Region:Middle East

Author(s):Rebecca

Product Code:KRAB7190

Pages:89

Published On:October 2025

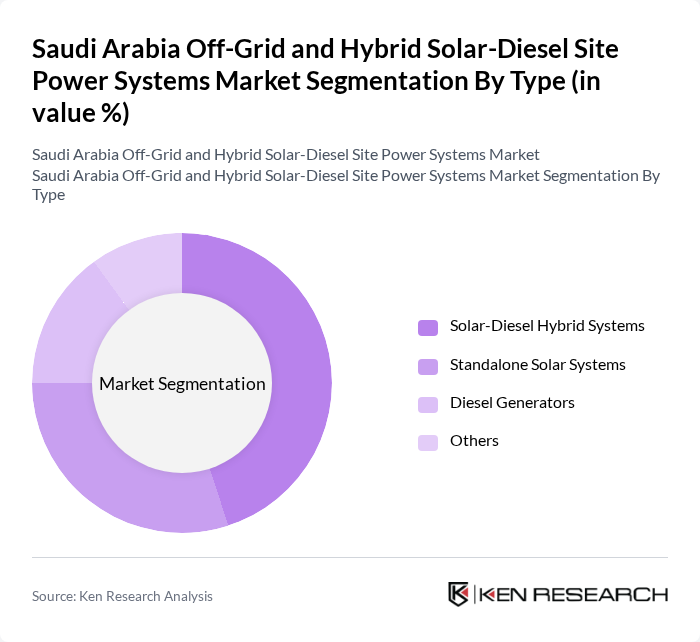

By Type:The market is segmented into various types, including Solar-Diesel Hybrid Systems, Standalone Solar Systems, Diesel Generators, and Others. Among these, Solar-Diesel Hybrid Systems are gaining traction due to their efficiency and ability to provide a reliable power supply in remote areas. The increasing adoption of renewable energy technologies is driving the demand for these hybrid systems, as they offer a sustainable solution to energy needs.

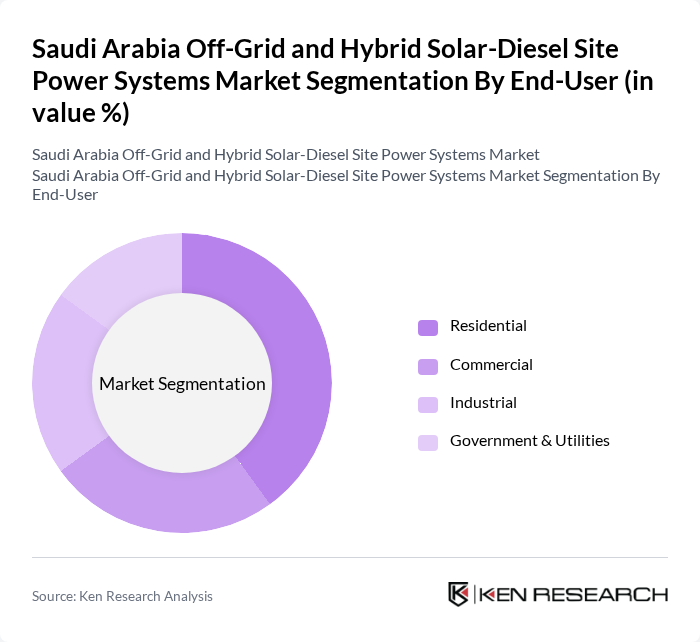

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The residential segment is witnessing significant growth as households seek reliable and cost-effective energy solutions. The increasing awareness of renewable energy benefits and government incentives are propelling the adoption of off-grid and hybrid systems among residential users.

The Saudi Arabia Off-Grid and Hybrid Solar-Diesel Site Power Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACWA Power, First Solar, Inc., Canadian Solar Inc., JinkoSolar Holding Co., Ltd., Trina Solar Limited, Siemens AG, Schneider Electric SE, ABB Ltd., Enphase Energy, Inc., SunPower Corporation, TotalEnergies SE, GE Renewable Energy, Risen Energy Co., Ltd., Hanwha Q CELLS, Solaria Energía y Medio Ambiente S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the off-grid and hybrid solar-diesel site power systems market in Saudi Arabia appears promising, driven by increasing energy demands and supportive government policies. As the country continues to invest in renewable energy infrastructure, technological advancements will likely enhance system efficiency and reduce costs. Furthermore, the integration of smart grid technologies and energy storage solutions will facilitate better energy management, paving the way for a more sustainable energy landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar-Diesel Hybrid Systems Standalone Solar Systems Diesel Generators Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Remote Area Electrification Disaster Recovery Solutions Agricultural Applications Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar-Diesel Systems | 100 | Homeowners, Energy Managers |

| Commercial Hybrid Power Solutions | 80 | Facility Managers, Operations Directors |

| Industrial Off-Grid Applications | 70 | Plant Managers, Procurement Officers |

| Government Renewable Energy Projects | 60 | Policy Makers, Project Coordinators |

| Energy Consultants and Advisors | 50 | Energy Analysts, Sustainability Consultants |

The Saudi Arabia Off-Grid and Hybrid Solar-Diesel Site Power Systems Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for reliable electricity in remote areas and government initiatives to diversify energy sources.