Region:Middle East

Author(s):Dev

Product Code:KRAD0405

Pages:80

Published On:August 2025

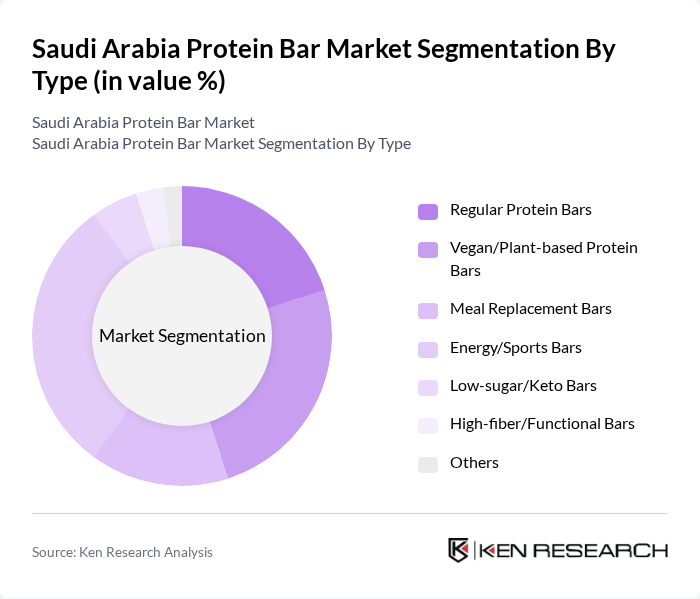

By Type:The protein bar market can be segmented into various types, including Regular Protein Bars, Vegan/Plant-based Protein Bars, Meal Replacement Bars, Energy/Sports Bars, Low-sugar/Keto Bars, High-fiber/Functional Bars, and Others. Among these, Energy/Sports Bars are currently prominent due to the increasing number of fitness enthusiasts and athletes seeking convenient sources of energy and protein. Industry reports also note growing interest in plant-based formulations as consumers pursue healthier lifestyles and clean-label options .

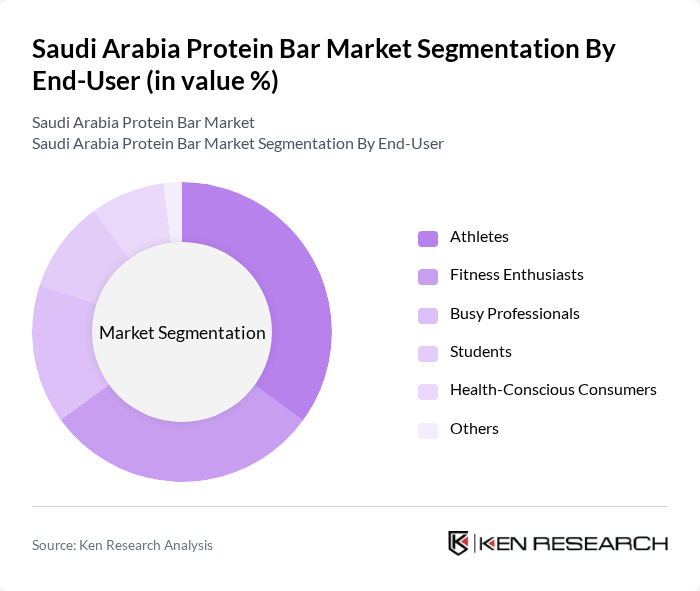

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, Busy Professionals, Students, Health-Conscious Consumers, and Others. Athletes and Fitness Enthusiasts are leading segments, reflecting the need for high-protein snacks to support training and recovery. Rising health awareness among Busy Professionals and Health-Conscious Consumers is also supporting uptake, aided by wide availability in supermarkets/hypermarkets and online channels .

The Saudi Arabia Protein Bar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Quest Nutrition (The Simply Good Foods Company), CLIF Bar & Company (Mondel?z International), RXBAR (Kellogg Company), KIND Snacks (Mars, Incorporated), Grenade (Mondelez UK-based brand), Optimum Nutrition (Glanbia Performance Nutrition), BSN – Bio-Engineered Supplements & Nutrition (Glanbia Performance Nutrition), MusclePharm, Pure Protein (NBTY/Threshold Enterprises under The Bountiful Company), Nature Valley (General Mills), GoMacro, Orgain, Larabar (General Mills), Health Warrior (PepsiCo), Bulletproof (Bulletproof 360, Inc.), Barebells Functional Foods, Think! (think! High Protein, formerly thinkThin), Mars Protein (Mars, Incorporated), Myprotein (The Hut Group, THG), Quest’s Middle East Distributors (e.g., Nahdi, BinDawood Holding – for retail presence) contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia protein bar market is poised for continued growth, driven by evolving consumer preferences towards health and convenience. As the population becomes more health-conscious, the demand for innovative and nutritious snack options will likely increase. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to protein bars, allowing brands to reach a wider audience. Companies that adapt to these trends and invest in product development will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular Protein Bars Vegan/Plant-based Protein Bars Meal Replacement Bars Energy/Sports Bars Low-sugar/Keto Bars High-fiber/Functional Bars Others |

| By End-User | Athletes Fitness Enthusiasts Busy Professionals Students Health-Conscious Consumers Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience/Grocery Stores Online Stores Health & Specialty Nutrition Stores Gyms and Fitness Centers Others |

| By Price Range | Value (? SAR 6 per bar) Mid (SAR 7–12 per bar) Premium (? SAR 13 per bar) Others |

| By Flavor | Chocolate Vanilla Fruit Flavors Nut Flavors Local/Regional Flavors (e.g., Date, Cardamom) Others |

| By Packaging Type | Single-Serve Packs Multi-Packs Bulk Packaging Others |

| By Brand Positioning | Premium Brands Mid-Tier Brands Value Brands Clean Label/Natural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences | 140 | Health-Conscious Consumers, Fitness Enthusiasts |

| Distribution Channel Analysis | 100 | Distributors, Wholesalers |

| Product Development Feedback | 80 | Product Managers, R&D Specialists |

| Market Trend Evaluation | 100 | Nutritionists, Health Coaches |

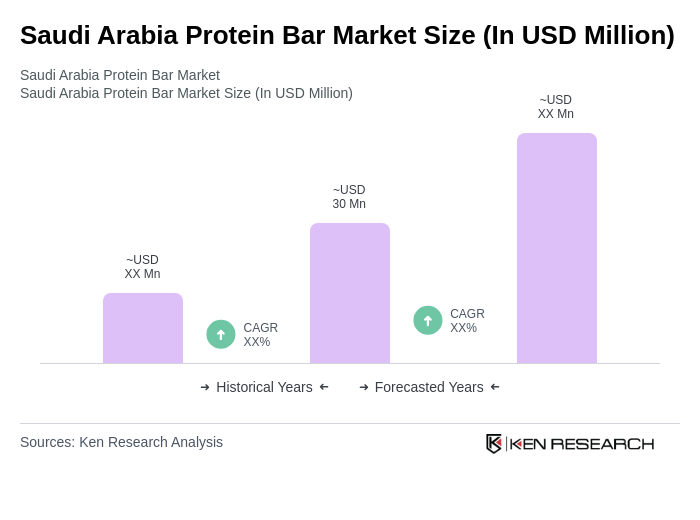

The Saudi Arabia Protein Bar Market is valued at approximately USD 30 million, reflecting a growing trend driven by increased health consciousness, fitness activities, and the demand for convenient, protein-rich snacks among consumers.