Region:Middle East

Author(s):Rebecca

Product Code:KRAD4979

Pages:96

Published On:December 2025

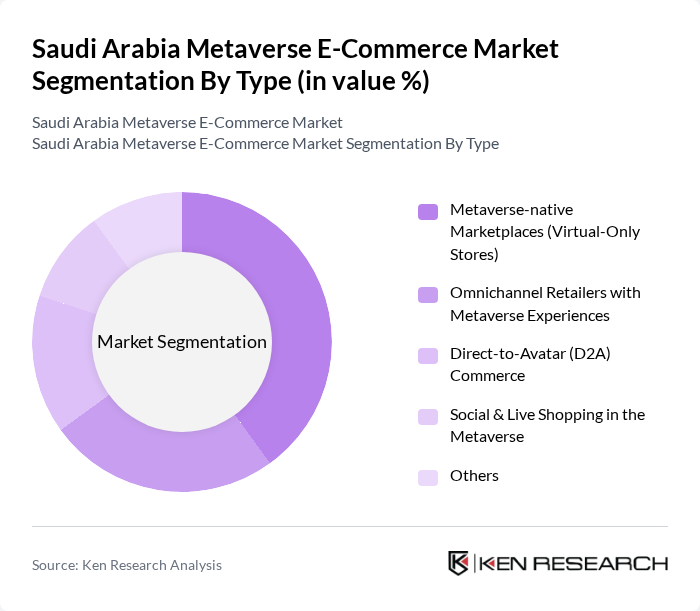

By Type:The market is segmented into various types, including Metaverse-native Marketplaces (Virtual-Only Stores), Omnichannel Retailers with Metaverse Experiences, Direct-to-Avatar (D2A) Commerce, Social & Live Shopping in the Metaverse, and Others. Each of these segments caters to different consumer preferences and shopping behaviors, with Metaverse-native Marketplaces and mobile-first immersive experiences gaining traction as brands test virtual stores, digital twins of malls, and gamified shopping environments to increase engagement and conversion.

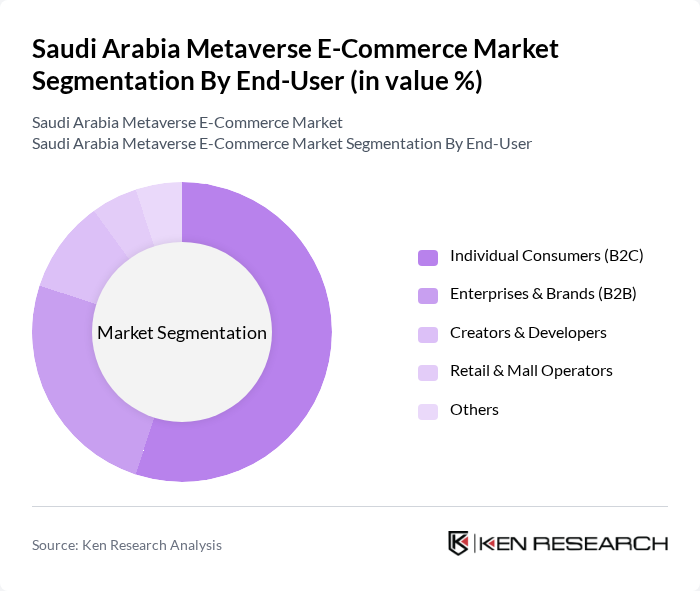

By End-User:The end-user segmentation includes Individual Consumers (B2C), Enterprises & Brands (B2B), Creators & Developers, Retail & Mall Operators, and Others. Individual Consumers dominate the market, driven by the growing trend of online shopping, high social media usage, and the desire for personalized and interactive experiences such as virtual try-ons, live shopping, and gamified loyalty in metaverse-like environments.

The Saudi Arabia Metaverse E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.sa (Amazon KSA), Noon.com, Jarir Marketing Company (Jarir Bookstore), Cenomi Retail (formerly Fawaz Alhokair Group), Majid Al Futtaim (Carrefour Saudi Arabia & Mall Metaverse Initiatives), stc Group (including stc pay & stc play / XR initiatives), Zain KSA (metaverse & immersive experience partnerships), Savvy Games Group, Gamers8 / Esports World Cup Foundation (EWC) – Saudi Esports Federation ecosystem, NEOM (XR & metaverse experience zones for retail and tourism), The Sandbox (regional partnerships including Saudi retail & mall activations), Roblox (brand-led commerce experiences targeting Saudi users), Binance & Other Web3/NFT Marketplaces Active in KSA (e.g., OKX, Bybit regional), Local Web3 / Metaverse Studios (e.g., Spoilz Games, Manga Productions), Apparel Group (Sandbox VR & immersive retail initiatives in KSA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia metaverse e-commerce market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt virtual reality and augmented reality technologies, the shopping experience will become more interactive and personalized. Additionally, the government's commitment to digital transformation will likely foster a conducive environment for innovation. With the rise of social commerce and virtual events, brands will have new avenues to engage consumers, enhancing their market presence and driving growth in this dynamic sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Metaverse-native Marketplaces (Virtual-Only Stores) Omnichannel Retailers with Metaverse Experiences Direct-to-Avatar (D2A) Commerce Social & Live Shopping in the Metaverse Others |

| By End-User | Individual Consumers (B2C) Enterprises & Brands (B2B) Creators & Developers Retail & Mall Operators Others |

| By Product Category | Virtual Fashion, Apparel & Luxury Goods Virtual Electronics & Digital Devices Virtual Real Estate & Spaces NFTs & Tokenized Assets Others (Tickets, Experiences, Services) |

| By Payment Method | Credit/Debit Cards Digital Wallets & BNPL (Tabby, Tamara, etc.) Cryptocurrencies & Stablecoins Closed-loop Tokens / In-experience Currencies Others |

| By User Demographics | Age Groups (18–24, 25–34, 35–44, etc.) Gender Income Levels Region (Riyadh, Jeddah, Dammam/Khobar, Others) Others |

| By Access Device & Platform | Mobile & Tablet (App-based) PC / Laptop VR Headsets AR Glasses / Wearables Others |

| By Customer Engagement Strategy | Gamified Shopping Journeys Loyalty & Token-based Rewards Personalized & AI-driven Experiences Branded Virtual Worlds & Communities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Engagement in Metaverse Shopping | 150 | Active Online Shoppers, Virtual Reality Users |

| Retailer Perspectives on Metaverse Integration | 90 | E-commerce Managers, Digital Marketing Directors |

| Technology Adoption in E-commerce | 70 | IT Managers, E-commerce Platform Developers |

| Consumer Behavior Analysis in Virtual Environments | 120 | Market Researchers, Consumer Insights Analysts |

| Investment Trends in Metaverse E-commerce | 60 | Venture Capitalists, Business Development Executives |

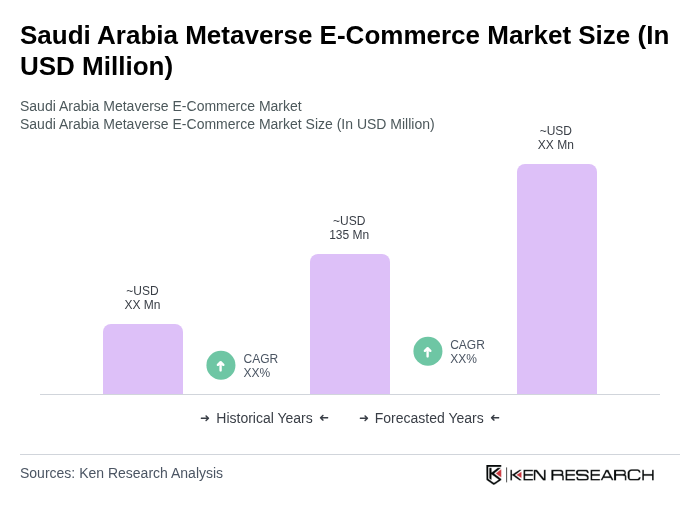

The Saudi Arabia Metaverse E-Commerce Market is valued at approximately USD 135 million, reflecting a significant growth trend driven by digital technology adoption and immersive retail experiences.