arabian Fiberglass Insulation Company Ltd. (AFICO), Saudi Rockwool Factory Company (SRWF), Acoustics & Insulation Manufacturing Co. (AIMC), Alghanim Insulation, United Insulation Company (UIC), Al-Bilad Fire Fighting Systems Co. (Acoustic Division) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia acoustic insulation market is poised for significant growth as urbanization accelerates and awareness of noise pollution increases. The government's commitment to sustainable construction will likely drive innovation in acoustic materials, aligning with global trends towards eco-friendly solutions. Additionally, the integration of smart technologies in building designs will enhance the functionality of acoustic insulation, making it a vital component in future construction projects. As these trends unfold, the market is expected to evolve, presenting new opportunities for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral Wool Insulation (Rock Wool, Glass Wool) Polymeric Foam Insulation (Foamed Plastics, Polyurethane, Polystyrene) Fiberglass Insulation Acoustic Panels & Tiles Soundproofing Curtains & Barriers Natural & Eco-Friendly Materials (Cellulose, Recycled Cotton, etc.) Others |

| By End-User | Residential Buildings Commercial Buildings (Offices, Retail, Hospitality, Education, Healthcare) Industrial Facilities (Manufacturing, Warehousing, Energy) Infrastructure & Public Utilities (Airports, Metro, Government Buildings) |

| By Application | New Construction Renovation & Retrofit Soundproofing (Walls, Floors, Ceilings, HVAC Ducts) Acoustic Treatment (Studios, Auditoriums, Theaters) |

| By Distribution Channel | Direct Sales (Project-Based) Distributors & Dealers Online Retail Specialty Construction Stores |

| By Material Source | Domestic Production Imported Materials |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Acoustic Insulation | 100 | Homeowners, Interior Designers |

| Commercial Building Insulation | 90 | Facility Managers, Architects |

| Industrial Acoustic Solutions | 60 | Plant Managers, Safety Officers |

| Regulatory Compliance in Construction | 50 | Building Inspectors, Compliance Officers |

| Acoustic Insulation Material Suppliers | 70 | Sales Managers, Product Development Managers |

The Saudi Arabia Acoustic Insulation Market is valued at approximately USD 135 million, driven by increasing demand for noise reduction solutions across residential, commercial, and industrial sectors, alongside a surge in construction activities and urbanization.