Region:Middle East

Author(s):Rebecca

Product Code:KRAD2944

Pages:96

Published On:November 2025

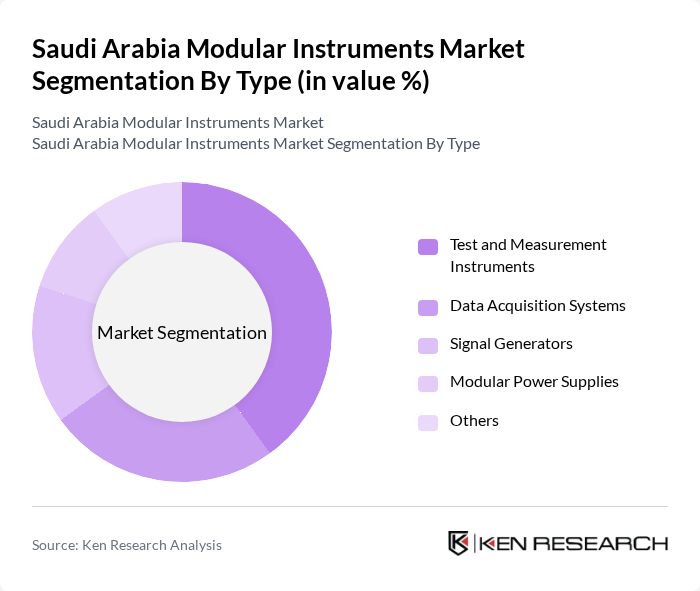

By Type:The market is segmented into various types, including Test and Measurement Instruments, Data Acquisition Systems, Signal Generators, Modular Power Supplies, and Others. Among these, Test and Measurement Instruments are leading due to their critical role in ensuring product quality and compliance across industries. The increasing complexity of electronic systems and the need for precise measurements drive the demand for these instruments.

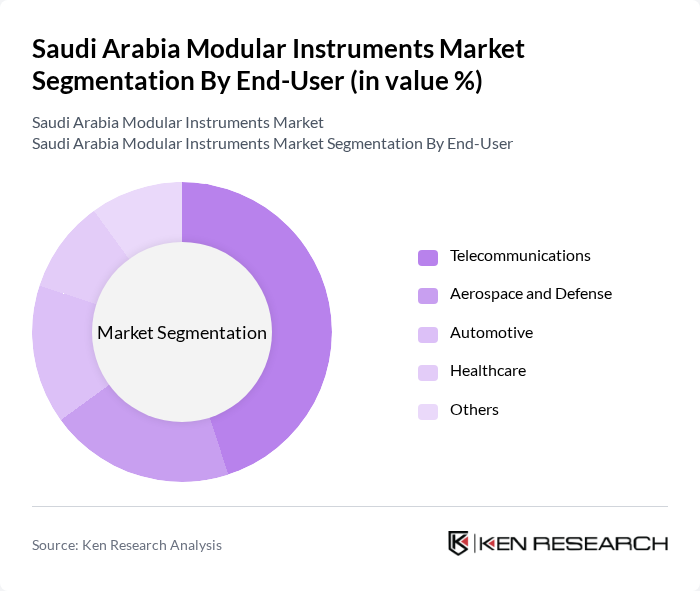

By End-User:The end-user segmentation includes Telecommunications, Aerospace and Defense, Automotive, Healthcare, and Others. The Telecommunications sector is the dominant end-user, driven by the rapid expansion of mobile networks and the increasing demand for high-speed internet services. The need for reliable testing solutions to ensure network performance and compliance with regulatory standards is a significant factor in this growth.

The Saudi Arabia Modular Instruments Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Instruments Corporation, Keysight Technologies, Tektronix, Inc., Fluke Corporation, Rohde & Schwarz GmbH & Co. KG, Agilent Technologies, Anritsu Corporation, Yokogawa Electric Corporation, Advantest Corporation, VIAVI Solutions Inc., Teledyne LeCroy, B&K Precision Corporation, Chroma ATE Inc., Testo SE & Co. KGaA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the modular instruments market in Saudi Arabia appears promising, driven by ongoing technological advancements and government support. As industries increasingly embrace automation and smart technologies, the demand for modular instruments is expected to rise significantly. In future, the market is likely to witness a shift towards more integrated solutions, with a focus on sustainability and energy efficiency, aligning with global trends. This evolution will create new avenues for growth and innovation within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Test and Measurement Instruments Data Acquisition Systems Signal Generators Modular Power Supplies Others |

| By End-User | Telecommunications Aerospace and Defense Automotive Healthcare Others |

| By Application | Research and Development Quality Control Production Testing Field Testing Others |

| By Industry Vertical | Manufacturing Energy and Utilities Education Government Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Analog Instruments Digital Instruments Hybrid Instruments Others |

| By Investment Source | Private Investments Government Funding International Investments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Instrumentation | 100 | Field Engineers, Operations Managers |

| Healthcare Laboratory Equipment | 80 | Lab Managers, Biomedical Engineers |

| Environmental Monitoring Solutions | 70 | Environmental Scientists, Compliance Officers |

| Industrial Automation Systems | 90 | Automation Engineers, Production Supervisors |

| Research & Development Facilities | 60 | R&D Managers, Product Development Specialists |

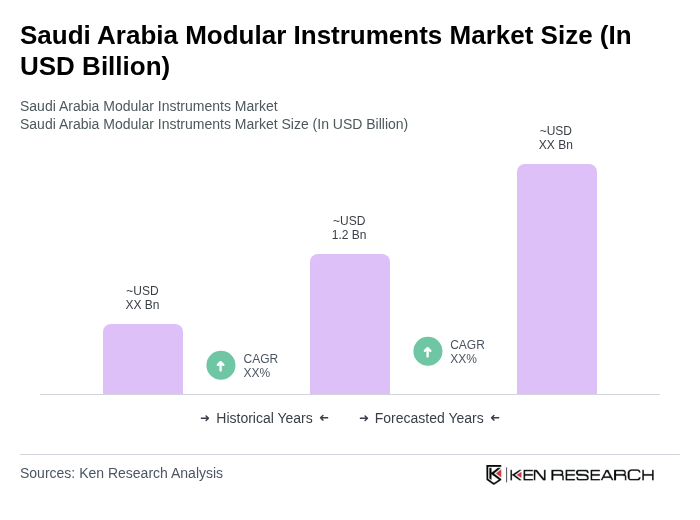

The Saudi Arabia Modular Instruments Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for advanced testing and measurement solutions across various industries, including telecommunications, aerospace, and healthcare.