Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5999

Pages:97

Published On:December 2025

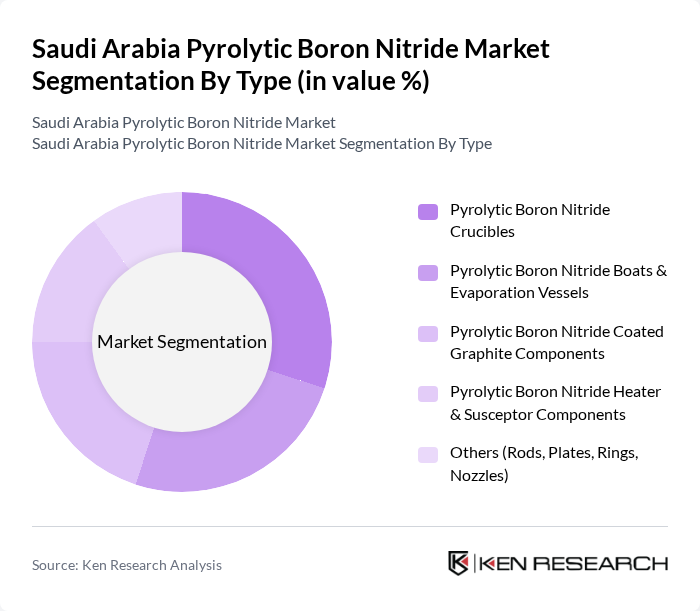

By Type:The market is segmented into various types of pyrolytic boron nitride products, including crucibles, boats, coated graphite components, heater and susceptor components, and others such as rods, plates, rings, and nozzles. Each of these subsegments serves specific applications across different industries.

The leading subsegment in the market is Pyrolytic Boron Nitride Crucibles, which are extensively used in semiconductor manufacturing and high-temperature applications. Their ability to withstand extreme conditions while providing excellent thermal and electrical insulation makes them indispensable in the industry. The growing demand for advanced semiconductor devices and the expansion of the electronics sector are driving the popularity of these crucibles, leading to a significant market share.

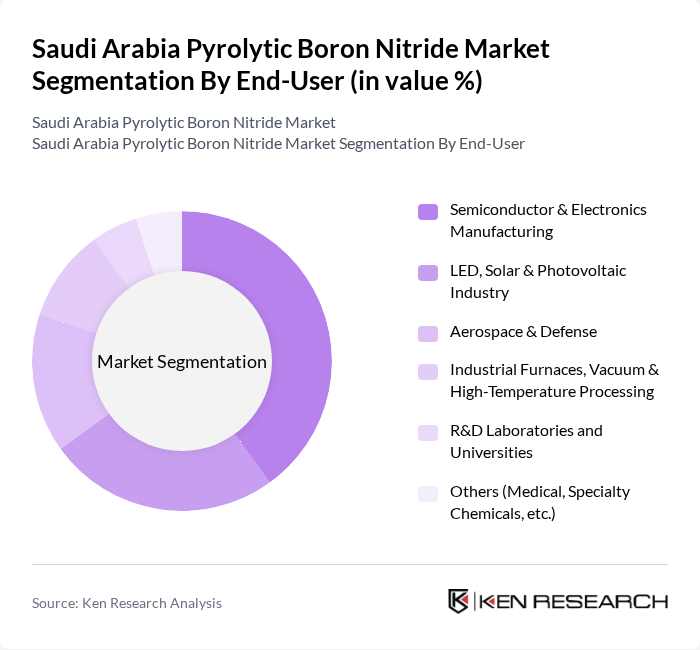

By End-User:The market is categorized based on end-users, including semiconductor and electronics manufacturing, LED, solar and photovoltaic industries, aerospace and defense, industrial furnaces, vacuum and high-temperature processing, R&D laboratories and universities, and others such as medical and specialty chemicals.

The Semiconductor & Electronics Manufacturing sector is the dominant end-user of pyrolytic boron nitride products, accounting for a substantial portion of the market. This is attributed to the increasing demand for high-performance materials in the production of semiconductors, which require materials that can withstand high temperatures and provide excellent electrical insulation. The rapid growth of the electronics industry, particularly in the context of advanced technologies such as 5G and IoT, further fuels this demand.

The Saudi Arabia Pyrolytic Boron Nitride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Momentive Technologies (Momentive Performance Materials Inc.), Shin-Etsu Chemical Co., Ltd., Morgan Advanced Materials plc, Saint-Gobain Ceramics & Plastics, Inc. (Saint-Gobain S.A.), Denka Company Limited, Beijing Boyu Semiconductor Vessel Craftwork Technology Co., Ltd., Innovacera Technical Ceramic Solutions, Liling Xing Tai Long Special Ceramics Co., Limited, Shandong Pengcheng Special Ceramics Co., Ltd., Shenyang Shunli Graphite Co., Ltd., Shandong Yuwang Industrial Co., Ltd., NGK Insulators, Ltd., Kyocera Corporation, Precision Ceramics (UK) Ltd., Saudi Arabian Oil Company (Saudi Aramco) – Advanced Materials & R&D Demand Partner contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Pyrolytic Boron Nitride market in Saudi Arabia appears promising, driven by technological advancements and a growing focus on sustainability. As industries increasingly prioritize eco-friendly materials, PBN's unique properties will likely gain traction. Additionally, the ongoing expansion of the electronics and renewable energy sectors will create new avenues for growth. Companies that invest in research and development to innovate PBN applications will be well-positioned to capitalize on these emerging trends and meet evolving market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Pyrolytic Boron Nitride Crucibles Pyrolytic Boron Nitride Boats & Evaporation Vessels Pyrolytic Boron Nitride Coated Graphite Components Pyrolytic Boron Nitride Heater & Susceptor Components Others (Rods, Plates, Rings, Nozzles) |

| By End-User | Semiconductor & Electronics Manufacturing LED, Solar & Photovoltaic Industry Aerospace & Defense Industrial Furnaces, Vacuum & High-Temperature Processing R&D Laboratories and Universities Others (Medical, Specialty Chemicals, etc.) |

| By Application | Crystal Growth (GaAs, GaN, SiC and Other Compound Semiconductors) MOCVD / CVD Reactor Components Thermal Management & High-Temperature Insulation Electrical Insulation in High-Vacuum Systems Corrosion & Chemical-Resistant Linings Others |

| By Form | Sheets & Plates Crucibles & Boats Tubes & Rings Custom-Machined Shapes & Assemblies Coatings |

| By Distribution Channel | Direct Contracts with OEMs (Semiconductor, LED, PV, Furnace OEMs) Specialized Technical Ceramics Distributors Global Key-Account / Framework Supply Agreements Online & Catalog-Based Technical Sales Others |

| By Region | Central Region (Riyadh, Qassim, Hail) Eastern Region (Dammam, Dhahran, Jubail) Western Region (Jeddah, Makkah, Madinah, NEOM) Southern Region (Asir, Jazan, Najran) |

| By Policy Support | Vision 2030 Industrial & Mining Programs Incentives from Saudi Industrial Development Fund (SIDF) Research Grants from KACST and National R&D Programs Foreign Direct Investment (FDI) Incentives & Free-Zone Benefits |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Manufacturing | 100 | Product Managers, Supply Chain Analysts |

| Aerospace Applications | 70 | Engineering Managers, Quality Assurance Leads |

| Automotive Industry | 80 | Procurement Managers, Technical Directors |

| Coatings and Composites | 60 | Research Scientists, Product Development Managers |

| Thermal Management Solutions | 90 | Application Engineers, Sales Directors |

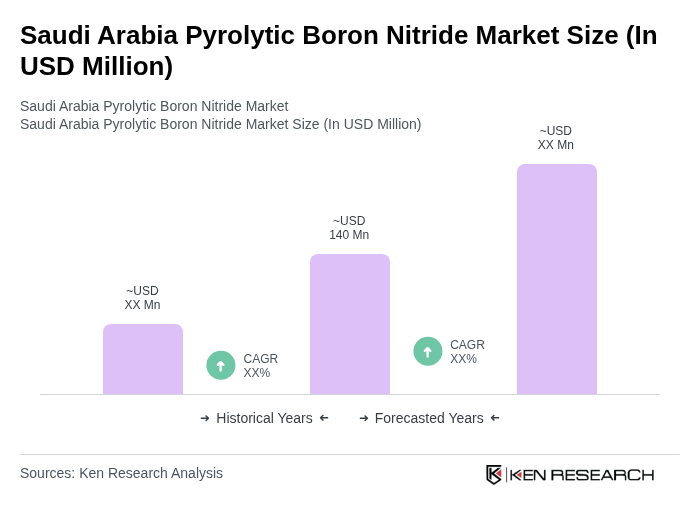

The Saudi Arabia Pyrolytic Boron Nitride Market is valued at approximately USD 140 million, driven by increasing demand for high-performance materials in the semiconductor and electronics industries, as well as advancements in aerospace and defense applications.