Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3897

Pages:93

Published On:November 2025

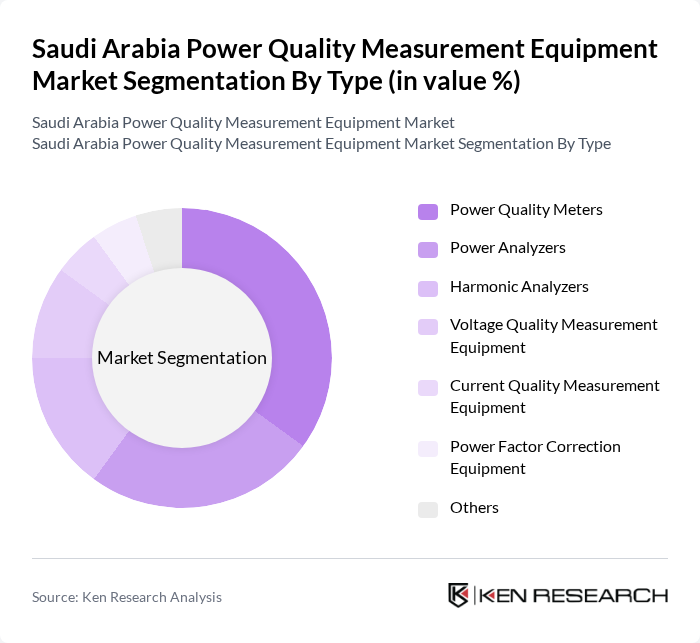

By Type:The market is segmented into various types of power quality measurement equipment, including Power Quality Meters, Power Analyzers, Harmonic Analyzers, Voltage Quality Measurement Equipment, Current Quality Measurement Equipment, Power Factor Correction Equipment, and Others. Among these, Power Quality Meters are leading the market due to their widespread application in monitoring and analyzing power quality parameters in real-time. The increasing need for energy efficiency and reliability in power supply is driving the demand for these devices.

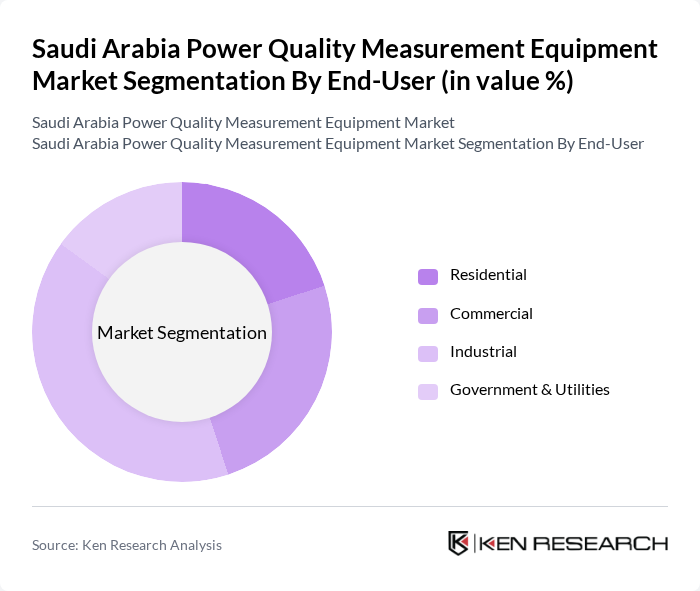

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities sectors. The Industrial segment is the dominant force in the market, driven by the increasing need for efficient energy management and compliance with regulatory standards. Industries are increasingly investing in power quality measurement equipment to enhance operational efficiency and reduce downtime caused by power quality issues.

The Saudi Arabia Power Quality Measurement Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fluke Corporation, Schneider Electric, Siemens AG, ABB Ltd., Yokogawa Electric Corporation, Keysight Technologies, National Instruments, Megger Group Limited, Kyoritsu Electrical Instruments Works, Ametek, Inc., Hioki E.E. Corporation, Testo SE & Co. KGaA, Gossen Metrawatt GmbH, Dranetz Technologies, Inc., Extech Instruments contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Saudi Arabia power quality measurement equipment market appears promising, driven by ongoing government initiatives and technological advancements. As the Kingdom continues to diversify its economy and invest in renewable energy, the demand for reliable power quality solutions will increase. Furthermore, the integration of smart grid technologies and IoT will enhance monitoring capabilities, leading to improved energy efficiency and sustainability. These trends indicate a robust growth trajectory for the market, positioning it as a critical component of the energy sector's evolution.

| Segment | Sub-Segments |

|---|---|

| By Type | Power Quality Meters Power Analyzers Harmonic Analyzers Voltage Quality Measurement Equipment Current Quality Measurement Equipment Power Factor Correction Equipment Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Digital Measurement Technology Analog Measurement Technology Hybrid Measurement Technology |

| By Application | Grid-Connected Systems Off-Grid Systems Utility-Scale Projects Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Power Quality Management | 100 | Plant Managers, Electrical Engineers |

| Commercial Sector Power Quality Solutions | 80 | Facility Managers, Energy Consultants |

| Residential Power Quality Equipment | 60 | Homeowners, Electrical Contractors |

| Utility Company Power Quality Monitoring | 70 | Utility Managers, Technical Directors |

| Research Institutions and Academia | 50 | Researchers, Professors in Electrical Engineering |

The Saudi Arabia Power Quality Measurement Equipment Market is valued at approximately USD 655 million, reflecting a significant growth driven by the increasing demand for reliable power supply and efficient energy management systems across various sectors.