Region:Middle East

Author(s):Rebecca

Product Code:KRAA9394

Pages:95

Published On:November 2025

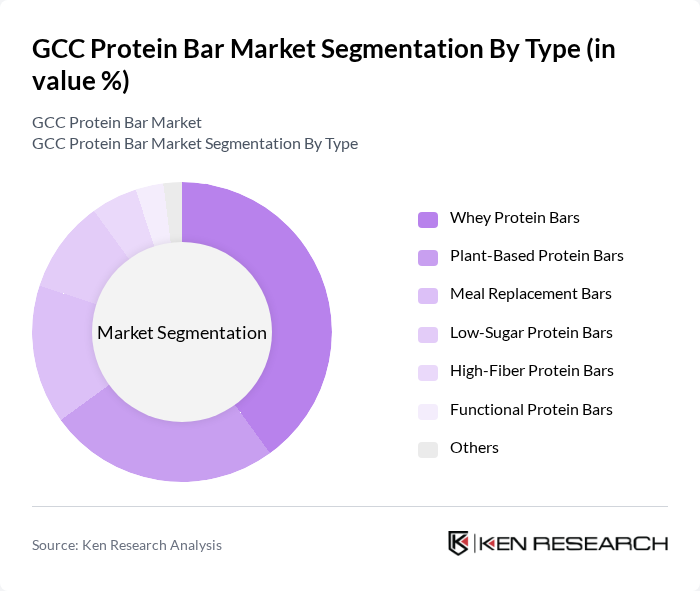

By Type:The market is segmented into Whey Protein Bars, Plant-Based Protein Bars, Meal Replacement Bars, Low-Sugar Protein Bars, High-Fiber Protein Bars, Functional Protein Bars, and Others. Whey Protein Bars currently lead the market, favored for their high protein content and popularity among fitness enthusiasts. The demand for Plant-Based Protein Bars is rising, driven by the increasing number of consumers adopting vegetarian and vegan diets, as well as growing interest in sustainable and allergen-friendly options. Functional bars with added vitamins, minerals, and adaptogens are gaining traction among consumers seeking targeted health benefits.

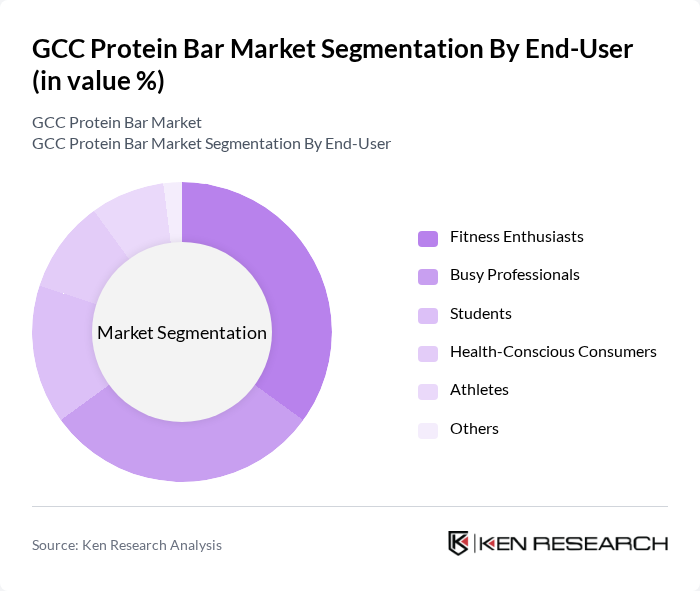

By End-User:The end-user segmentation includes Fitness Enthusiasts, Busy Professionals, Students, Health-Conscious Consumers, Athletes, and Others. Fitness Enthusiasts dominate the market, actively seeking high-protein snacks to support workout regimes and muscle recovery. Busy Professionals represent a significant segment, prioritizing convenient meal options for fast-paced lifestyles. Health-conscious consumers and athletes increasingly prefer protein bars for their nutritional value and portability, while students and other segments contribute to overall market diversity.

The GCC Protein Bar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Quest Nutrition, RXBAR, Clif Bar & Company, KIND Snacks, Optimum Nutrition, BSN (Bio-Engineered Supplements and Nutrition), Pure Protein, MusclePharm, Grenade, Orgain, GoMacro, Nature Valley, LaraBar, Health Warrior, Bulletproof, Herbalife Nutrition, Bodybuilding.com, PowerBar, GNC (General Nutrition Centers), Fitbar, Protein World, Nutrabay, MyProtein, Bulk, Al Rawabi, Almarai, Saffola (by Marico), Amway, Herbalife Saudi Arabia, NutriFit contribute to innovation, geographic expansion, and service delivery in this space.

The GCC protein bar market is poised for continued growth, driven by evolving consumer preferences towards healthier and more convenient snack options. As the fitness culture expands, brands are likely to innovate with new flavors and ingredients, catering to diverse dietary needs. Additionally, the rise of e-commerce platforms will facilitate easier access to protein bars, enhancing market penetration. Companies that adapt to these trends and focus on sustainability will likely gain a competitive edge in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Bars Plant-Based Protein Bars Meal Replacement Bars Low-Sugar Protein Bars High-Fiber Protein Bars Functional Protein Bars Others |

| By End-User | Fitness Enthusiasts Busy Professionals Students Health-Conscious Consumers Athletes Others |

| By Distribution Channel | Supermarkets/Hypermarkets Health Food Stores Online Retailers Convenience Stores Gyms and Fitness Centers Others |

| By Flavor | Chocolate Vanilla Fruit Flavors Nut Flavors Others |

| By Packaging Type | Single-Serve Packs Multi-Packs Bulk Packaging Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Nutritional Content | High Protein Low Carb High Fiber Gluten-Free Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Protein Bars | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Health Foods | 120 | Health-Conscious Consumers, Fitness Trainers |

| Nutritionist Insights on Protein Bars | 80 | Registered Dietitians, Nutrition Consultants |

| Market Trends in E-commerce for Protein Bars | 60 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Feedback from Manufacturers | 40 | Product Managers, R&D Specialists |

The GCC Protein Bar Market is valued at approximately USD 980 million, reflecting a significant growth driven by increasing health consciousness, fitness activities, and the trend of on-the-go snacking among consumers in the region.