Region:Asia

Author(s):Shubham

Product Code:KRAA8501

Pages:84

Published On:November 2025

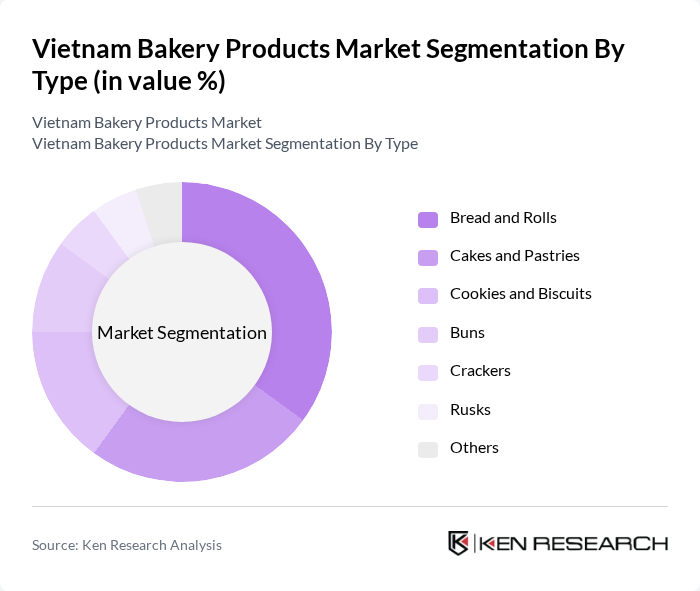

By Type:The bakery products market can be segmented into various types, including bread and rolls, cakes and pastries, cookies and biscuits, buns, crackers, rusks, and others. Each of these subsegments caters to different consumer preferences and occasions, with bread and rolls being the most consumed due to their versatility and convenience. Cakes and pastries follow closely, driven by the growing trend of celebrations, gifting, and café culture. The market is also witnessing increased demand for cookies, biscuits, and artisanal baked goods, reflecting evolving tastes and a preference for premium and health-oriented products .

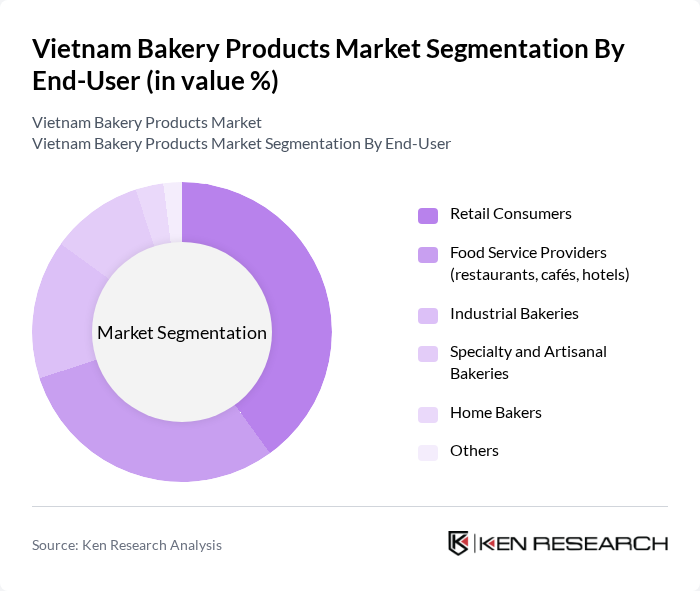

By End-User:The end-user segmentation includes retail consumers, food service providers (restaurants, cafés, hotels), industrial bakeries, specialty and artisanal bakeries, home bakers, and others. Retail consumers represent the largest segment, driven by the increasing demand for convenient and ready-to-eat products. Food service providers also play a significant role, as they require a steady supply of baked goods for their menus. The growth of specialty and artisanal bakeries is notable, reflecting consumer interest in premium, health-focused, and innovative bakery items .

The Vietnam Bakery Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as KIDO Group (Kinh Do Bakery), Huu Nghi Food Joint Stock Company, Mondelez Kinh Do Vietnam, ABC Bakery (Bánh Mì ABC), Orion Food Vina, Hai Ha Confectionery Joint Stock Company (Hai Ha Bakery), Bibica Corporation, Givral Bakery, Tous Les Jours Vietnam, Paris Baguette Vietnam, Thanh Long Bakery, Minh Tam Bakery, An Phu Bakery, Phu Nhuan Bakery (PNB) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam bakery products market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-consciousness rises, there will be a notable shift towards healthier options, including whole grain and gluten-free products. Additionally, the integration of e-commerce platforms will facilitate broader market access, allowing bakeries to reach a wider audience. Innovations in production techniques will further enhance product quality and variety, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread and Rolls Cakes and Pastries Cookies and Biscuits Buns Crackers Rusks Others |

| By End-User | Retail Consumers Food Service Providers (restaurants, cafés, hotels) Industrial Bakeries Specialty and Artisanal Bakeries Home Bakers Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Independent Retailers Artisanal Bakeries Online Retail Food Service Distributors Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Product Formulation | Traditional Gluten-Free Organic Fortified Vegan Others |

| By Packaging Type | Plastic Packaging Paper Packaging Eco-friendly Packaging Modified Atmosphere Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bakery Outlets | 100 | Bakery Owners, Store Managers |

| Consumer Preferences Survey | 120 | Regular Bakery Customers, Food Enthusiasts |

| Wholesale Bakery Distributors | 60 | Distribution Managers, Sales Representatives |

| Food Service Sector Insights | 50 | Restaurant Owners, Catering Managers |

| Health-Conscious Consumer Segment | 40 | Health and Wellness Advocates, Nutritionists |

The Vietnam Bakery Products Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by urbanization, changing consumer lifestyles, and an expanding middle class with increased disposable incomes.