Region:Middle East

Author(s):Dev

Product Code:KRAD1643

Pages:98

Published On:November 2025

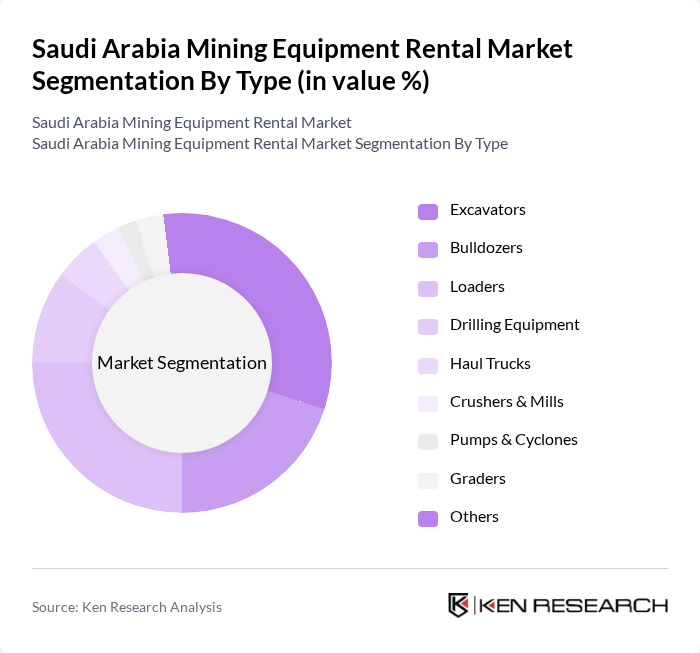

By Type:The market is segmented into various types of equipment, including excavators, bulldozers, loaders, drilling equipment, haul trucks, crushers & mills, pumps & cyclones, graders, and others. Among these, excavators and loaders are the most sought-after due to their versatility and essential role in mining and construction activities. The demand for these equipment types is driven by ongoing infrastructure projects, increased mineral extraction, and the need for efficient material handling in mining operations .

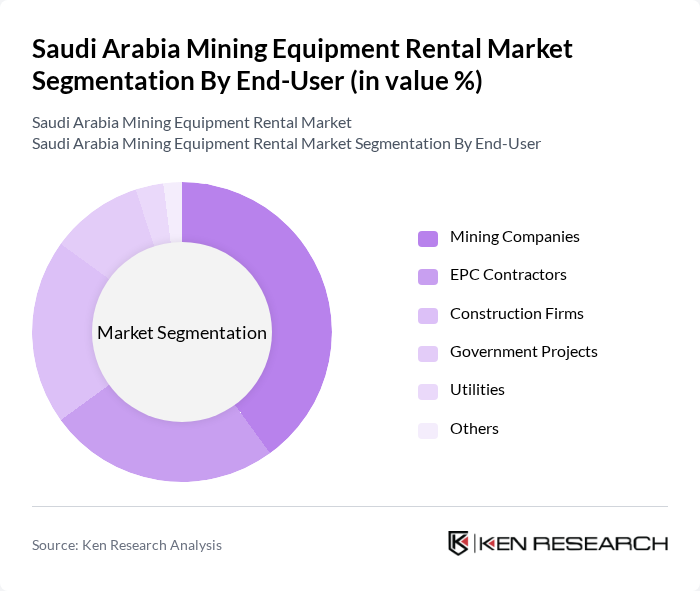

By End-User:The end-user segmentation includes mining companies, EPC contractors, construction firms, government projects, utilities, and others. Mining companies are the leading end-users, driven by the increasing demand for minerals and metals. The growth in construction activities and government infrastructure projects also significantly contributes to the demand for rental equipment, as these sectors require heavy machinery for various operations .

The Saudi Arabia Mining Equipment Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zahid Tractor & Heavy Machinery Co. Ltd., Abdul Latif Jameel Machinery, Bin Quraya Rental, Ejar Cranes & Equipment Co., Al Faris Equipment Rentals LLC, Byrne Equipment Rental, Arabian Machinery & Heavy Equipment Co. (AMHEC), Al-Bassam Group, Peax Equipment Rental, Al-Suwaidi Equipment & Transport, TAMGO (The Machinery Group LLC), Al-Iman for Contracting & Trading, Al-Babtain Group, Al-Kifah Equipment, and Al-Mutawa Equipment Rental contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mining equipment rental market in Saudi Arabia appears promising, driven by ongoing government initiatives and technological advancements. As the country continues to invest in mining infrastructure and sustainable practices, the demand for rental services is expected to grow. Companies are likely to increasingly adopt digital solutions for equipment management, enhancing operational efficiency. Furthermore, the shift towards eco-friendly mining practices will create new avenues for rental services, aligning with global sustainability trends and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Excavators Bulldozers Loaders Drilling Equipment Haul Trucks Crushers & Mills Pumps & Cyclones Graders Others |

| By End-User | Mining Companies EPC Contractors Construction Firms Government Projects Utilities Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region |

| By Application | Surface Mining Underground Mining Mineral Processing Infrastructure Development Others |

| By Equipment Condition | New Equipment Used Equipment |

| By Rental Duration | Short-term Rentals Long-term Rentals Rent-to-Own |

| By Financing Options | Lease-to-Own Traditional Rentals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Equipment Rental Firms | 50 | CEOs, Business Development Managers |

| Construction and Mining Projects | 45 | Project Managers, Site Supervisors |

| Heavy Machinery Operators | 40 | Equipment Operators, Maintenance Technicians |

| Mining Regulatory Bodies | 40 | Regulatory Officers, Policy Makers |

| Industry Consultants and Analysts | 40 | Market Analysts, Industry Experts |

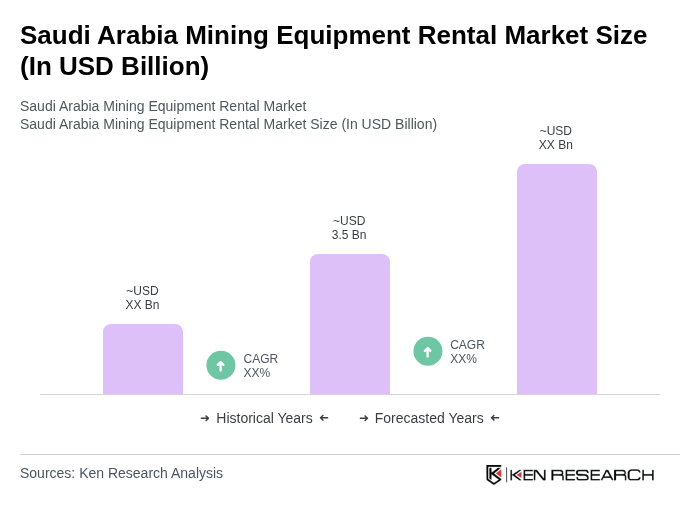

The Saudi Arabia Mining Equipment Rental Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by increased mining activities, government initiatives to diversify the economy, and large-scale infrastructure projects.