Region:Middle East

Author(s):Geetanshi

Product Code:KRAE5877

Pages:88

Published On:December 2025

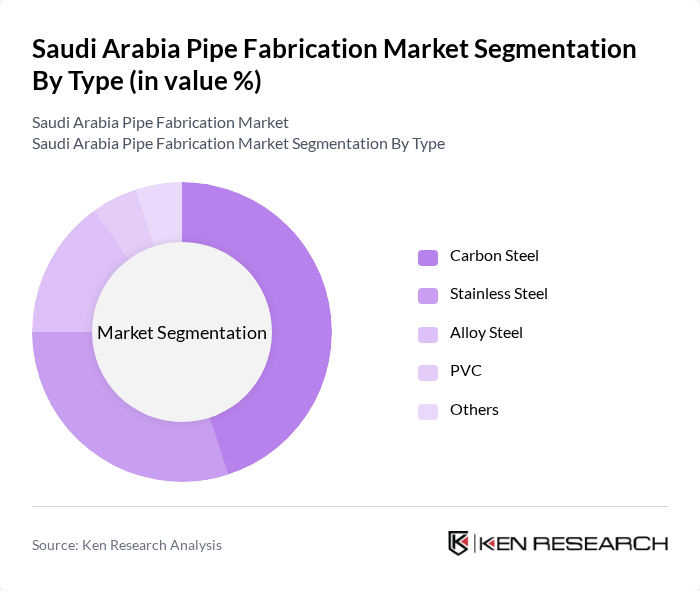

By Type:The market is segmented into various types of materials used in pipe fabrication. The primary subsegments include Carbon Steel, Stainless Steel, Alloy Steel, PVC, and Others. Among these, Carbon Steel is the leading subsegment due to its widespread use in various applications, particularly in the oil and gas sector, where durability and strength are paramount. The demand for Stainless Steel is also growing, driven by its corrosion resistance and suitability for high-temperature applications.

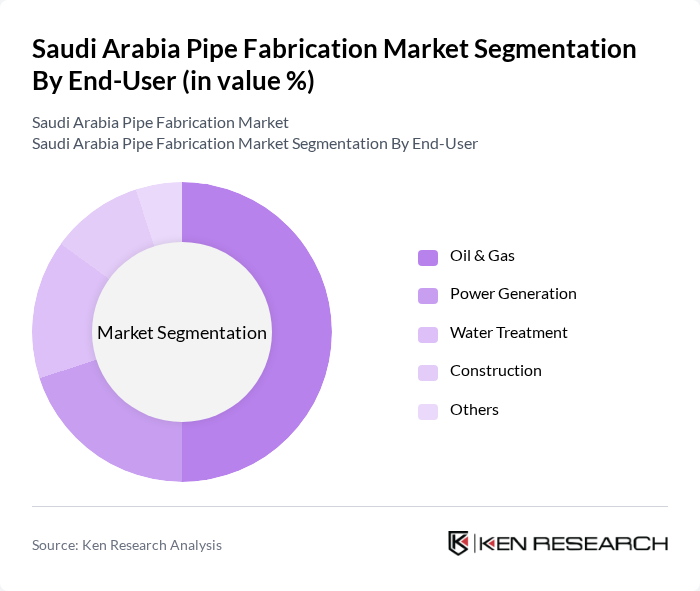

By End-User:The market is segmented based on end-user industries, including Oil & Gas, Power Generation, Water Treatment, Construction, and Others. The Oil & Gas sector is the dominant end-user, accounting for a significant portion of the market share due to the extensive use of pipes in exploration, extraction, and transportation processes. The Construction sector is also witnessing growth, driven by ongoing infrastructure projects and urban development initiatives.

The Saudi Arabia Pipe Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Pipe Systems Co. Ltd., Al-Babtain Group, National Pipe Company, Arabian Pipes Company, Al-Falak Electronic Equipment & Supplies, Al-Khodari & Sons, Al-Muhaidib Group, Al-Jazira Group, Al-Rajhi Steel, Eastern Province Cement Company, Saudi Steel Pipe Co., Al-Hokair Group, Al-Mansoori Specialized Engineering, Gulf Steel Works, Al-Suwaidi Industrial Services Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia pipe fabrication market appears promising, driven by ongoing investments in infrastructure and industrial projects. As the government continues to diversify the economy, the demand for innovative fabrication solutions will rise. Additionally, the integration of automation and digital technologies is expected to enhance efficiency and reduce costs. Companies that adapt to these trends will likely capture significant market share, positioning themselves favorably for long-term growth in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbon Steel Stainless Steel Alloy Steel PVC Others |

| By End-User | Oil & Gas Power Generation Water Treatment Construction Others |

| By Application | Industrial Applications Commercial Applications Residential Applications Infrastructure Projects Others |

| By Fabrication Method | Welding Bending Cutting Assembly Others |

| By Material Source | Domestic Suppliers International Suppliers Recycled Materials Others |

| By Project Type | New Construction Renovation Maintenance Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Pipe Fabrication | 120 | Project Managers, Procurement Officers |

| Construction Sector Pipe Supply | 90 | Construction Managers, Supply Chain Coordinators |

| Water Management Systems | 80 | Environmental Engineers, Water Resource Managers |

| Industrial Pipe Applications | 70 | Operations Managers, Technical Directors |

| Research & Development in Pipe Technology | 60 | R&D Managers, Product Development Engineers |

The Saudi Arabia Pipe Fabrication Market is valued at approximately USD 3.2 billion, driven by the increasing demand for infrastructure development, particularly in the oil and gas sector, and various industrial activities aligned with Vision 2030 initiatives.