Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1098

Pages:96

Published On:January 2026

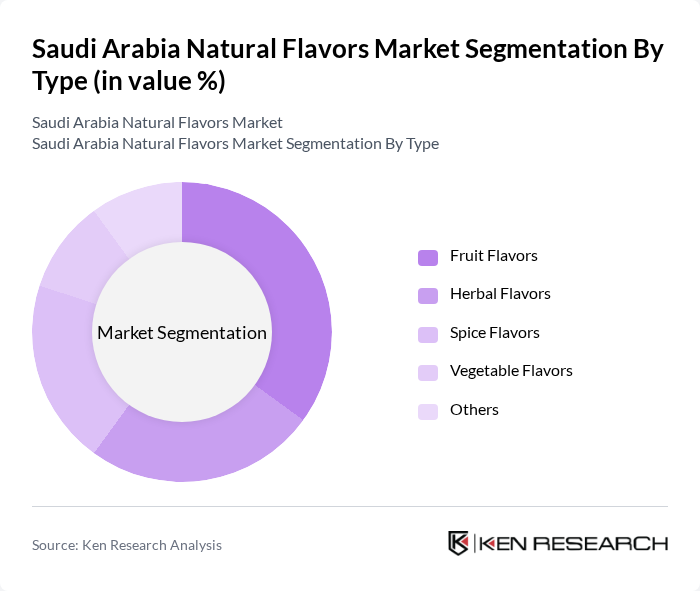

By Type:The market is segmented into various types of natural flavors, including fruit flavors, herbal flavors, spice flavors, vegetable flavors, and others. Among these, fruit flavors are currently dominating the market due to their versatility and widespread application in beverages and confectionery products. The growing trend towards healthier and more natural food options has led to an increased demand for fruit-based flavors, which are perceived as more appealing and refreshing by consumers.

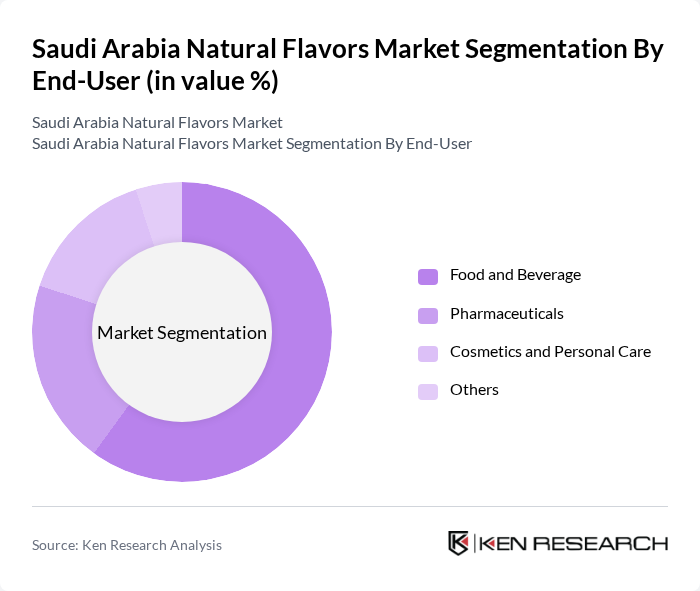

By End-User:The end-user segmentation includes food and beverage, pharmaceuticals, cosmetics and personal care, and others. The food and beverage sector is the largest consumer of natural flavors, driven by the increasing demand for clean-label products and healthier alternatives. This segment is particularly influenced by consumer trends favoring organic and natural ingredients, leading to a significant rise in the use of natural flavors in various food applications.

The Saudi Arabia Natural Flavors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Givaudan, Firmenich, Symrise, International Flavors & Fragrances (IFF), Sensient Technologies, Takasago International Corporation, Mane, Robertet, DÖhler, Frutarom, Naturex, Axxence, Wild Flavors, Flavorchem Corporation, and Bell Flavors and Fragrances contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia natural flavors market appears promising, driven by a sustained shift towards clean-label and health-oriented products. As consumer awareness of ingredient transparency grows, the demand for natural flavors is expected to rise. Additionally, the ongoing expansion of the non-oil sector, particularly in retail and hospitality, will likely bolster the market. Innovations in flavor extraction technologies will further enhance product offerings, catering to diverse consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruit Flavors Herbal Flavors Spice Flavors Vegetable Flavors Others |

| By End-User | Food and Beverage Pharmaceuticals Cosmetics and Personal Care Others |

| By Application | Bakery Products Dairy Products Confectionery Beverages Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Flavor Profile | Sweet Flavors Savory Flavors Spicy Flavors Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Manufacturers | 100 | Product Development Managers, Flavor Technologists |

| Dairy Product Producers | 80 | Quality Assurance Managers, R&D Directors |

| Confectionery Companies | 70 | Marketing Managers, Production Supervisors |

| Food Service Operators | 60 | Menu Developers, Procurement Managers |

| Natural Flavor Suppliers | 90 | Sales Directors, Technical Support Specialists |

The Saudi Arabia Natural Flavors Market is valued at approximately USD 20 million, reflecting a growing consumer preference for clean-label and natural ingredients, particularly in the food and beverage sector.