Region:Middle East

Author(s):Shubham

Product Code:KRAB7603

Pages:96

Published On:October 2025

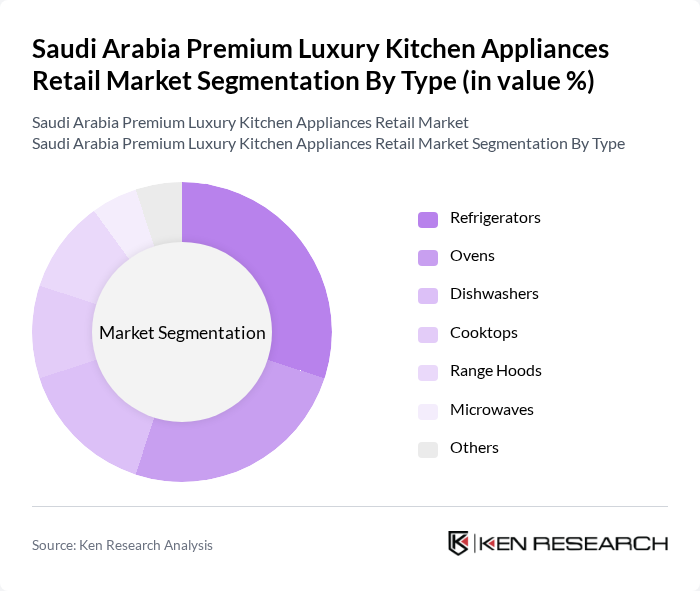

By Type:The market is segmented into various types of kitchen appliances, including refrigerators, ovens, dishwashers, cooktops, range hoods, microwaves, and others. Among these, refrigerators and ovens are the most popular, driven by consumer demand for energy-efficient and multifunctional appliances. The trend towards smart kitchens has also led to increased interest in advanced cooking technologies.

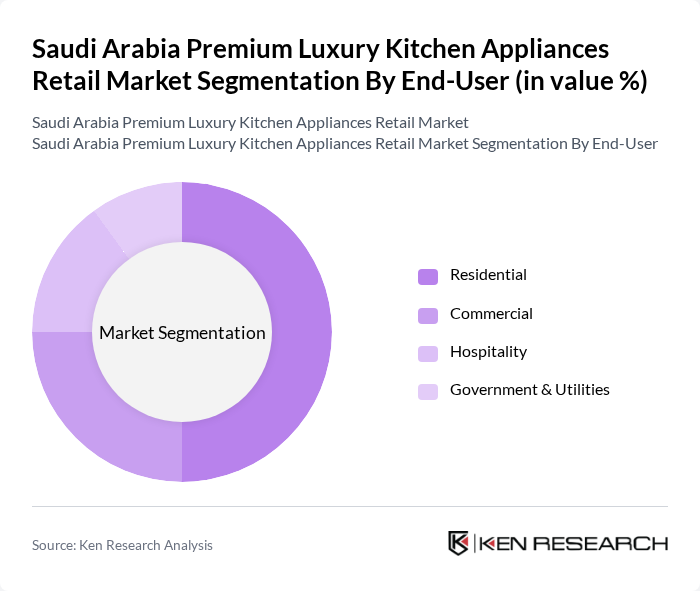

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government & utilities. The residential segment dominates the market, driven by increasing home renovations and the trend of gourmet cooking at home. The commercial segment is also growing, particularly in upscale restaurants and hotels that seek high-quality kitchen appliances to enhance their culinary offerings.

The Saudi Arabia Premium Luxury Kitchen Appliances Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch, Miele, Smeg, Gaggenau, Electrolux, Samsung, LG Electronics, Whirlpool, KitchenAid, AEG, Panasonic, Frigidaire, Haier, Sharp, GE Appliances contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia premium luxury kitchen appliances market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As the trend towards smart home technologies continues, manufacturers are expected to innovate and integrate IoT features into their products. Additionally, the increasing focus on sustainability will likely lead to a rise in demand for eco-friendly appliances. These factors, combined with a growing middle class, will create a dynamic market environment that fosters opportunities for both established and emerging brands.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Ovens Dishwashers Cooktops Range Hoods Microwaves Others |

| By End-User | Residential Commercial Hospitality Government & Utilities |

| By Sales Channel | Online Retail Specialty Stores Department Stores Direct Sales |

| By Price Range | Premium Mid-Range Budget |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Kitchen Appliance Retailers | 100 | Store Managers, Sales Directors |

| Affluent Consumers | 150 | Homeowners, Interior Designers |

| Distributors and Wholesalers | 80 | Supply Chain Managers, Procurement Officers |

| Market Analysts and Consultants | 60 | Market Research Analysts, Business Development Managers |

| Home Improvement Experts | 70 | Contractors, Renovation Specialists |

The Saudi Arabia Premium Luxury Kitchen Appliances Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by rising disposable incomes, urbanization, and a preference for high-end kitchen solutions among consumers.