Region:Middle East

Author(s):Shubham

Product Code:KRAB7455

Pages:83

Published On:October 2025

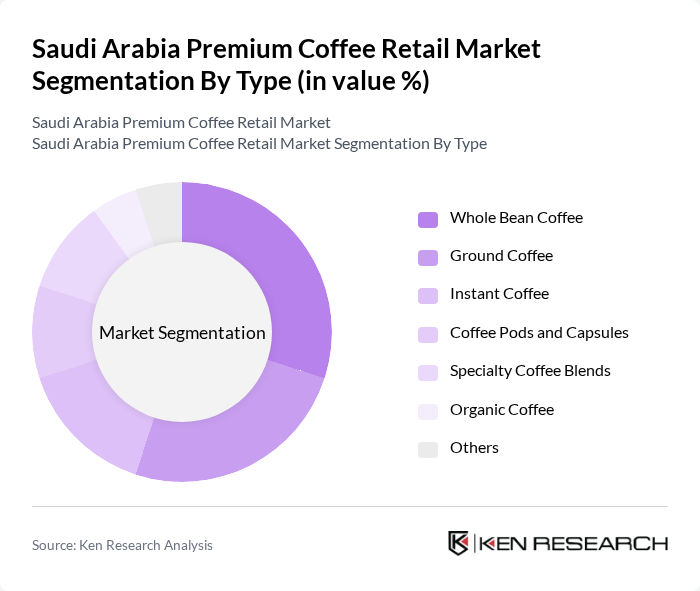

By Type:The market is segmented into various types of coffee products, including Whole Bean Coffee, Ground Coffee, Instant Coffee, Coffee Pods and Capsules, Specialty Coffee Blends, Organic Coffee, and Others. Among these, Whole Bean Coffee and Specialty Coffee Blends are particularly popular due to the growing trend of home brewing and the demand for unique flavor profiles. Consumers are increasingly seeking high-quality, artisanal products that offer a premium experience.

By End-User:The end-user segmentation includes Households, Cafés and Restaurants, Offices and Workplaces, and Retail Outlets. Households represent a significant portion of the market as more consumers are investing in premium coffee for home brewing. Cafés and Restaurants are also crucial, as they drive the demand for high-quality coffee experiences, particularly among younger demographics who frequent these establishments.

The Saudi Arabia Premium Coffee Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Masah Coffee, Starbucks Coffee Company, Al-Hokair Group, Nespresso, Lavazza, Illycaffè, Costa Coffee, Dunkin' Donuts, Tim Hortons, Café Najjar, Coffee Planet, Caffè Nero, Caribou Coffee, Peet's Coffee, Specialty Coffee Association of Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia premium coffee retail market is poised for continued growth, driven by evolving consumer preferences and a burgeoning coffee culture. As disposable incomes rise, consumers are increasingly willing to invest in high-quality coffee experiences. Additionally, the integration of technology in retail, such as mobile ordering and personalized marketing, is expected to enhance customer engagement. The market will likely see innovative product offerings and sustainable practices gaining traction, aligning with global trends towards ethical consumption and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Bean Coffee Ground Coffee Instant Coffee Coffee Pods and Capsules Specialty Coffee Blends Organic Coffee Others |

| By End-User | Households Cafés and Restaurants Offices and Workplaces Retail Outlets |

| By Sales Channel | Online Retail Supermarkets and Hypermarkets Specialty Coffee Shops Convenience Stores |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bags Cans Boxes |

| By Flavor Profile | Fruity Nutty Chocolatey Spicy |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Coffee Retailers | 100 | Store Managers, Franchise Owners |

| Consumer Preferences | 150 | Coffee Enthusiasts, Regular Consumers |

| Importers and Distributors | 80 | Supply Chain Managers, Business Development Executives |

| Café and Restaurant Owners | 70 | Operations Managers, Beverage Directors |

| Market Analysts and Experts | 50 | Industry Analysts, Coffee Consultants |

The Saudi Arabia Premium Coffee Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by consumer preferences for high-quality coffee and the rise of specialty coffee shops.