Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7181

Pages:82

Published On:December 2025

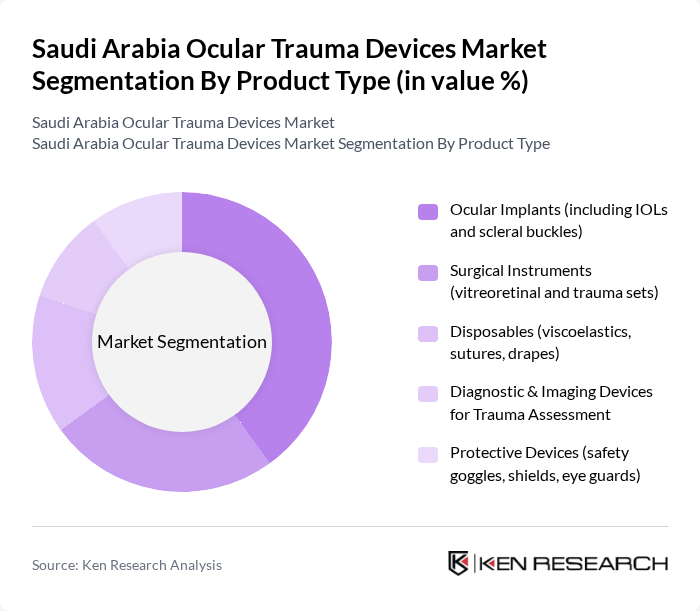

By Product Type:The product type segmentation includes various categories such as ocular implants, surgical instruments, disposables, diagnostic and imaging devices, and protective devices. Among these, ocular implants, including intraocular lenses (IOLs) and scleral buckles, are leading the market due to their critical role in restoring vision after trauma. The increasing number of cataract surgeries and retinal detachment cases further drives the demand for these implants.

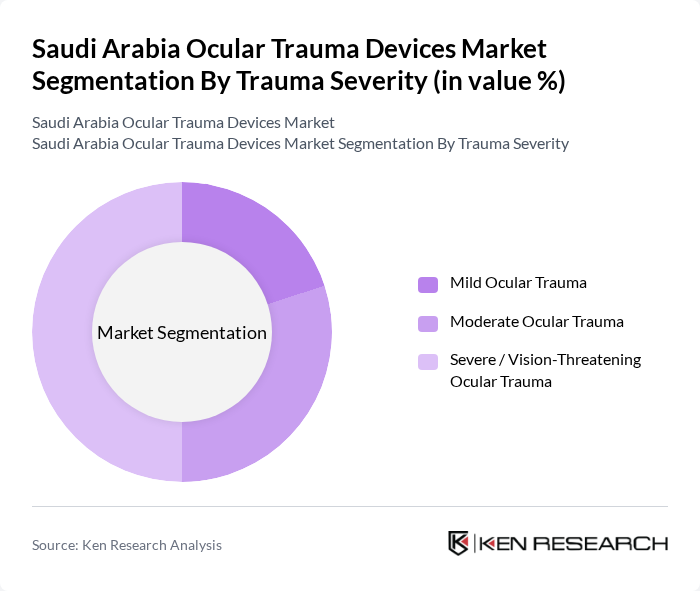

By Trauma Severity:The trauma severity segmentation categorizes ocular trauma into mild, moderate, and severe/vision-threatening injuries. Severe ocular trauma is the leading segment due to the critical nature of these injuries, which often require immediate surgical intervention. The increasing incidence of accidents and sports-related injuries contributes to the demand for advanced trauma devices and surgical solutions.

The Saudi Arabia Ocular Trauma Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon Inc., Bausch & Lomb Incorporated, Johnson & Johnson Vision Care, Inc., Carl Zeiss Meditec AG, Santen Pharmaceutical Co., Ltd., Topcon Corporation, Nidek Co., Ltd., Haag-Streit AG, Rayner Surgical Group Limited, Allergan (an AbbVie company), EssilorLuxottica SA, Optos plc, Glaukos Corporation, Oertli Instrumente AG, Magrabi Hospitals & Centers (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ocular trauma devices market in Saudi Arabia appears promising, driven by ongoing advancements in technology and increasing healthcare investments. The government’s commitment to enhancing healthcare infrastructure, with a projected budget increase of 12% in future, will facilitate better access to advanced medical devices. Additionally, the integration of telemedicine and AI in ocular care is expected to revolutionize treatment approaches, making them more efficient and accessible to a broader population.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Ocular Implants (including IOLs and scleral buckles) Surgical Instruments (vitreoretinal and trauma sets) Disposables (viscoelastics, sutures, drapes) Diagnostic & Imaging Devices for Trauma Assessment Protective Devices (safety goggles, shields, eye guards) |

| By Trauma Severity | Mild Ocular Trauma Moderate Ocular Trauma Severe / Vision-Threatening Ocular Trauma |

| By Care Setting | Tertiary Care Hospitals & University Hospitals Specialized Ophthalmology Centers Ambulatory Surgery Centers (ASCs) Emergency Departments & Trauma Centers Others |

| By Region | Central Region (including Riyadh) Western Region (including Jeddah and Makkah) Eastern Region (including Dammam and Al Khobar) Southern Region Northern Region |

| By Clinical Application | Trauma Surgery (open and closed globe injuries) Retinal Detachment Associated with Trauma Cataract Surgery Following Ocular Trauma Glaucoma Management Post-Trauma Other Trauma-Related Indications |

| By Technology | Laser-Based Systems Advanced Microsurgical Platforms Advanced Imaging Systems (OCT, fundus, UBM) Conventional Techniques & Other Technologies |

| By Payer Type | Public Hospitals & Government Programs Private Hospitals & Clinics Self-Pay and Out-of-Pocket Private Insurance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologists in Major Hospitals | 100 | Consultant Ophthalmologists, Trauma Surgeons |

| Medical Device Distributors | 80 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Regulatory Experts |

| Patients with Ocular Trauma | 70 | Recent Trauma Patients, Rehabilitation Specialists |

| Emergency Room Staff | 60 | ER Physicians, Nursing Staff |

The Saudi Arabia Ocular Trauma Devices Market is valued at approximately USD 140 million, driven by factors such as the increasing prevalence of ocular injuries, advancements in medical technology, and government initiatives like Vision 2030 aimed at enhancing ophthalmology infrastructure.