Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3146

Pages:90

Published On:October 2025

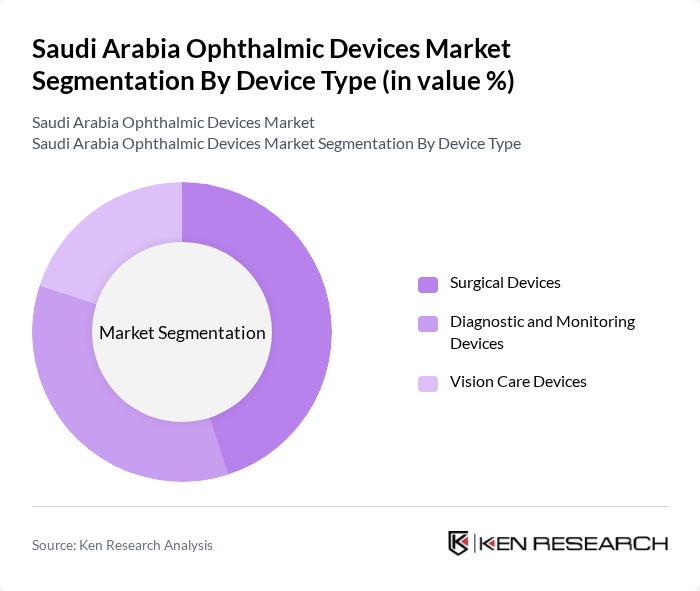

By Device Type:

The ophthalmic devices market is segmented into three main types:Surgical Devices,Diagnostic and Monitoring Devices, andVision Care Devices. Surgical Devices, including phacoemulsification systems and laser systems, lead the market, driven by the rising number of cataract surgeries and refractive procedures. Diagnostic and Monitoring Devices, such as optical coherence tomography (OCT) and fundus cameras, are gaining traction as early detection of eye diseases becomes increasingly important. Vision Care Devices, including contact lenses and spectacle lenses, address the growing demand for corrective eyewear among the population. The market reflects a shift toward minimally invasive surgical solutions and advanced diagnostic modalities, with increased adoption in both public and private healthcare settings .

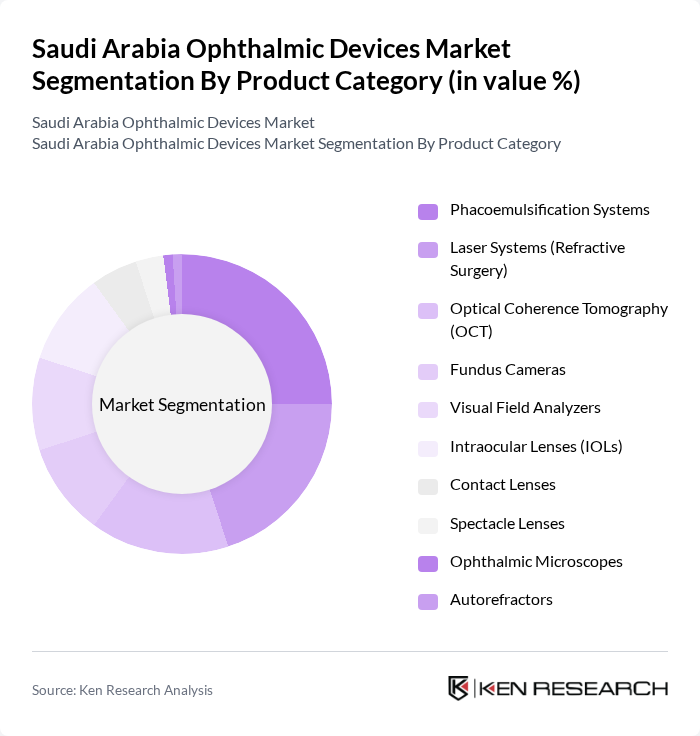

By Product Category:

This market is further segmented into various product categories, includingPhacoemulsification Systems,Laser Systems (Refractive Surgery),Optical Coherence Tomography (OCT),Fundus Cameras,Visual Field Analyzers,Intraocular Lenses (IOLs),Contact Lenses,Spectacle Lenses,Ophthalmic Microscopes, andAutorefractors. Among these, Phacoemulsification Systems and Laser Systems are leading due to the high volume of cataract and refractive surgeries performed. The increasing adoption of advanced diagnostic tools like OCT and fundus cameras is also noteworthy, as they play a crucial role in managing eye diseases. Optical coherence tomography scanners are currently the largest revenue-generating product segment in the Saudi market .

The Saudi Arabia Ophthalmic Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carl Zeiss Meditec AG, Alcon Inc., Johnson & Johnson Vision, Bausch + Lomb, Haag-Streit Group, Ziemer Ophthalmic Systems AG, Topcon Corporation, Nidek Co., Ltd., Hoya Corporation, EssilorLuxottica, CooperVision, Rayner Intraocular Lenses Limited, Optos (Nikon subsidiary), Ellex Medical Lasers Ltd., and Lumenis Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia ophthalmic devices market is poised for significant growth, driven by technological advancements and an increasing focus on eye health. The integration of telemedicine and artificial intelligence in ophthalmology is expected to enhance diagnostic accuracy and patient engagement. Additionally, the government's commitment to improving healthcare infrastructure will facilitate better access to ophthalmic services, ultimately benefiting both patients and providers. As the market evolves, stakeholders must adapt to these trends to capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Surgical Devices Diagnostic and Monitoring Devices Vision Care Devices |

| By Product Category | Phacoemulsification Systems Laser Systems (Refractive Surgery) Optical Coherence Tomography (OCT) Fundus Cameras Visual Field Analyzers Intraocular Lenses (IOLs) Contact Lenses Spectacle Lenses Ophthalmic Microscopes Autorefractors |

| By Application | Cataract Surgery Glaucoma Treatment Refractive Surgery (LASIK, SMILE) Retinal Disease Management Diabetic Retinopathy Screening Macular Degeneration |

| By End-User | Hospitals and Clinics (Public and Private) Eye Care Centers Ophthalmologists' Offices Retail Pharmacies Research Institutions |

| By Distribution Channel | Direct Sales Distributors and Wholesalers Online Sales Platforms Retail Optical Chains |

| By Region | Central Region (Riyadh) Western Region (Jeddah, Makkah) Eastern Region (Dammam, Dhahran) Southern Region |

| By Price Range | Low-End Devices Mid-Range Devices High-End/Premium Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Device Procurement | 100 | Procurement Managers, Hospital Administrators |

| Clinical Usage of Ophthalmic Devices | 90 | Ophthalmologists, Optometrists |

| Market Trends in Eye Care | 70 | Healthcare Analysts, Industry Experts |

| Patient Experience with Eye Treatments | 60 | Patients, Caregivers |

| Regulatory Compliance in Ophthalmology | 50 | Regulatory Affairs Specialists, Compliance Officers |

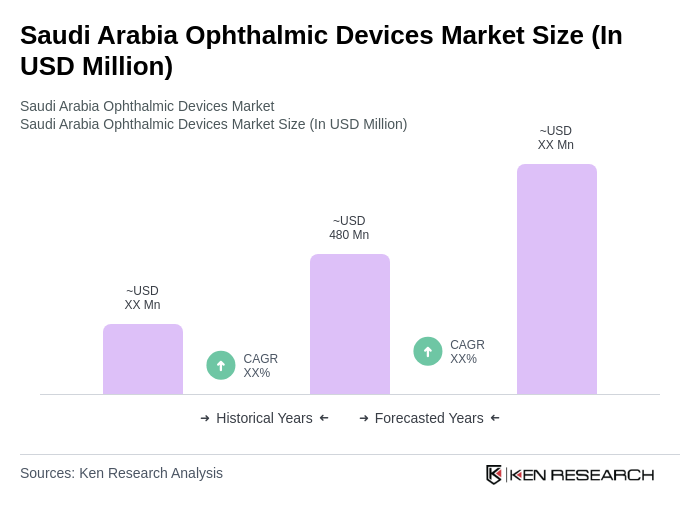

The Saudi Arabia Ophthalmic Devices Market is valued at approximately USD 480 million, reflecting significant growth driven by the increasing prevalence of age-related eye disorders, advancements in technology, and rising healthcare expenditure.