Region:Middle East

Author(s):Rebecca

Product Code:KRAB7350

Pages:82

Published On:October 2025

By Type:The mobile banking apps market can be segmented into various types, including Personal Banking Apps, Business Banking Apps, Investment Banking Apps, Payment Processing Apps, Loan Management Apps, Budgeting and Financial Planning Apps, and Others. Each of these segments caters to different user needs and preferences, contributing to the overall growth of the market.

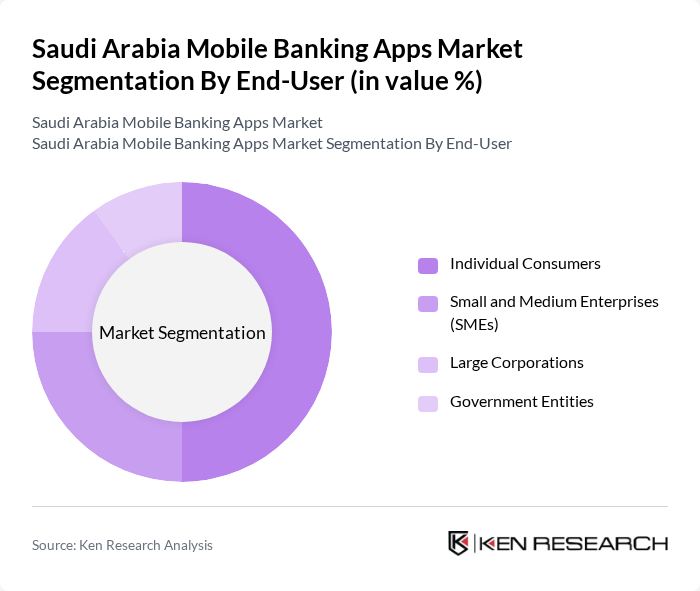

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has distinct requirements and usage patterns, influencing the development and features of mobile banking applications.

The Saudi Arabia Mobile Banking Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Bank, National Commercial Bank (NCB), Saudi British Bank (SABB), Riyad Bank, Arab National Bank, Banque Saudi Fransi, Alinma Bank, Bank Aljazira, Saudi Investment Bank, Emirates NBD, Qatar National Bank (QNB), Abu Dhabi Commercial Bank (ADCB), First Abu Dhabi Bank (FAB), Gulf Bank, Bank of Khartoum contribute to innovation, geographic expansion, and service delivery in this space.

The future of mobile banking apps in Saudi Arabia appears promising, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence and machine learning is expected to enhance user experiences through personalized services. Additionally, the growing trend of partnerships between banks and fintech companies will likely foster innovation and expand service offerings. As the market matures, the focus will shift towards improving security measures and enhancing user trust, ensuring sustainable growth in the mobile banking sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Banking Apps Business Banking Apps Investment Banking Apps Payment Processing Apps Loan Management Apps Budgeting and Financial Planning Apps Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Downloads from App Stores Bank Websites Third-party Platforms Others |

| By User Demographics | Age Groups (18-24, 25-34, 35-44, 45+) Income Levels (Low, Middle, High) Urban vs Rural Users |

| By Features | Basic Banking Functions Advanced Security Features Customer Support Services Financial Management Tools |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Wallets Others |

| By Geographic Reach | National Coverage Regional Coverage Localized Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Users | 150 | Retail Banking Customers, Account Holders |

| Fintech App Users | 100 | Users of Digital Wallets, Mobile Payment Apps |

| Corporate Banking Clients | 80 | Finance Managers, CFOs of SMEs |

| Young Adults (18-30 years) | 120 | University Students, Young Professionals |

| Senior Citizens (60+ years) | 70 | Retirees, Senior Banking Customers |

The Saudi Arabia Mobile Banking Apps Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased smartphone penetration and a shift towards digital banking services among consumers.