Region:Middle East

Author(s):Dev

Product Code:KRAE0229

Pages:94

Published On:December 2025

By Type:The essential oils market in Saudi Arabia is segmented by type into various categories, including Citrus Oils, Floral Oils, Herbal Oils, Spice Oils, Mint Oils, Woody Oils, and Others. Among these, Citrus Oils are particularly popular due to their refreshing scents and versatility in applications ranging from personal care to food flavoring. Floral Oils also hold a significant share, driven by their use in cosmetics and aromatherapy. The demand for these oils is influenced by consumer preferences for natural ingredients and the growing trend of wellness and self-care.

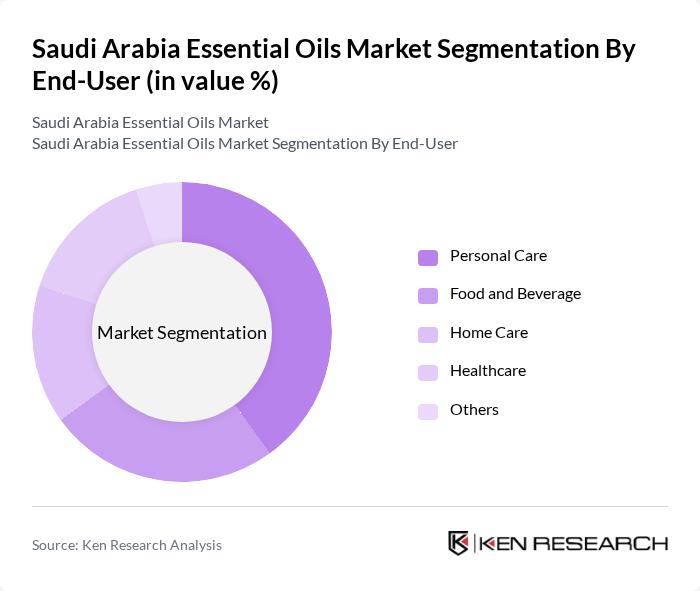

By End-User:The essential oils market is also segmented by end-user applications, which include Personal Care, Food and Beverage, Home Care, Healthcare, and Others. The Personal Care segment dominates the market, driven by the increasing use of essential oils in skincare and haircare products. The Food and Beverage segment is also growing, as consumers seek natural flavoring agents. The rising trend of health and wellness is further propelling the demand for essential oils across various applications.

The Saudi Arabia Essential Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as Young Living Essential Oils, Kelvin Natural Mint, Cargill, FAROTTI SRL, Falcon, and Aethon International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia essential oils market appears promising, driven by a growing consumer base that values natural and organic products. As health and wellness trends continue to gain traction, the demand for essential oils is expected to rise. Additionally, advancements in e-commerce and digital marketing strategies will facilitate broader access to these products, allowing companies to reach a wider audience. The market is likely to see increased innovation in product offerings, catering to diverse consumer preferences and enhancing overall market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Citrus Oils Floral Oils Herbal Oils Spice Oils Mint Oils Woody Oils Others |

| By End-User | Personal Care Food and Beverage Home Care Healthcare Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Aromatherapy Cosmetics Food Flavoring Household Cleaning Others |

| By Packaging Type | Bottles Jars Bulk Packaging Others |

| By Price Range | Premium Mid-range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Essential Oils Market | 150 | Retail Managers, Store Owners |

| Aromatherapy Practitioners | 100 | Aromatherapists, Wellness Coaches |

| Cosmetic and Personal Care Manufacturers | 80 | Product Development Managers, Brand Managers |

| Food and Beverage Sector | 70 | Flavorists, Product Development Specialists |

| Health and Wellness Consumers | 120 | Health Enthusiasts, Regular Users of Essential Oils |

The Saudi Arabia Essential Oils Market is valued at approximately USD 115 million, reflecting a significant growth trend driven by consumer preferences for natural and organic products across various sectors, including personal care, wellness, and food.