Region:Middle East

Author(s):Shubham

Product Code:KRAD3514

Pages:94

Published On:November 2025

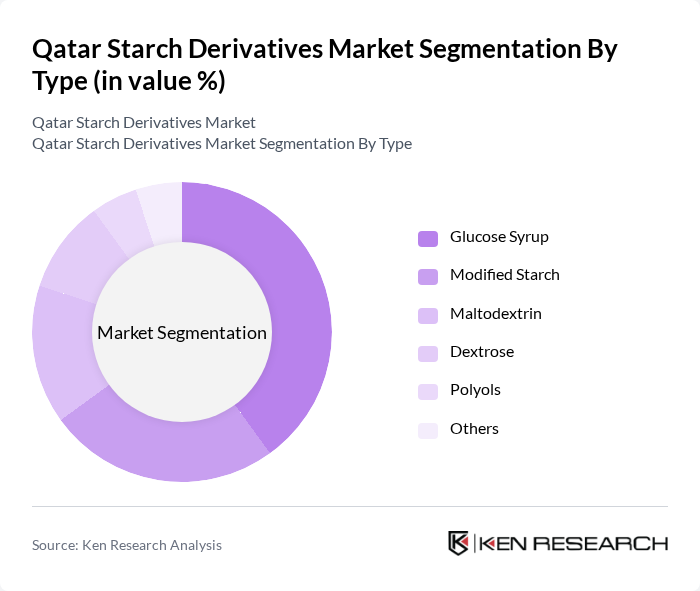

By Type:The starch derivatives market is segmented into various types, including Glucose Syrup, Modified Starch, Maltodextrin, Dextrose, Polyols, and Others. Among these, Glucose Syrup is the leading sub-segment, primarily due to its extensive use in the food and beverage industry as a sweetener and thickening agent. The increasing demand for convenience foods and beverages has significantly contributed to the growth of this segment, as manufacturers seek to enhance product texture and flavor. Modified starches and maltodextrin are also gaining traction as fat replacers and texture modifiers in line with consumer demand for healthier, plant-based, and clean-label products .

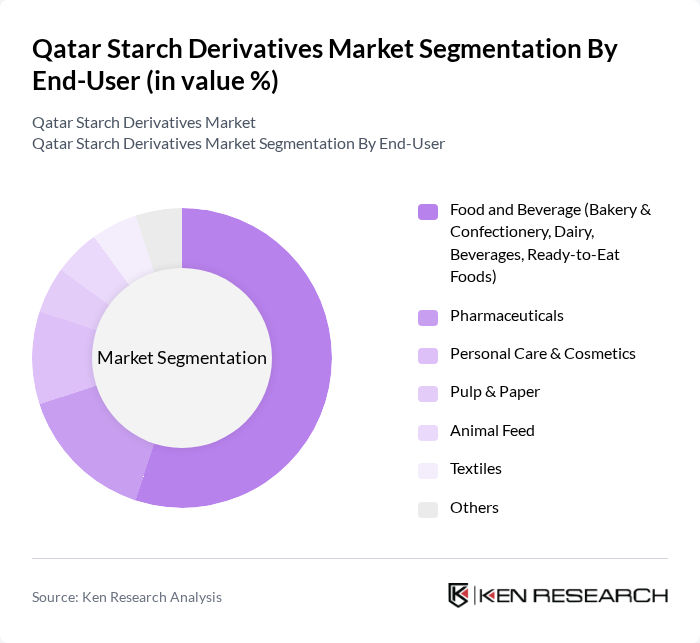

By End-User:The end-user segmentation includes Food and Beverage (Bakery & Confectionery, Dairy, Beverages, Ready-to-Eat Foods), Pharmaceuticals, Personal Care & Cosmetics, Pulp & Paper, Animal Feed, Textiles, and Others. The Food and Beverage sector is the dominant end-user, driven by the increasing consumption of processed foods and beverages. The trend towards healthier eating habits has also led to a rise in demand for starch derivatives that serve as natural thickeners and stabilizers in various food products. The pharmaceuticals segment is expanding due to the adoption of starch-based excipients for drug delivery, while industrial applications are growing as starch derivatives are increasingly used in bioplastics, adhesives, and paper manufacturing .

The Qatar Starch Derivatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ingredion Incorporated, Cargill, Incorporated, Tate & Lyle PLC, Archer Daniels Midland Company (ADM), Roquette Frères, Tereos S.A., AGRANA Beteiligungs-AG, Gulfood Industries Qatar, Al Waha Starch & Sweeteners, Qatar Flour Mills Co. (QFM), Qatari German Company for Starch & Derivatives, Al Safwa Food Industries, Al Jazeera Food Processing & Starch, United Food Industries Qatar, Al Khor Food Industries contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar starch derivatives market is poised for significant growth, driven by increasing consumer demand for natural and healthy food options. As the food and beverage industry continues to expand, manufacturers are likely to innovate and develop new starch-based products that cater to evolving consumer preferences. Additionally, the focus on sustainability and clean label products will further shape market dynamics, encouraging companies to adopt environmentally friendly practices and enhance product transparency.

| Segment | Sub-Segments |

|---|---|

| By Type | Glucose Syrup Modified Starch Maltodextrin Dextrose Polyols Others |

| By End-User | Food and Beverage (Bakery & Confectionery, Dairy, Beverages, Ready-to-Eat Foods) Pharmaceuticals Personal Care & Cosmetics Pulp & Paper Animal Feed Textiles Others |

| By Application | Thickener Binder Stabilizer Emulsifier Film-forming Agent Others |

| By Source | Corn (Maize) Potato Wheat Cassava (Tapioca) Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Product Form | Powder Liquid Granules Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Production Managers, Quality Assurance Managers |

| Pharmaceutical Companies | 60 | Regulatory Affairs Managers, Product Development Managers |

| Industrial Applications of Starch | 50 | Operations Managers, Supply Chain Managers |

| Research Institutions and Universities | 40 | Research Scientists, Professors |

| Retail Sector Insights | 50 | Category Managers, Procurement Managers |

The Qatar Starch Derivatives Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by increasing demand across various sectors, including food and beverage, pharmaceuticals, and personal care.