Region:Middle East

Author(s):Dev

Product Code:KRAD7780

Pages:88

Published On:December 2025

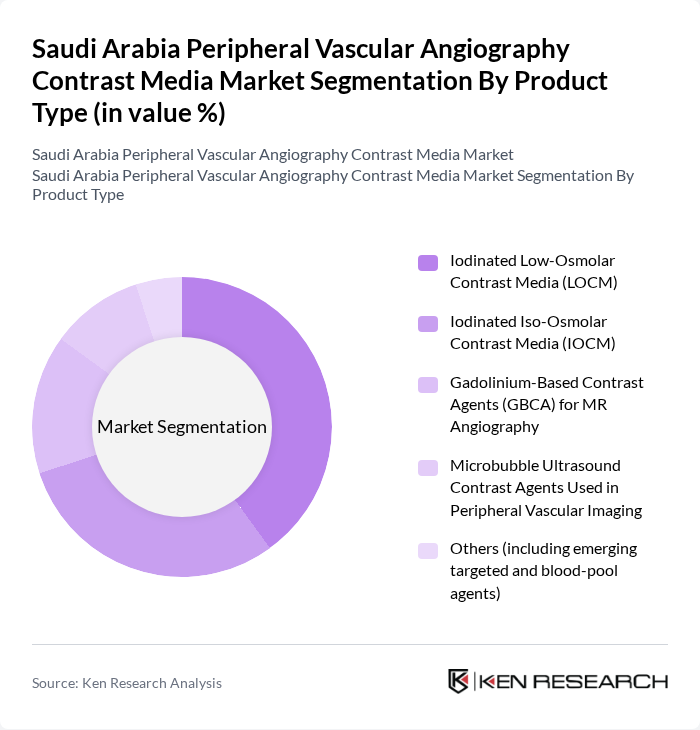

By Product Type:The product type segmentation includes various categories of contrast media used in peripheral vascular angiography. The subsegments are as follows:

The Iodinated Low-Osmolar Contrast Media (LOCM) segment is currently dominating the market due to its widespread use in various imaging procedures, including peripheral vascular angiography. The preference for LOCM is attributed to its lower osmolarity, which reduces the risk of adverse reactions compared to high-osmolar contrast agents. Additionally, advancements in formulation and increased availability have made LOCM a preferred choice among healthcare providers, contributing to its significant market share.

By Route of Administration:The route of administration segmentation includes the following categories:

Intra-Arterial Administration is the leading route of administration in the market, primarily due to its effectiveness in delivering contrast media directly to the target area, enhancing the quality of imaging results. This method is particularly favored in interventional procedures where precise visualization of vascular structures is critical. The growing number of interventional radiology procedures and the need for accurate diagnostics further bolster the preference for intra-arterial administration.

The Saudi Arabia Peripheral Vascular Angiography Contrast Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, GE Healthcare, Bracco Imaging S.p.A., Guerbet Group, Lantheus Holdings Inc., Jiangsu Hengrui Pharmaceuticals Co., Ltd., Beijing Beilu Pharmaceutical Co., Ltd., Trivitron Healthcare Pvt. Ltd., Nano Therapeutics Pvt. Ltd., Philips Healthcare (Koninklijke Philips N.V.), Siemens Healthineers AG, Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Medtronic plc, Abbott Laboratories contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia peripheral vascular angiography contrast media market appears promising, driven by ongoing advancements in healthcare technology and increasing government support for healthcare initiatives. As the population ages and the prevalence of chronic diseases rises, the demand for effective diagnostic tools will continue to grow. Furthermore, the integration of artificial intelligence in imaging processes is expected to enhance diagnostic accuracy, paving the way for innovative solutions that improve patient care and operational efficiency in healthcare facilities.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Iodinated Low-Osmolar Contrast Media (LOCM) Iodinated Iso-Osmolar Contrast Media (IOCM) Gadolinium-Based Contrast Agents (GBCA) for MR Angiography Microbubble Ultrasound Contrast Agents Used in Peripheral Vascular Imaging Others (including emerging targeted and blood-pool agents) |

| By Route of Administration | Intra-Arterial Administration Intravenous Administration Others |

| By Imaging Modality | Peripheral Digital Subtraction Angiography (DSA) CT Peripheral Angiography (CTPA/CTA) MR Peripheral Angiography (MRA) Ultrasound-Based Peripheral Vascular Imaging Using Contrast Agents |

| By End-User | Tertiary Care Hospitals & Cardiac Centers Specialized Vascular & Interventional Radiology Centers Diagnostic Imaging Centers Others |

| By Distribution Channel | Direct Hospital & Group Purchasing Contracts Local Pharmaceutical & Medical Device Distributors Tender-Based Government Procurement (e.g., NUPCO) Others |

| By Patient Demographics | Patients with Peripheral Artery Disease (PAD) Diabetic Patients with Peripheral Vascular Complications General Cardiovascular Risk Population (Adult & Geriatric) Others |

| By Region | Riyadh & Central Region Makkah & Western Region Eastern Province Northern & Southern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 90 | Procurement Managers, Supply Chain Coordinators |

| Interventional Radiology Units | 80 | Radiologists, Interventional Specialists |

| Medical Imaging Technicians | 70 | Imaging Technologists, Radiology Nurses |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Regulatory Experts |

| Contrast Media Manufacturers | 60 | Product Managers, Sales Directors |

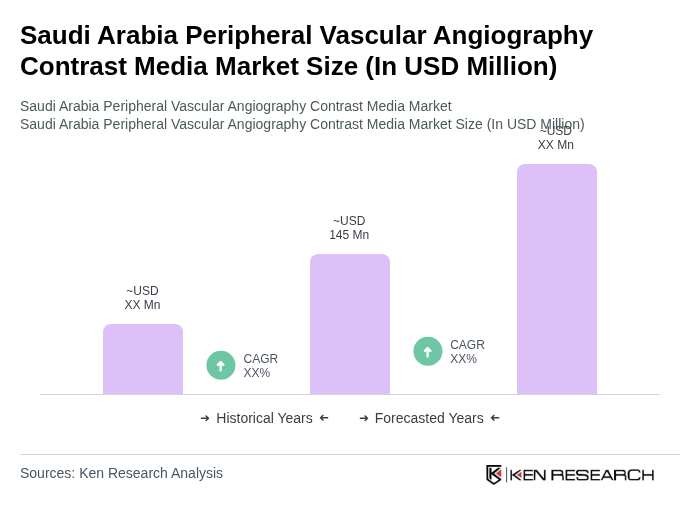

The Saudi Arabia Peripheral Vascular Angiography Contrast Media Market is valued at approximately USD 145 million, reflecting a significant growth driven by the increasing prevalence of cardiovascular diseases and advancements in imaging technologies.